AB: The Hidden Hazard in Climate Portfolios: Equity Concentration Risk

If climate portfolios are positioned in the same giant US stocks held in broad equity allocations, investors may unwittingly double down on risk.

Published 11-13-24

Submitted by AllianceBernstein

Kent Hargis, PhD| Chief Investment Officer—Strategic Core Equities; Portfolio Manager—Global Low Carbon Strategy

Teresa Keane| Managing Director—Equities

Brian Holland, CFA| Portfolio Manager and Senior Research Analyst—International Strategic Core Equities

Investors seeking to reduce climate risk in targeted equity strategies might not be aware of hidden hazards to portfolio construction. Climate-focused benchmarks have big positions in US heavyweight stocks, which adds concentration risk and mutes portfolio diversification benefits.

There are different ways for equity portfolios to address climate-related issues. Some might focus on companies that help solve climate challenges, while others target firms with lower carbon emissions than their peers. Another approach is to focus on companies that are integral to the energy transition across diverse sectors and industries.

Whatever approach an investor chooses, we believe it’s important to manage a climate-related portfolio with the same research rigor and risk management as any other active equity strategy. That means ensuring that the portfolio has adequate diversification.

Heavy Weights in US Mega-Caps

Passive approaches to climate-focused investing may lack that diversification. That’s because key climate benchmarks are prone to heavy concentration in a small group of giant US stocks—just like broad cap-weighted benchmarks.

It sounds surprising. After all, you would expect a climate-focused benchmark to have much different positions than the broad equity market. But in fact, the MSCI World Climate Paris Aligned Index is heavily concentrated in the same stocks that dominate the MSCI World broad market index. This is largely by design, as climate indices typically seek to limit tracking error to the broader market index.

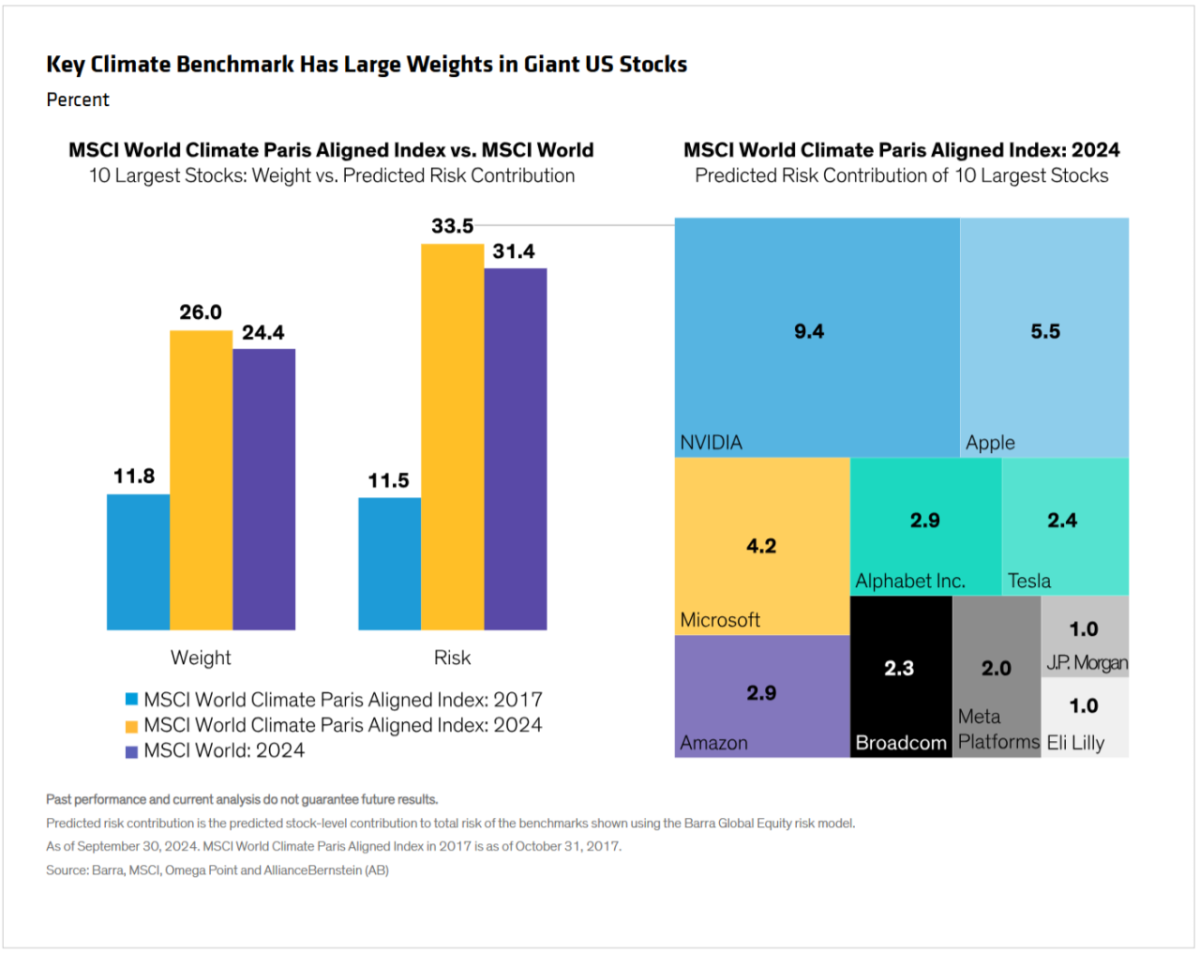

As a result, the weight of the 10 largest stocks in the MSCI World Climate Paris Aligned Index has more than doubled since 2017, to 26% (Display), higher than their weight in the MSCI World. Most of the 10 biggest stocks in the MSCI World Climate benchmark are the same as those in the MSCI World and S&P 500, such as NVIDIA, Apple and Microsoft. And the top 10 account for 33.5% of the MSCI World Climate Paris Aligned Index risk, versus 31.4% of the MSCI World risk.

To be sure, the US megacaps, also known as the Magnificent Seven, include some excellent businesses. However, we think it’s risky to own the entire group at benchmark weights, and the recent divergence in returns of the Mag Seven reinforces the case for selective stock picking. In any equity strategy, portfolio managers should own each stock based on the strategy’s philosophy while also paying attention to its overall risk characteristics. These principles apply to climate portfolios, too.

Diversifying Return Streams in Climate Portfolios

Effective low-carbon equity strategies involve more than just vetting companies for carbon emissions. Many other variables must be weighed too, since so much can determine a stock’s risk/reward profile beyond the long arm of climate change.

In climate portfolios, we believe investors should search across sectors and industries for high-quality companies that are transitioning to a lower-carbon economy. These include enablers, implementers and beneficiaries of the transition that play instrumental roles in the global energy transformation but whose carbon emission scores may not reflect that.

That’s why company fundamentals such as profitability and capital discipline are equally vital inputs in active climate-focused strategies. Strong fundamentals help quality businesses surmount macro hurdles beyond climate risks, such as inflation and higher interest rates. Attractive share valuations support return potential and help investors avoid risks in expensive parts of the market. We believe that integrating these three targets in stock selection—quality, climate and price—can better align a portfolio’s climate goals with investors’ long-term financial objectives and risk appetite (Display). Today, heightened political and geopolitical risk makes it especially important to apply thorough fundamental research to stock selection in a climate-focused portfolio.

Investors seeking a climate-focused portfolio should also think about how it fits into a broader equity allocation. The heavy concentration of the MSCI World Climate Paris Aligned Index in giant US stocks could lead investors to inadvertently double down on absolute risk if they hold similar large weights in the same companies in a US or global equity allocation.

Diversification is the cornerstone of prudent, risk-aware equity investing. Climate-focused investing is no different—long-term investing success depends on the real diversification of businesses and return streams, both within a portfolio and versus a broader equity allocation.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams. Views are subject to change over time.

MSCI makes no express or implied warranties or representations, and shall have no liability whatsoever with respect to any MSCI data contained herein.

The MSCI data may not be further redistributed or used as a basis for other indices or any securities or financial products. This report is not approved, reviewed or produced by MSCI.

References to specific securities discussed are for illustrative purposes only and are not to be considered recommendations by AllianceBernstein L.P.

Learn more about AB’s approach to responsibility here.

AllianceBernstein

AllianceBernstein

AllianceBernstein (AB) is a leading global investment management firm that offers diversified investment services to institutional investors, individuals, and private wealth clients in major world markets.

To be effective stewards of our clients’ assets, we strive to invest responsibly—assessing, engaging on and integrating material issues, including environmental, social and governance (ESG) considerations into most of our actively managed strategies (approximately 79% of AB’s actively managed assets under management as of December 31, 2024).

Our purpose—to pursue insight that unlocks opportunity—describes the ethos of our firm. Because we are an active investment manager, differentiated insights drive our ability to design innovative investment solutions and help our clients achieve their investment goals. We became a signatory to the Principles for Responsible Investment (PRI) in 2011. This began our journey to formalize our approach to identifying responsible ways to unlock opportunities for our clients through integrating material ESG factors throughout most of our actively managed equity and fixed-income client accounts, funds and strategies. Material ESG factors are important elements in forming insights and in presenting potential risks and opportunities that can affect the performance of the companies and issuers that we invest in and the portfolios that we build. AB also engages issuers when it believes the engagement is in the best financial interest of its clients.

Our values illustrate the behaviors and actions that create our strong culture and enable us to meet our clients' needs. Each value inspires us to be better:

- Invest in One Another: At AB, there’s no “one size fits all” and no mold to break. We celebrate idiosyncrasy and make sure everyone’s voice is heard. We seek and include talented people with diverse skills, abilities and backgrounds, who expand our thinking. A mosaic of perspectives makes us stronger, helping us to nurture enduring relationships and build actionable solutions.

- Strive for Distinctive Knowledge: Intellectual curiosity is in our DNA. We embrace challenging problems and ask tough questions. We don’t settle for easy answers when we seek to understand the world around us—and that’s what makes us better investors and partners to our colleagues and clients. We are independent thinkers who go where the research and data take us. And knowing more isn’t the end of the journey, it’s the start of a deeper conversation.

- Speak with Courage and Conviction: Collegial debate yields conviction, so we challenge one another to think differently. Working together enables us to see all sides of an issue. We stand firmly behind our ideas, and we recognize that the world is dynamic. To keep pace with an ever changing world and industry, we constantly reassess our views and share them with intellectual honesty. Above all, we strive to seek and speak truth to our colleagues, clients and others as a trusted voice of reason.

- Act with Integrity—Always: Although our firm is comprised of multiple businesses, disciplines and individuals, we’re united by our commitment to be strong stewards for our people and our clients. Our fiduciary duty and an ethical mind-set are fundamental to the decisions we make.

As of December 31, 2024, AB had $792B in assets under management, $555B of which were ESG-integrated. Additional information about AB may be found on our website, www.alliancebernstein.com.

Learn more about AB’s approach to responsibility here.

More from AllianceBernstein