AllianceBernstein - Renewable Energy and Insurers: Tailor Made?

Published 06-06-25

Submitted by AllianceBernstein

Xiaoyu Gu| Managing Director—AB CarVal

Deanna Leighton, CFA| Lead Portfolio Manager—Insurance Portfolio Management

Gerry Anderson| Insurance Solutions Specialist

Investment in clean energy infrastructure may tick a lot of boxes for life insurers.

Matching assets to long-term liabilities without compromising on return potential can be a challenge for insurers with long-duration liabilities. Investment in renewable energy infrastructure may provide a clever way to tackle that challenge.

The opportunity set in this arena is expansive. Last year, the world invested almost twice as much in clean energy as it did in fossil fuels, according to the International Energy Agency. Financing is increasingly coming from private capital providers who are able to structure assets that can meet life insurers’ unique needs.

These assets can come with investment-grade ratings from the major ratings agencies, which may increase relative attractiveness on a capital-adjusted yield and spread basis. And maturities in the 20-year range make them a good match for insurers with long-term liabilities.

Other potential benefits include:

- High Return Potential: Assets typically sit on the lowest rung of the investment-grade ratings ladder, which usually means larger spreads and enhanced return potential over similar quality long-term assets, including utility bonds and publicly traded government and corporate debt. Illiquidity premiums also enhance return potential.

- Diversification Benefits: Because these assets tend to have relatively low correlations with similar duration assets, they may offer an effective way to diversify insurers’ portfolios.

- Capital Efficiency: Certain renewable energy infrastructure—particularly in Europe—may warrant a substantial reduction in capital requirements.

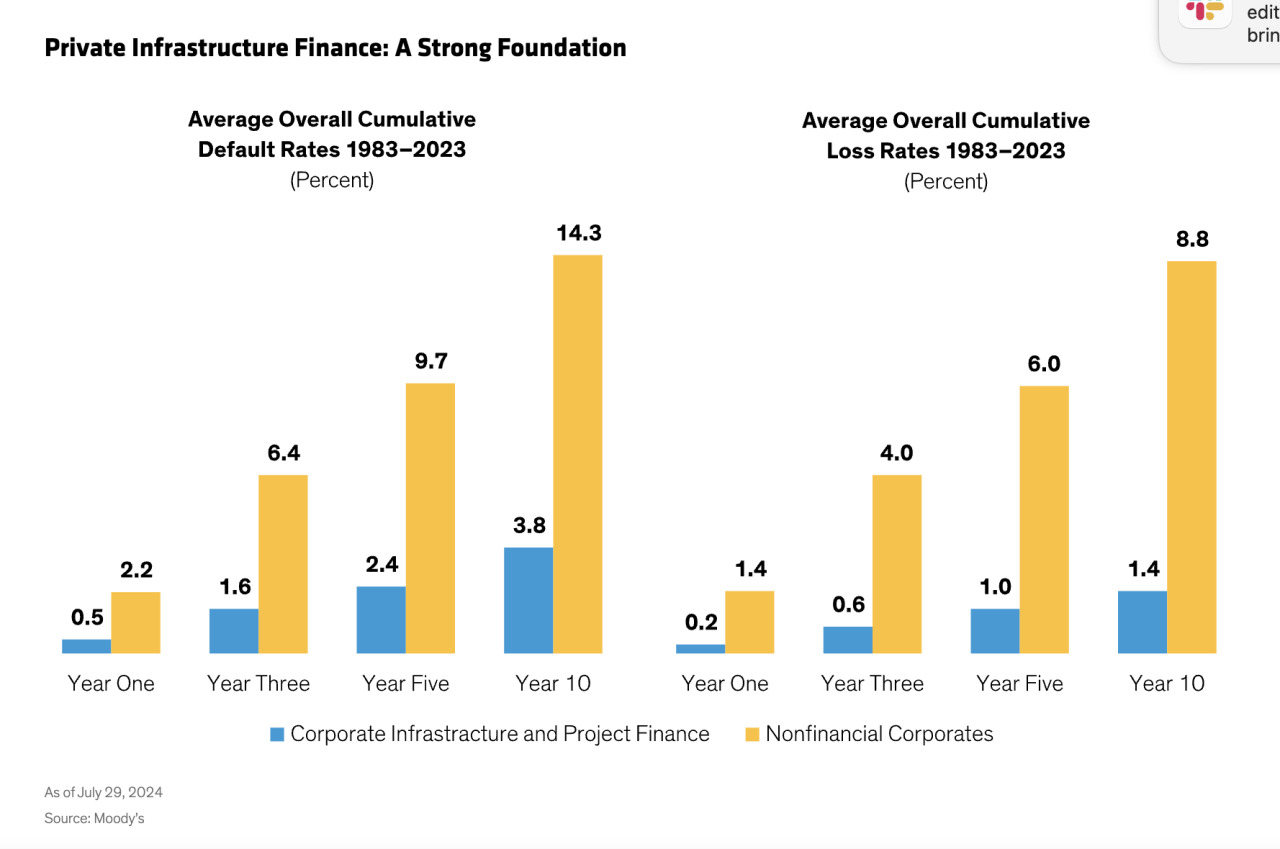

- Muted Default History: Defaults on private infrastructure financing have been consistently lower than those on comparable public corporate bonds issued by nonfinancial companies (Display).

Traditionally, banks have provided a healthy share of the financing for renewable energy infrastructure. But projects have grown larger as bank balance sheets have become more constrained, with private credit assuming a larger role.

That’s good news for insurers, because private lenders can pool projects into investment portfolios that may help reduce single-asset risk. For example, a pooled portfolio might include community solar projects across multiple states, all contracted with utilities or other investment-grade offtakers.

Private credit’s flexibility to structure assets in ways that meet insurers’ longer time horizons has also created a steadier source of capital for developers, who would otherwise be forced to rely on shorter-term bank financing.

US Offers a Broader Opportunity Set

Today, we see the most attractive opportunities in the US—for both US and European insurers. Clean energy is the fastest growing—and least expensive—electricity source in the country, and the market’s sheer size opens up broader investment options.

Renewable power is even more entrenched in Europe’s energy ecosystem, with solar and wind having overtaken fossil fuels, according to Ember, a think tank. But for now, few assets come with similarly insurance-friendly structures and investment-grade credit ratings.

The Tale of Tariffs: Assessing the Risks

US tariffs on a range of imports will affect energy infrastructure opportunities, particularly for projects being planned and waiting on imported equipment. But while China remains the largest single producer of solar panels, the widening of supply chains beyond China in recent years has blunted the impact of tariffs on new construction.

More importantly, the low cost of solar energy in recent years has prompted developers to fast-track projects, creating a healthy inventory of operating plants not subject to tariffs. These are the projects that fit most comfortably into insurance portfolios. They come with investment-grade ratings and can be structured as long-term debt that helps insurers match assets to liabilities.

Overall, we expect little effect on projects expected to come online in 2025, since equipment should already be in the country. Delays may pick up in 2026 from supply chain challenges. Potential changes to the Inflation Reduction Act (IRA) that reduce or eliminate tax credits may also slow momentum.

But we see these as short-term hiccups. Global energy demand is surging. In 2024, it rose by 2.2%, according to the IEA, a significant jump from the 1.3% annual average between 2013 and 2023. This adds up to trillions of dollars of investment per year on an annualized basis. Meeting that demand will require a healthy dose of renewable energy infrastructure, in our view.

Weighing the Regulatory Considerations

When assessing the opportunity, non-US insurers will have to consider the higher cost of currency hedges when matching US-dollar assets against non-dollar liabilities. This will require reviewing the costs of FX forwards and over-the-counter cross country hedges and how currency volatility will affect those costs.

Regulatory considerations will vary across regions, too. In Europe, insurers should carefully review the rating methodology used—whether internal or external. Also important: determining whether the underlying asset can be classed as “qualifying infrastructure,” which can reduce capital requirements. Insurers that apply the matching adjustment mechanism will need to review any cash flow prepayment features to ensure compliance with all Matching Adjustment eligibility requirements.

For US-based insurers, most of the opportunity set is rated BBB- and carries a NAIC rating of 2.C, and may be considered as a component of private placement allocations.

Overall, though, we think these assets offer insurers with long liabilities an appealing opportunity to enhance returns on regulatory capital and diversification while reducing the risk of default. Tariffs have little impact on operating portfolios that are a good fit for insurance capital, and demand for power remains strong. We don’t expect that to change.

The views expressed herein do not constitute research, investment advice or trade recommendations, and do not necessarily represent the views of all AB portfolio-management teams, and are subject to change over time.

Learn more about AB’s approach to responsibility here.

AllianceBernstein

AllianceBernstein

AllianceBernstein (AB) is a leading global investment management firm that offers diversified investment services to institutional investors, individuals, and private wealth clients in major world markets.

To be effective stewards of our clients’ assets, we strive to invest responsibly—assessing, engaging on and integrating material issues, including environmental, social and governance (ESG) considerations into most of our actively managed strategies (approximately 79% of AB’s actively managed assets under management as of December 31, 2024).

Our purpose—to pursue insight that unlocks opportunity—describes the ethos of our firm. Because we are an active investment manager, differentiated insights drive our ability to design innovative investment solutions and help our clients achieve their investment goals. We became a signatory to the Principles for Responsible Investment (PRI) in 2011. This began our journey to formalize our approach to identifying responsible ways to unlock opportunities for our clients through integrating material ESG factors throughout most of our actively managed equity and fixed-income client accounts, funds and strategies. Material ESG factors are important elements in forming insights and in presenting potential risks and opportunities that can affect the performance of the companies and issuers that we invest in and the portfolios that we build. AB also engages issuers when it believes the engagement is in the best financial interest of its clients.

Our values illustrate the behaviors and actions that create our strong culture and enable us to meet our clients' needs. Each value inspires us to be better:

- Invest in One Another: At AB, there’s no “one size fits all” and no mold to break. We celebrate idiosyncrasy and make sure everyone’s voice is heard. We seek and include talented people with diverse skills, abilities and backgrounds, who expand our thinking. A mosaic of perspectives makes us stronger, helping us to nurture enduring relationships and build actionable solutions.

- Strive for Distinctive Knowledge: Intellectual curiosity is in our DNA. We embrace challenging problems and ask tough questions. We don’t settle for easy answers when we seek to understand the world around us—and that’s what makes us better investors and partners to our colleagues and clients. We are independent thinkers who go where the research and data take us. And knowing more isn’t the end of the journey, it’s the start of a deeper conversation.

- Speak with Courage and Conviction: Collegial debate yields conviction, so we challenge one another to think differently. Working together enables us to see all sides of an issue. We stand firmly behind our ideas, and we recognize that the world is dynamic. To keep pace with an ever changing world and industry, we constantly reassess our views and share them with intellectual honesty. Above all, we strive to seek and speak truth to our colleagues, clients and others as a trusted voice of reason.

- Act with Integrity—Always: Although our firm is comprised of multiple businesses, disciplines and individuals, we’re united by our commitment to be strong stewards for our people and our clients. Our fiduciary duty and an ethical mind-set are fundamental to the decisions we make.

As of December 31, 2024, AB had $792B in assets under management, $555B of which were ESG-integrated. Additional information about AB may be found on our website, www.alliancebernstein.com.

Learn more about AB’s approach to responsibility here.

More from AllianceBernstein