AllianceBernstein - Governance Matters: Don’t Overlook Board Oversight

By Bob Herr and Cem Inal

Published 18 hours ago

Submitted by AllianceBernstein

Director elections can be a powerful tool for investors to weigh in on ineffective boards.

Most conversations around proxy voting focus on shareholder proposals and executive compensation. Meanwhile, the most significant votes tend to fly under the radar: director elections. Boards of directors play a vital role in representing shareholder interests by overseeing a company’s strategic direction, monitoring management and ensuring accountability for the creation of long-term value.

Director-election votes can be a powerful tool for weighing in on material governance issues. Increasingly, investors are doing just that. In the 2024 proxy season, directors who chaired their board’s nominating and governance committees received 5% more dissenting votes on average, reflecting investors’ willingness to hold specific directors accountable for board composition and broad governance concerns.

Beyond conventional governance issues like director independence or shareholder rights, we have leveraged director elections to convey our perspective on issues ranging from product safety and quality to executive compensation to strategic transactions.

A Higher-Quality Board May Bolster Performance

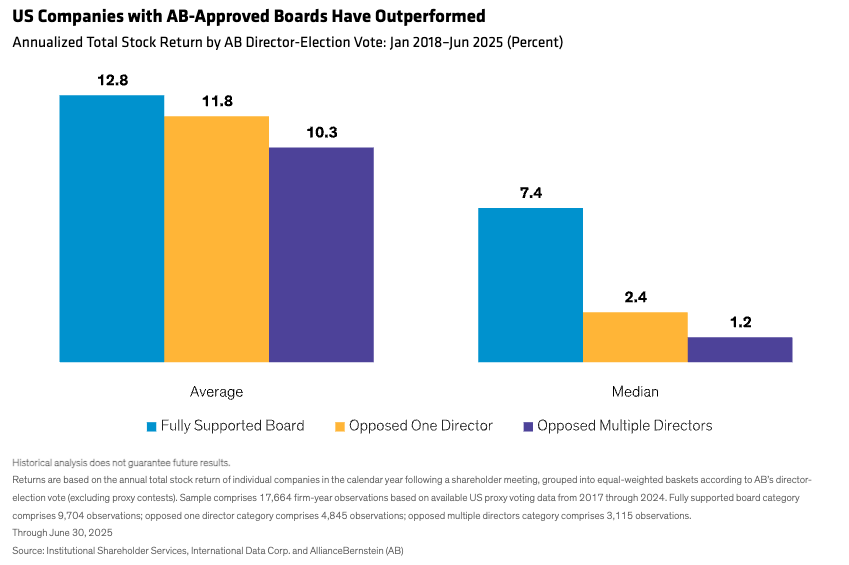

Our votes are always aimed at improving investment outcomes by promoting good governance. While there are countless reasons that a company may underperform its peers, we have found a clear link between our assessment of a board’s effectiveness (as measured by our director votes) and a company’s future stock performance.

Since 2017, US companies with boards warranting our full support have gone on to deliver stronger median and average stock returns the ensuing year (Display). The results show a strong, consistent correlation across nearly all sectors and company sizes. Simply put, when a board doesn’t meet our expectations, it’s generally a leading indicator of underperformance.

What Makes a Board Effective?

The board of directors is critical in overseeing management’s performance, composition and compensation. An effective board is necessary to managing the risks to a company’s operations and financial performance. Directors of public companies are ultimately responsible for ensuring that management acts in the best financial interests of all shareholders. Effective governance is often most visible during corporate turnarounds, where alignment between management and shareholders is essential.

No matter the company or sector, effective boards are defined by their composition, structure and actions. High-quality board composition entails majority-independent oversight, and a variety of skills and backgrounds, without attendance issues or excessive outside commitments. Structural mechanisms such as formal board committees, majority-vote standards and annual director elections ensure accountability. Lastly, boards demonstrate effectiveness through their actions: aligning pay with performance, ensuring disciplined allocation of capital and engaging with shareholders.

Naturally, not all boards meet these criteria. If we determine that a board’s structure or actions aren’t aligned with our clients’ best financial interests, we may hold relevant directors accountable, which is consistent with our fiduciary duty.

How does this work in practice? At a major US bank, we recognized historical governance shortcomings such as fraud, risk-management failures, workplace misconduct and broad misalignment with shareholders. We then engaged* in a multiyear dialogue with its board and senior leaders, consistently voting against relevant directors. Ultimately, the bank implemented improved oversight mechanisms as a part of a larger cultural overhaul, in addition to improving management incentives.

Keep Your Eye on the Board

We believe that investors should stay focused on a simple question: Is the board delivering for shareholders? Our research shows a clear connection: disappointing boards tend to deliver disappointing results, while boards earning our full support historically outperformed in the following year.

Boards perform best when they know investors are watching. Director-election votes may not make headlines, but they’re where investors’ voices matter most.

*AB engages issuers where it believes the engagement is in the best financial interest of its clients.

Landon Shea, Investment Stewardship Associate, and Cole Moore, Investment Stewardship Analyst, contributed significantly to the research for this blog.

The views expressed herein do not constitute research, investment advice or trade recommendations, do not necessarily represent the views of all AB portfolio-management teams and are subject to change over time.

Learn more about AB’s approach to responsibility here.

AllianceBernstein

AllianceBernstein

AllianceBernstein (AB) is a leading global investment management firm that offers diversified investment services to institutional investors, individuals, and private wealth clients in major world markets.

To be effective stewards of our clients’ assets, we strive to invest responsibly—assessing, engaging on and integrating material issues, including environmental, social and governance (ESG) considerations into most of our actively managed strategies (approximately 79% of AB’s actively managed assets under management as of December 31, 2024).

Our purpose—to pursue insight that unlocks opportunity—describes the ethos of our firm. Because we are an active investment manager, differentiated insights drive our ability to design innovative investment solutions and help our clients achieve their investment goals. We became a signatory to the Principles for Responsible Investment (PRI) in 2011. This began our journey to formalize our approach to identifying responsible ways to unlock opportunities for our clients through integrating material ESG factors throughout most of our actively managed equity and fixed-income client accounts, funds and strategies. Material ESG factors are important elements in forming insights and in presenting potential risks and opportunities that can affect the performance of the companies and issuers that we invest in and the portfolios that we build. AB also engages issuers when it believes the engagement is in the best financial interest of its clients.

Our values illustrate the behaviors and actions that create our strong culture and enable us to meet our clients' needs. Each value inspires us to be better:

- Invest in One Another: At AB, there’s no “one size fits all” and no mold to break. We celebrate idiosyncrasy and make sure everyone’s voice is heard. We seek and include talented people with diverse skills, abilities and backgrounds, who expand our thinking. A mosaic of perspectives makes us stronger, helping us to nurture enduring relationships and build actionable solutions.

- Strive for Distinctive Knowledge: Intellectual curiosity is in our DNA. We embrace challenging problems and ask tough questions. We don’t settle for easy answers when we seek to understand the world around us—and that’s what makes us better investors and partners to our colleagues and clients. We are independent thinkers who go where the research and data take us. And knowing more isn’t the end of the journey, it’s the start of a deeper conversation.

- Speak with Courage and Conviction: Collegial debate yields conviction, so we challenge one another to think differently. Working together enables us to see all sides of an issue. We stand firmly behind our ideas, and we recognize that the world is dynamic. To keep pace with an ever changing world and industry, we constantly reassess our views and share them with intellectual honesty. Above all, we strive to seek and speak truth to our colleagues, clients and others as a trusted voice of reason.

- Act with Integrity—Always: Although our firm is comprised of multiple businesses, disciplines and individuals, we’re united by our commitment to be strong stewards for our people and our clients. Our fiduciary duty and an ethical mind-set are fundamental to the decisions we make.

As of December 31, 2024, AB had $792B in assets under management, $555B of which were ESG-integrated. Additional information about AB may be found on our website, www.alliancebernstein.com.

Learn more about AB’s approach to responsibility here.

More from AllianceBernstein