Fifth Third Bank Finance Academy® Entrepreneurship Course Leads to 67% Increase in Knowledge About Business Topics

Published 04-27-23

Submitted by Fifth Third Bancorp

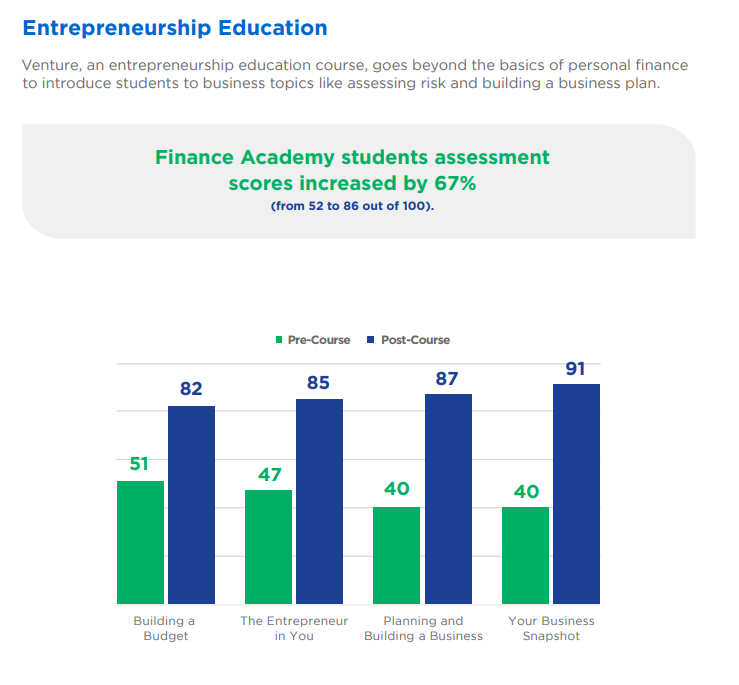

Fifth Third Bank Finance Academy® students saw their knowledge about entrepreneurship topics increase by 67% during the 2021-2022 school year. Scores increases from 52 in a pre-course assessment to 86 out of 100 in a post-course assessment.

Key learning gains included:

- Building a Budget knowledge increased from 51 to 82.

- Awareness of how to plan and building a business improved from 40 to 87.

- Knowledge of how to create a Business Snapshot increased from 40 to 91.

Further, 72% of Finance Academy students were at least somewhat interested in owning their own business in the future. Most students see value in entrepreneurship and desire to support it, even if they don’t have their own plans to become an entrepreneur themselves. Thirty-five percent of learners felt more prepared to understand the risk involved in a business venture after taking the course and 56% of learners felt more prepared to identify business opportunities.

Fifth Third Finance Academy is one of the Fifth Third Bank L.I.F.E. (Lives Improved through Financial Empowerment®) programs offered at no charge to people at every age and stage of life. Other signature programs include the Fifth Third Bank Young Bankers Club® and the Fifth Third Financial Empowerment Mobile, or eBus, a financial empowerment classroom on wheels, that takes financial access and resources directly into underserved communities.

Fifth Third Bancorp

Fifth Third Bancorp

Fifth Third Bancorp is a diversified financial services company headquartered in Cincinnati, Ohio and the indirect parent company of Fifth Third Bank, National Association, a federally chartered institution. As of Dec. 31, 2021, Fifth Third had $211 billion in assets and operated 1,117 full-service banking centers and 2,322 ATMs with Fifth Third branding in Ohio, Kentucky, Indiana, Michigan, Illinois, Florida, Tennessee, West Virginia, Georgia and North Carolina. In total, Fifth Third provides its customers with access to approximately 54,000 fee-free ATMs across the United States. Fifth Third operates four main businesses: Commercial Banking, Branch Banking, Consumer Lending and Wealth & Asset Management. Investor information and press releases can be viewed at www.53.com. Fifth Third’s common stock is traded on the Nasdaq® Global Select Market under the symbol “FITB.” Fifth Third Bank was established in 1858. Deposit and Credit products are offered by Fifth Third Bank, National Association. Member FDIC.

Fifth Third’s Purpose is to improve lives and the well-being of its communities by being the One Bank people most value and trust. The Company believes in doing well by doing good and delivering long-term sustainable value to all its stakeholders. Fifth Third is focused on five environmental, social and governance priorities: keeping the customer at the center, demonstrating its commitment to employees, strengthening its communities, promoting inclusion and diversity, and addressing climate change.

More from Fifth Third Bancorp