Cyber Fraud Index: An Exclusive Look Inside the C-Suite

By Webster Bank

Published 02-27-25

Submitted by Webster Bank

Download the Webster Bank Cyber Fraud Index here

Cyber fraud is a growing risk for many businesses, their customers and their reputations. To find out how C-suite leaders are handling cybersecurity, we surveyed 150 of them. Our exclusive Cyber Fraud Index presents our findings . . . and some surprising insights.

Our 2024 Cyber Fraud Index Score reflects executives’ insecurities.

During an era of rising cybercrime, we asked C-suite executives how confident they are in their organization’s ability to protect itself from cyber fraud. Our Cyber Fraud Index Score represents the percentages who answered “Very Confident” or “Confident.”

- Cyber Fraud Index Score: 55

We Took the Elevator up to the C-Suite for a Look Into How Executives Are Reacting to Cyber Fraud.

With cybercrime on the rise, Webster Bank wanted to better understand how business leaders are feeling about the risks they face, and how they’re protecting their organizations.

So we fielded an exclusive, intensive market study to dive into the matter, and asked questions designed to:

- Identify the primary concerns C-suite leaders have about cyber fraud and cybersecurity.

- Explore the different issues that cause them concern, as well as who they believe will be impacted by

these issues. - Understand the cybersecurity protection measures organizations have implemented.

- Learn about executives’ experiences of being cyber fraud victims, as well as the impact.

- Assess how these leaders and organizations perceive their bank as a resource for addressing cyber fraud concerns.

Nothing’s more important to Webster than the success of our business customers. And we know a big part of that depends on security. So let’s take a closer look at the insights we discovered in our 2024 Cyber Fraud Index survey.

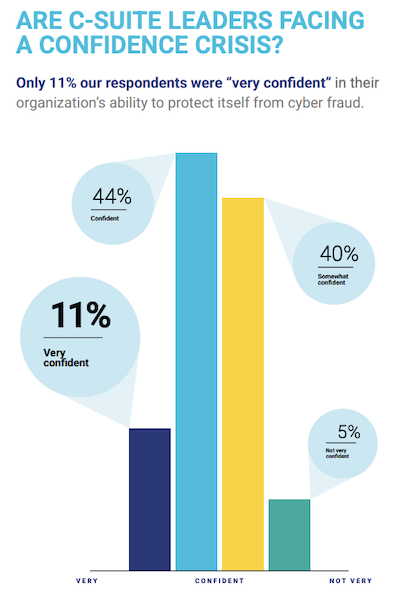

Are C-Suite Leaders Facing a Confidence Crisis?

Only 11% our respondents were “very confident” in their organization’s ability to protect itself from cyber fraud.

- 11%: Very confident

- 44%: confident

- 40%: Somewhat confident

- 5%: Not very confident

The how and the who behind our survey.

- The Cyber Fraud Index Methodology.

Our study was fielded in October 2024. It included both open-ended and closed questions, and took approximately 8 minutes to complete. We received 150 completes from C-Suite executives, most of whom identified themselves as one of the following:

- Chief Information Security Officer

- Chief Information Officer

- Chief Financial Officer

- Chief Technology Office

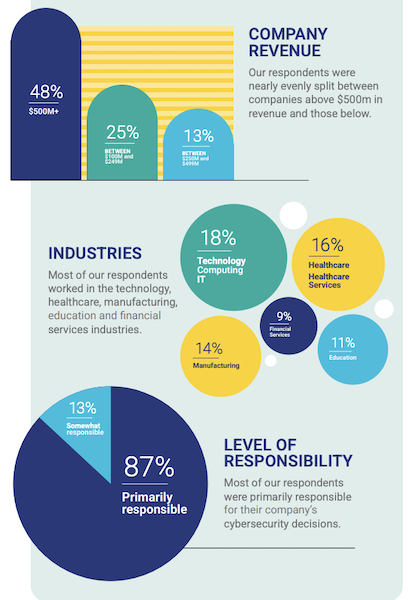

Company Revenue

Our respondents were nearly evenly split between companies above $500m in revenue and those below.

- 48%: $500M+

- 25%: Between $100M and $249M

- 13%: Between $250M and $499M

Industries

Most of our respondents worked in the technology, healthcare, manufacturing, education and financial services industries.

- 18%: Technology Computing IT

- 16%: Healthcare

- 14%: Manufacturing

- 11%: Education

- 9%: Financial Services

Level of Responsibility

Most of our respondents were primarily responsible for their company’s cybersecurity decisions.

- 87%: Primarily responsible

- 13%: Somewhat responsible

Insights that attracted our attention.

- An Executive Summary of Our C-Suite Survey.

Our Cyber Fraud Index uncovered many interesting statistics, but a few insights stood out when stepping back and looking at the bigger picture. As you analyze our results in the following pages, keep an eye out for the following themes and potential conflicts:

Tension between concerns and relied-upon resources.

Many C-Suite leaders identified third-party vendor risk as one of their top cybersecurity concerns, yet 6 in 10 still depend on third-party IT providers and consultants to protect their organizations from cyber fraud.

Cybersecurity plans vs. budgets.

91% of C-Suite executives report having a cybersecurity plan in place, but more than half also feel their cybersecurity budget is insufficient. This suggests that many executives want to do more to protect against cyber fraud but lack the funds.

High adoption of technical defenses, but low strategic guidance.

Many respondents have defenses like firewalls and multifactor authentication in place, but only about half have established a cybersecurity advisory council or a similar group to provide strategic guidance and governance on new and emerging threats.

High reliance on internal protection, but low confidence in cybersecurity.

92% of the executives we surveyed rely on internal IT resources as their primary line of defense, but less than half are fully confident in their organization’s cybersecurity measures.

The desire for more bank support.

The C-Suite leaders who responded expressed a desire for banks to take a more active role in cyber fraud protection, but 40% are neutral or unsatisfied with what their banks offer them.

Resource Reliance

The majority of respondents rely on internal IT resources, but also call upon outside resources, despite concerns over third-party risks.

Get a C‑suite view of cyber fraud; download the Webster Bank Cyber Fraud Index here.

Webster Bank

Webster Bank

About Webster

Webster Bank (“Webster”) is a leading commercial bank in the Northeast that provides a wide range of digital and traditional financial solutions across three differentiated lines of business: Commercial Banking, Consumer Banking and Healthcare Financial Services, one of the country's largest providers of employee benefits and administration of medical insurance claim settlements solutions. Headquartered in Stamford, CT, Webster is a values-driven organization with $76 billion in assets. Its core footprint spans the northeastern U.S. from New York to Massachusetts, with certain businesses operating in extended geographies. Webster Bank is a member of the FDIC and an equal housing lender. For more information about Webster, including past press releases and the latest annual report, visit the Webster website at www.websterbank.com.

More from Webster Bank