Navigating the Road to Compliance: Strategic Steps for Fleets Eyeing Emissions Rule

Published 08-28-24

Submitted by Cummins, Inc.

by Tom Quimby, On-highway Journalist

Between the fine print and varying perspectives on the rule announced March 29, you may be seeking steadiness amid uncertainty. Cummins Inc. met the U.S. Environmental Protection Agency (EPA) unprecedented ambition with a call to action for all of industry and all levels of government to work together. “This is an ambitious goal, and there will be challenges across our industry to reach it,” Cummins wrote. “However, Cummins is uniquely positioned to develop and manufacture a broad range of technologies that enable our customers to prosper, wherever they are along their energy transitions journey.” The following considerations may help a fleet chart a path to compliance with the stringent standards set by the new emissions rule.

1. Determine what your fleet must know about the Environmental Protection Agency’s heavy-duty Phase 3 emissions regulations.

It’s best to get ahead of the curve in terms of knowing the avenues of compliance. EPA projects that one pathway for meeting the new standards would be for industry to aim for 34% ZEVs for day cab tractors and 25% for sleeper cabs in model year 2032. The stated goals include use of battery electric and fuel cell technologies. EPA also suggests other potential pathways for both day and sleeper cabs like hybrids, hydrogen combustion, or natural gas. Knowing which pathway is best for your fleet will make all the difference.

2. Get familiar with forms of emissions.

From carbon dioxide, nitrous oxide, methane to fluorinated gases, the more familiar you are with emissions the better off you will be in terms of knowing how best to address each one and why. CO2 comprises nearly 80% of all greenhouse gases (GHGs), according to EPA. Nitrous oxide (N2O) makes up roughly 6 percent of GHGs and is blamed for posing health risks among communities exposed to heavy vehicle traffic, according to EPA. While methane makes up only a 12% share of GHGs, EPA considers it to be 28 times more potent in terms of trapping heat. Fleets can help reduce methane by using natural gas engines like Cummins new X15N. Renewable natural gas used in advanced engines like the X15N can produce near-zero emissions well-to-wheel.

3. Get more familiar with alternative fuels and powertrain options.

Cummins and its subsidiary Accelera have published several articles and videos that shed light on various fuels and technologies designed to lower or eliminate emissions. The company is hard at work around the world perfecting internal combustion powertrain designs, batteries, fuel cells and hydrogen production systems that can allow your fleet to reach emissions goals.

4. Know where to find alternative fuels.

The Department of Energy regularly updates its Alternative Fueling Station Locator map. To date, there are 73,850 charging stations across the U.S. and Canada. About 15% of those are DC fast-chargers which may not yet be suitable for Class 8 electric trucks. The Argonne National Laboratory notes that “a long-haul truck driver driving a Class 8 [electric] tractor would require a 1.6-megawatt charge to recover 400 miles of charge within a 30-minute break.” The higher-powered approach for medium- and heavy-duty electric trucks is known as the megawatt charging system (MCS). Chargers for Class 1 and 2 passenger EVs peak at around 500kW or roughly three times less. Truck-centric refueling corridors for electric and fast-fill hydrogen are being funded along major routes through the Inflation Reduction Act. Keep an eye on progress through the DOE’s interactive corridor map and the Joint Office of Energy and Transportation’s recently published National Zero-Emission Freight Corridor Strategy. Detailed information including maps lay out a nationwide plan for fueling the next generation of clean trucks.

5. Transitioning your work force.

Have fleet managers, drivers and technicians familiarize themselves with cleaner-running diesel, natural gas, hydrogen combustion, hybrids, battery electric and fuel cell trucks. One way to do this is to attend trade shows for opportunities to see these vehicles up close and experience valuable seat time in 'ride and drive' events. Cummins leaders are also accessible in sharing the ins and outs of clean, hard-working trucks which may offer a break in maintenance costs. Service methods and tooling will also change, leaving some fleets to opt for OEMs and others to handle servicing until they’re more comfortable in having their own technicians take on these high-tech rigs.

6. Calculate the cost.

The EPA estimates that fleets will “pay an average of $17,000 more in upfront costs for a MY 2032 day cab tractor ZEV than for a conventional, including the cost of electric vehicle charging infrastructure, but recoup these costs in 3 years or less through yearly operational savings.” Those costs are based on tax credits through the Inflation Reduction Act and an anticipated drop in production costs particularly for EV batteries. Total cost of ownership (TCO) for electric trucks can be trimmed if fleets rely on slower, overnight charging when utility rates are lower. Slower charging also prolongs battery life.

7. Work with utilities to understand infrastructure changes required for installing chargers at fleet sites.

Utilities, like fleets, are bracing for major changes in energy use and show eagerness to help. Several utilities including Southern California Edison and Duke Energy offer programs aimed at informing and assisting fleets in the transition to cleaner energy.

8. Be on the lookout for incentives.

Grants, tax credits and other offers will be offered to help make the switch to alt fuel trucks and vans. Look for opportunities at the federal, state and local levels.

9. Study vehicle lifecycle management and battery storage.

When EV batteries can no longer perform at peak efficiency for powertrain use, that does not mean that they are no longer useful. According to global management group McKinsey & Company, second-life use applications for used EV batteries are growing and “after remanufacturing, such batteries are still able to perform sufficiently to serve less-demanding applications, such as stationary energy-storage service.” Second-life use cases include grid resiliency, EV charging and facility backup power. These batteries get an even greener profile when charged through clean solar or hydrogen fuel cell generators. Following second-life use, batteries are candidates for recycling, an industry that’s projected to grow as more of these valuable batteries enter the market through EVs, hybrids and fuel-cells. Recycling methods used to recover battery elements like lithium, cobalt and nickel continue to improve and thus provide more value as EV manufacturing increases. Market research firm MarketsandMarkets expects a nearly 26% jump in value for the EV battery recycling market by 2031. Nonetheless, some fleets may prefer that OEMs or other entities take on battery lifecycle management.

10. Seek reliable resources.

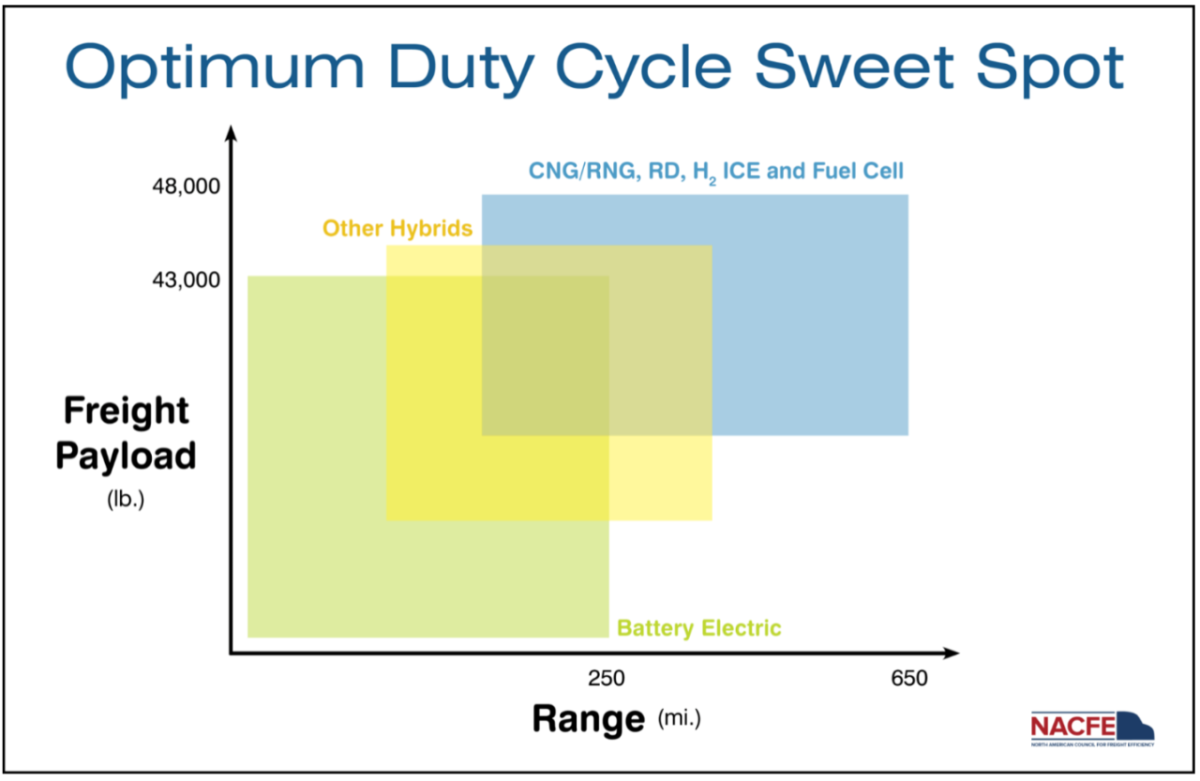

In addition to utilizing experts like OEMs or Cummins, fleets can use many resources when sorting a given technology’s capability to measure up to needs. Trade publications and organizations closely study and assess commercial vehicle performance. Research groups report results of in-depth studies on emerging technologies such as the non-profit North American Council for Freight Efficiency (NACFE). NACFE’s chart below offers a quick assessment of alt fuel vehicle capabilities. TRC Companies offers consulting services for businesses interested in adopting alt fuel vehicles. Its annual trade show, the Advanced Clean Transportation Expo, attracts OEMs and thousands of attendees including fleet executives who often share their experiences with alt fuel vehicles in various panels throughout the week-long event. Utilities are also gaining traction as subject matter experts. Southern California Edison offers a full line-up of EV guidance including its Funding Finder Tool and Electrification & Infrastructure Guidebook. Case studies are also available for review.

Cummins, Inc.

Cummins, Inc.

Cummins Inc., a global power leader, is a corporation of complementary business segments that design, manufacture, distribute and service a broad portfolio of power solutions. The company’s products range from diesel, natural gas, electric and hybrid powertrains and powertrain-related components including filtration, aftertreatment, turbochargers, fuel systems, controls systems, air handling systems, automated transmissions, electric power generation systems, batteries, electrified power systems, hydrogen generation and fuel cell products. Headquartered in Columbus, Indiana (U.S.), since its founding in 1919, Cummins employs approximately 61,600 people committed to powering a more prosperous world through three global corporate responsibility priorities critical to healthy communities: education, environment and equality of opportunity.

More from Cummins, Inc.