AllianceBernstein: Early Alert System: One Way AI May Help Improve Investment Outcomes

Natural language processing can give investment managers an early warning about negative ESG news.

Published 03-04-25

Submitted by AllianceBernstein

Artificial intelligence (AI) is taking the world by storm, and for good reason. AI can help automate mundane tasks, improve operational efficiency and enhance human decision-making.

Some of its benefits extend to investing as well. We believe that powerful AI tools such as natural language processing (NLP) may help active managers deliver better investment outcomes by alerting them to negative environmental, social and governance (ESG) news before it becomes widely disseminated.

The Fallout When Bad News Breaks

From environmental disasters like oil spills and chemical leaks to social issues such as child labor to governance failures like executive misconduct, negative ESG news can severely damage a company’s reputation, erode investor confidence and undermine financial performance.

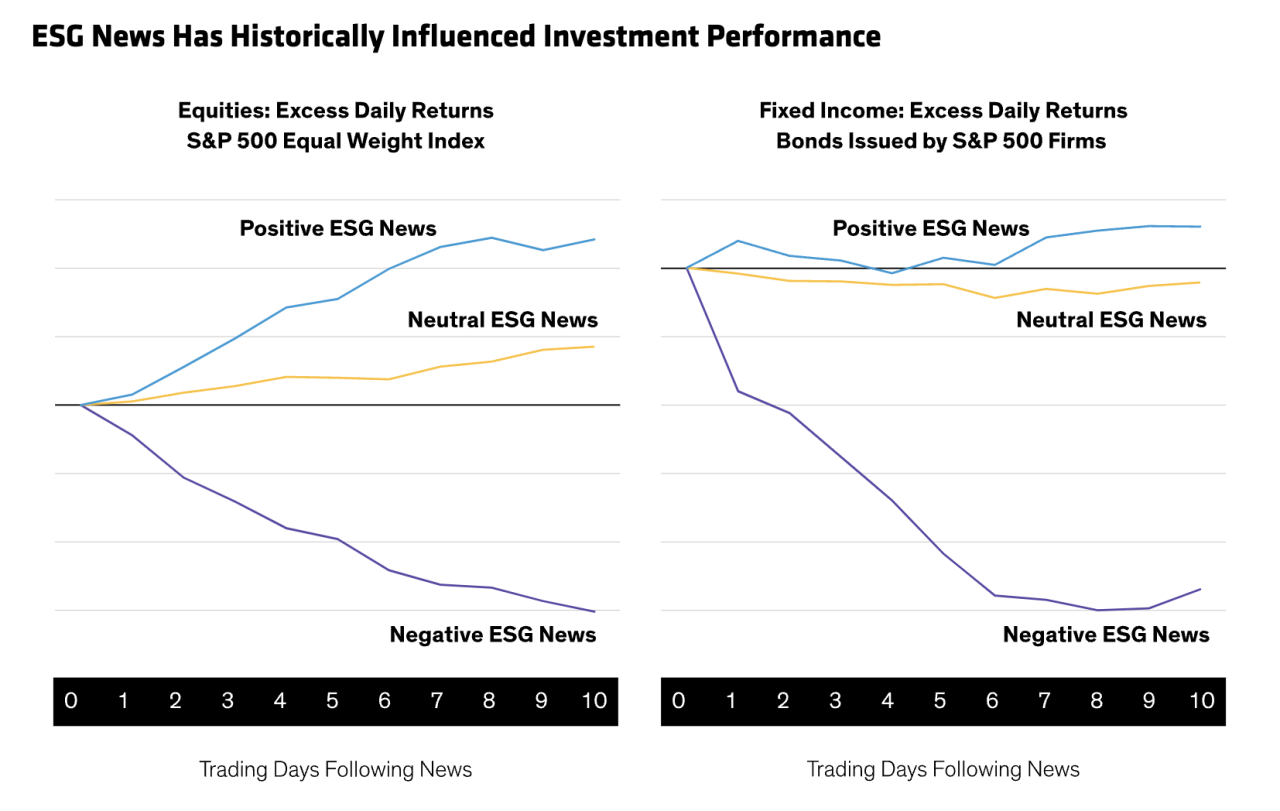

Our research indicates that, while positive ESG news has quickly boosted company returns, negative ESG has done just the opposite. Companies with negative ESG events have underperformed their peers—not just on the first day the news broke, but for weeks after (Display). For stocks associated with negative ESG news, returns over the 10-day holding period shown annualize to –7.3% in excess return (–1.2% for fixed income); for stocks associated with positive ESG news, returns over the 10-day holding period shown annualize to 6.2% in excess return (0.2% for fixed income).

Natural Language Processing Changes the Game

Clearly, if asset managers could uncover ESG-related controversies faster than their peers, they’d have an investment edge. But that’s easier said than done. Manually sifting through mountains of corporate filings and news articles is not just cumbersome and time-consuming; it’s also a Sisyphean task that must be repeated daily.

That’s where NLP technology comes in.

NLP is a field of AI that enables algorithms to understand, interpret and generate human communication. NLP applications have evolved dramatically since their advent in the 1950s, progressing from simple pattern matching—such as recognizing the phrase “thank you” and responding with “you’re welcome,” or counting the number of occurrences of a given word in a text—to more sophisticated techniques that involve deep learning and contextual understanding.

The result is a technology that is highly accurate and nuanced in its understanding and generation of human language, with the power to process and analyze vast amounts of raw data quickly and efficiently.

Putting NLP to Work: Controversy Alerts

We’ve built a powerful NLP tool that serves as a complement to our fundamental analysis. Incorporating the latest large-language models, this tool transforms the daunting task of sifting through thousands of company and news reports into an efficient and insightful process that flags potentially material ESG issues in real time.

Our tool monitors companies around the world, screening global news in multiple languages for controversies across a wide range of topics, including modern slavery, child labor, discrimination, tax scandals, executive pay and corruption. Furthermore, the tool is scalable, screening for developing ESG controversies across hundreds of companies simultaneously and providing timely alerts before negative news impacts the market.

It understands financial jargon, is trained in ESG-specific knowledge, and can assess tone and context, with the goal of evaluating the sentiment around a particular ESG news item with respect to a specific company. The tool extracts relevant information from the news sources, creates a summary and highlights what it deems most important for our analysts to evaluate. And it includes links to the original articles, allowing analysts to verify the information quickly.

For example, our NLP tool flagged a large mining concern with operations in Central America, alerting us to alleged poor treatment of employees and community members that compelled local governments to file lawsuits. Eventually, the company’s local mining permits were pulled, and it had to abandon operations in the area after investing nearly US$10 billion in the project. Fortunately, our tool had alerted us to these risks ahead of the government’s punitive actions.

The Bigger Picture: Integrating Our NLP Tool

Of course, AI and other tools are no substitute for sound fundamental analysis, which is why negative ESG news alerts don’t necessarily keep us from taking a position. The news may represent headline risk with which we’re comfortable or that we find is already priced into valuations.

As always, it’s up to our investment teams to assemble relevant data, including NLP alerts, into a bigger picture. Ultimately, our NLP tool is just one resource—albeit a valuable one—within a broader fundamental analysis that helps us make an informed decision about a company.

What’s more, NLP allows our analysts and portfolio managers to devote less time to tracking down data and more time to thinking critically about it—and to putting it to use on behalf of our clients.

References to specific securities discussed are not to be considered recommendations by AllianceBernstein L.P.

The views expressed herein do not constitute research, investment advice or trade recommendations, and do not necessarily represent the views of all AB portfolio-management teams and are subject to change over time.

Learn more about AB’s approach to responsibility here.

AllianceBernstein

AllianceBernstein

AllianceBernstein (AB) is a leading global investment management firm that offers diversified investment services to institutional investors, individuals, and private wealth clients in major world markets.

To be effective stewards of our clients’ assets, we strive to invest responsibly—assessing, engaging on and integrating material issues, including environmental, social and governance (ESG) considerations into most of our actively managed strategies (approximately 79% of AB’s actively managed assets under management as of December 31, 2024).

Our purpose—to pursue insight that unlocks opportunity—describes the ethos of our firm. Because we are an active investment manager, differentiated insights drive our ability to design innovative investment solutions and help our clients achieve their investment goals. We became a signatory to the Principles for Responsible Investment (PRI) in 2011. This began our journey to formalize our approach to identifying responsible ways to unlock opportunities for our clients through integrating material ESG factors throughout most of our actively managed equity and fixed-income client accounts, funds and strategies. Material ESG factors are important elements in forming insights and in presenting potential risks and opportunities that can affect the performance of the companies and issuers that we invest in and the portfolios that we build. AB also engages issuers when it believes the engagement is in the best financial interest of its clients.

Our values illustrate the behaviors and actions that create our strong culture and enable us to meet our clients' needs. Each value inspires us to be better:

- Invest in One Another: At AB, there’s no “one size fits all” and no mold to break. We celebrate idiosyncrasy and make sure everyone’s voice is heard. We seek and include talented people with diverse skills, abilities and backgrounds, who expand our thinking. A mosaic of perspectives makes us stronger, helping us to nurture enduring relationships and build actionable solutions.

- Strive for Distinctive Knowledge: Intellectual curiosity is in our DNA. We embrace challenging problems and ask tough questions. We don’t settle for easy answers when we seek to understand the world around us—and that’s what makes us better investors and partners to our colleagues and clients. We are independent thinkers who go where the research and data take us. And knowing more isn’t the end of the journey, it’s the start of a deeper conversation.

- Speak with Courage and Conviction: Collegial debate yields conviction, so we challenge one another to think differently. Working together enables us to see all sides of an issue. We stand firmly behind our ideas, and we recognize that the world is dynamic. To keep pace with an ever changing world and industry, we constantly reassess our views and share them with intellectual honesty. Above all, we strive to seek and speak truth to our colleagues, clients and others as a trusted voice of reason.

- Act with Integrity—Always: Although our firm is comprised of multiple businesses, disciplines and individuals, we’re united by our commitment to be strong stewards for our people and our clients. Our fiduciary duty and an ethical mind-set are fundamental to the decisions we make.

As of December 31, 2024, AB had $792B in assets under management, $555B of which were ESG-integrated. Additional information about AB may be found on our website, www.alliancebernstein.com.

Learn more about AB’s approach to responsibility here.

More from AllianceBernstein