AllianceBernstein: Healthcare Pipelines and Paychecks - A Formula for Assessing Executive Pay

Published 16 hours ago

Submitted by AllianceBernstein

Bob Herr| Director of Corporate Governance

Ryan Oden| Co–Portfolio Manager and Senior Research Analyst—US Growth Equities

Our research suggests that firms with sound executive pay practices yield healthier returns.

Executive compensation plans are a useful tool for aligning the interests of management with those of shareholders. But we find that for pharmaceutical and biotechnology firms in particular, good incentives are critical. Our research points to better long-term investment outcomes for healthcare companies with better compensation practices.

Proxy Vote Prognosis

Every proxy season, companies across most markets slate their executive pay packages for shareholder approval. We leverage these votes as a tool to formally express our compensation philosophy. When we determine that a company’s pay structure fails to appropriately incentivize executives, we vote against it—something we’ve historically done more often than not in the healthcare sector.

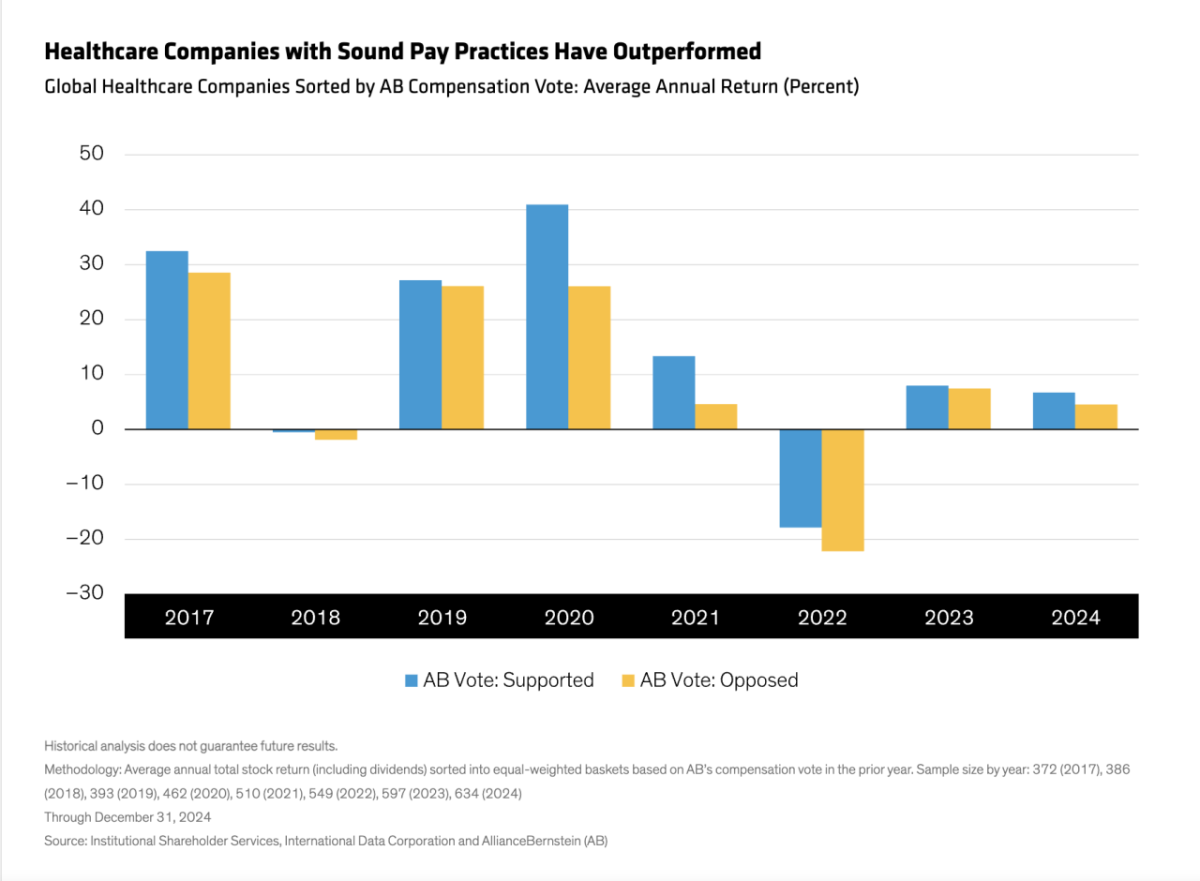

We’ve found that an AB-approved compensation package has been a leading indicator of outperformance for healthcare companies globally. Since 2016, companies with compensation practices we approved of have posted higher average returns the following calendar year versus those we opposed (Display).

Active Ingredients for Good Incentives

Having engaged* with hundreds of healthcare firms on compensation design, we’ve identified three core signs of an effective pay program.

- Equity Alignment: When the company does well, management should do well, and vice versa. For this reason, we keep a close eye on the equity/cash mix of executive pay packages, as well as the length of vesting periods, the robustness of share-ownership guidelines and the presence of clawback provisions. When it comes to managing a long-term pipeline, there’s no replacement for long-term skin in the game.

- Profitable Innovation: Performance-based awards work best when linked to financial and strategic goals geared toward efficiency and innovation. This might include metrics such as operating profit and return on invested capital. For some businesses, research-and-development milestones such as patents or regulatory approvals may also be useful metrics. We prefer goals that reward executives for pursuing long-term value instead of short-term share price hurdles.

- Value Add: Ultimately, we prefer healthcare companies that add value for customers, shareholders and the healthcare system as a whole—with pay packages structured accordingly. This may mean linking pay to goals that capture patient outcomes, cost of care and access to medicine.

A Tough Pill to Swallow: Bad Incentives Persist

Unfortunately, poorly designed pay plans remain a problem across pharma and biotech—from early-stage initial public offerings (IPOs) to well-established players.

For example, many large pharmaceutical companies directly adjust litigation and compliance expenses out of executive compensation calculations. This can result in generous bonuses even in years when stakeholders are adversely affected by legal settlements and penalties that detract from financial performance. Companies may attempt to characterize litigation expenses as legacy concerns, since the alleged damages occurred in the past—or as one-offs, despite multiple occurrences.

We think investors should be particularly wary of these tactics when practiced by firms with recurring product quality and safety issues. Our view on this is simple. If executives can be rewarded for selling legacy products, then they should also be accountable for managing the legal risks.

IPOs, too, may distort incentives. New research from Yale Law School reveals that early-stage biotech firms frequently partake in a practice called pre-IPO option discounting. This involves awarding options to insiders shortly before an IPO, with an exercise price well below the expected IPO price. This risky practice can create an immediate windfall for insiders without any meaningful performance conditions or approval from public investors.

In a sample of more than 100 newly public biotech companies, researchers found that more than two-thirds of these firms awarded discounted options to insiders. On average, recipients enjoyed a discount of 48% off the IPO price.

Of course, there must be incentives to develop new therapies, and we’re in favor of well-structured option grants. But we think pre-IPO option discounting warrants closer scrutiny from investors, as it may create a day-one jackpot for executives and dilution down the road for public investors, regardless of the company’s contribution to the healthcare system.

Compensation as an Investment Consideration

Assessing a company’s executive compensation structure is only one component of fundamental analysis, but in the case of healthcare investing, it has material implications. Healthcare executives effective in improving health outcomes deserve to be rewarded for their leadership, but it’s up to investors to verify.

Active managers can help weed out companies that favor insiders over investors, while prioritizing firms with shareholder-friendly pay practices. Over time, we believe that companies with good incentives will deliver better long-term outcomes for patients and investors alike.

Landon Shea, Associate—Responsible Investing, was instrumental in the research supporting this blog.

*AB engages issuers where it believes the engagement is in the best interest of its clients.

The views expressed herein do not constitute research, investment advice or trade recommendations, and do not necessarily represent the views of all AB portfolio-management teams, and are subject to change over time.

Learn more about AB’s approach to responsibility here.

AllianceBernstein

AllianceBernstein

AllianceBernstein (AB) is a leading global investment management firm that offers diversified investment services to institutional investors, individuals, and private wealth clients in major world markets.

To be effective stewards of our clients’ assets, we strive to invest responsibly—assessing, engaging on and integrating material issues, including environmental, social and governance (ESG) considerations into most of our actively managed strategies (approximately 79% of AB’s actively managed assets under management as of December 31, 2024).

Our purpose—to pursue insight that unlocks opportunity—describes the ethos of our firm. Because we are an active investment manager, differentiated insights drive our ability to design innovative investment solutions and help our clients achieve their investment goals. We became a signatory to the Principles for Responsible Investment (PRI) in 2011. This began our journey to formalize our approach to identifying responsible ways to unlock opportunities for our clients through integrating material ESG factors throughout most of our actively managed equity and fixed-income client accounts, funds and strategies. Material ESG factors are important elements in forming insights and in presenting potential risks and opportunities that can affect the performance of the companies and issuers that we invest in and the portfolios that we build. AB also engages issuers when it believes the engagement is in the best financial interest of its clients.

Our values illustrate the behaviors and actions that create our strong culture and enable us to meet our clients' needs. Each value inspires us to be better:

- Invest in One Another: At AB, there’s no “one size fits all” and no mold to break. We celebrate idiosyncrasy and make sure everyone’s voice is heard. We seek and include talented people with diverse skills, abilities and backgrounds, who expand our thinking. A mosaic of perspectives makes us stronger, helping us to nurture enduring relationships and build actionable solutions.

- Strive for Distinctive Knowledge: Intellectual curiosity is in our DNA. We embrace challenging problems and ask tough questions. We don’t settle for easy answers when we seek to understand the world around us—and that’s what makes us better investors and partners to our colleagues and clients. We are independent thinkers who go where the research and data take us. And knowing more isn’t the end of the journey, it’s the start of a deeper conversation.

- Speak with Courage and Conviction: Collegial debate yields conviction, so we challenge one another to think differently. Working together enables us to see all sides of an issue. We stand firmly behind our ideas, and we recognize that the world is dynamic. To keep pace with an ever changing world and industry, we constantly reassess our views and share them with intellectual honesty. Above all, we strive to seek and speak truth to our colleagues, clients and others as a trusted voice of reason.

- Act with Integrity—Always: Although our firm is comprised of multiple businesses, disciplines and individuals, we’re united by our commitment to be strong stewards for our people and our clients. Our fiduciary duty and an ethical mind-set are fundamental to the decisions we make.

As of December 31, 2024, AB had $792B in assets under management, $555B of which were ESG-integrated. Additional information about AB may be found on our website, www.alliancebernstein.com.

Learn more about AB’s approach to responsibility here.

More from AllianceBernstein