AllianceBernstein: Active or Passive? Seeking Solutions to ESG Confusion

Published 05-23-24

Submitted by AllianceBernstein

Kate Mead| Investment Strategist—Equity Business Development

Amelia Sexton, CFA| Director of ESG Strategy & Operations—Client Group

Active management can help investors address some of the especially tricky issues in sustainable equity portfolios.

Investors with an environmental, social and governance (ESG) focus are increasingly leaning toward passive portfolios, which may seem to offer the simplicity they crave in a complex market landscape. But the path to passive is fraught with risks, particularly when it comes to sustainable strategies.

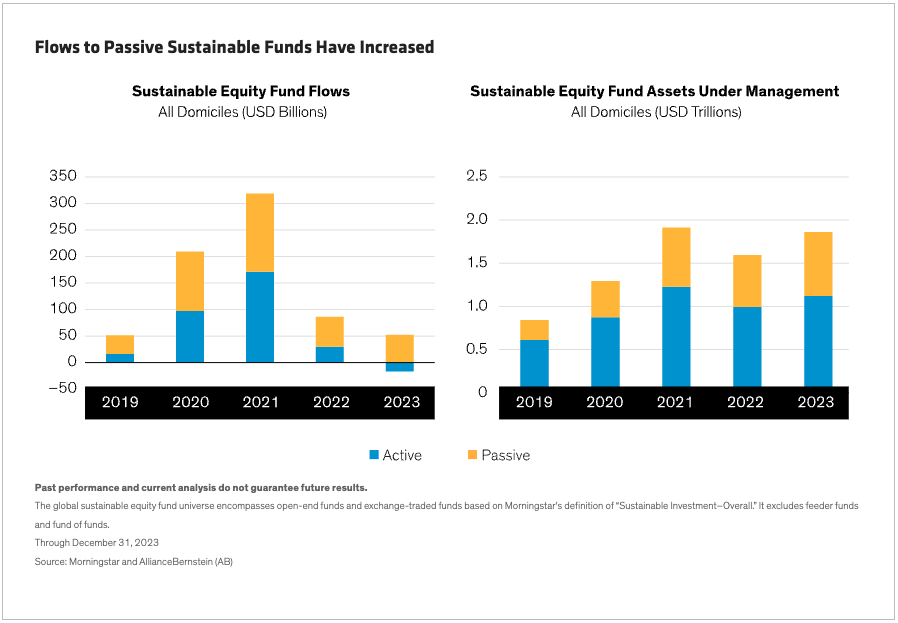

Passive portfolios continue to gain traction. In 2023, for the first time, equity assets managed by passive funds overtook actively managed assets, according to Morningstar data. The trend hasn’t been as acute for sustainable portfolios. Yet passive sustainable equity funds globally attracted $52.6 billion of inflows in 2023, while active sustainable funds bled nearly $16.7 billion, according to Morningstar (Display).

Is this the start of a rush toward passive sustainable funds? It’s too soon to say. Active funds still comprise the lion’s share of sustainable equity assets managed globally, worth $1.87 trillion. But we do know that it can be hard to compare active strategies amid different definitions of sustainability and diverse investing processes. And evolving ESG regulation, which may be intended to simplify sustainable investing, often adds to the confusion. As investors consider their options, we think the pros and cons of each approach deserve a closer look.

The Pull to Passive: Fees and Ease

The appeals of passive are well known. Passive portfolios offer lower fees than active peers and are typically based on a clear index-construction methodology that provides easy access to market returns. Investors can easily find a passive portfolio aligned with their individual preferences, given the explosion of specialized benchmarks in recent years.

For sustainable investors, the presumed simplicity of passive options might appear to be a suitable antidote to confusion over ESG regulation and the complexity of active options and diverse methodologies. But the simplicity of passive portfolios may be overstated. We believe that, in a rapidly changing environment, active portfolios offer several clear benefits for sustainable equity portfolios.

Evaluating Active Advantages in Sustainable Equities

Looking forward, not back. Passive portfolios are typically built to mimic an index. But benchmarks are inherently backward looking, as constituent weights are set based on their market capitalization, which reflects past performance. As a result, the largest weights aren’t necessarily the best opportunities. In our view, active managers are better equipped with research tools to identify structural growth opportunities and develop strategic outlooks for individual businesses. This enables them to position selectively in sustainable companies with ESG profiles that are forward-looking and aligned with an investment strategy, while offering attractive long-term return potential.

Fundamental analysis provides an ESG edge. Third-party ESG metrics are useful but have well-documented flaws. Providers may deliver very different ESG verdicts about the same company. And weightings attributed to each of the three ESG components may skew the outcome; for example, a strong governance score could outweigh a poor environmental score and paint a rosier picture of a company than it deserves—or vice versa.

Passive strategies rely on these types of ratings to construct portfolios. We believe ESG ratings are a helpful starting reference point, from which active managers can conduct their own research to determine a company’s sustainability credentials based on a clear investing philosophy—and decide how these fit into an overall risk/reward outlook.

Engaging for positive change. Active equity managers are typically longer-term investors who are interested in strategically engaging with the management of companies held in the portfolio. Focused engagement with executives on financially material ESG issues affords an opportunity to influence corporate behavior and promote positive change that can add shareholder value over time. We believe these types of interactions, combined with an active proxy voting policy, can be more fruitful for an active manager. While passive investors may possess voting power, they don’t usually have the same incentives to wield influence, given the breadth of their exposure and the shorter length of their holding period.

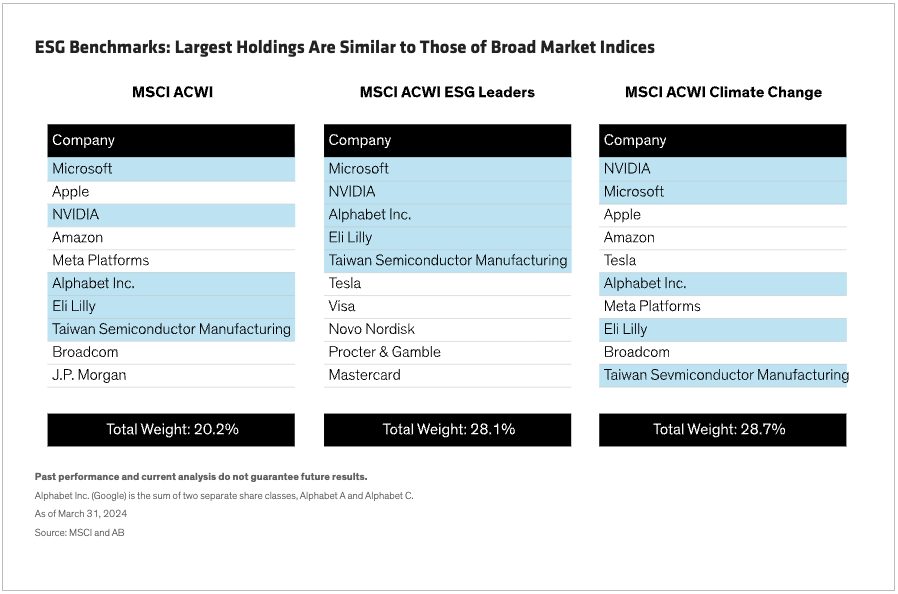

More diversification of return streams. Much has been said about the domination of the so-called Magnificent Seven stocks in equity markets. In some cases, ESG-focused benchmarks, which passive portfolios seek to replicate, are even more concentrated—particularly in the US. For example, the 10 largest stocks in the two key S&P ESG benchmarks accounted for more than 40% of the index weight—far more than the 31% weight of the 10 largest in the broad S&P 500. Popular global ESG benchmarks are less concentrated but feature many of the same names among their biggest holdings, including several US mega-caps (Display).

Passive portfolios that track a concentrated index will similarly hold large positions in a small group of companies. In our view, high concentration exposes investors to crowding risk if sentiment toward the dominant group of stocks sours. Concentration can also create unintended skews toward certain sectors and equity styles. Active managers can create portfolios with more diversified sources of returns to reduce these vulnerabilities.

Does the Portfolio Meet Your Sustainable Mandate?

Given the similarities between ESG and traditional benchmarks, investors may not actually be meeting their defined sustainability goals in an index-tracking fund. While passive portfolios do have a role to play in a wider sustainable allocation, we don’t think they can do the job alone. In our view, active strategies can function as a standalone ESG portfolio or as a complementary component of a core/satellite construction, for investors who prefer a passive anchor to market returns.

When assembling an allocation, investors should first clearly define their sustainability and financial goals. Then, they should search for active managers whose philosophy is aligned with those objectives and who offer transparency via clear, repeatable investment processes.

Not every active manager has the requisite skill to capture sustainable equity returns. We think effective active portfolios must integrate ESG research with fundamental analysis to target companies with long-term business advantages. With a well-defined approach, equity portfolios can selectively capture sources of market-beating returns that actively overcome the hurdles to sustainable investing success.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams. Views are subject to revision over time.

References to specific securities discussed are for illustrative purposes only and are not to be considered recommendations by AllianceBernstein L.P.

Learn more about AB's approach to responsibility here.

AllianceBernstein

AllianceBernstein

AllianceBernstein (AB) is a leading global investment management firm that offers diversified investment services to institutional investors, individuals, and private wealth clients in major world markets.

To be effective stewards of our clients’ assets, we strive to invest responsibly—assessing, engaging on and integrating material issues, including environmental, social and governance (ESG) considerations into most of our actively managed strategies (approximately 79% of AB’s actively managed assets under management as of December 31, 2024).

Our purpose—to pursue insight that unlocks opportunity—describes the ethos of our firm. Because we are an active investment manager, differentiated insights drive our ability to design innovative investment solutions and help our clients achieve their investment goals. We became a signatory to the Principles for Responsible Investment (PRI) in 2011. This began our journey to formalize our approach to identifying responsible ways to unlock opportunities for our clients through integrating material ESG factors throughout most of our actively managed equity and fixed-income client accounts, funds and strategies. Material ESG factors are important elements in forming insights and in presenting potential risks and opportunities that can affect the performance of the companies and issuers that we invest in and the portfolios that we build. AB also engages issuers when it believes the engagement is in the best financial interest of its clients.

Our values illustrate the behaviors and actions that create our strong culture and enable us to meet our clients' needs. Each value inspires us to be better:

- Invest in One Another: At AB, there’s no “one size fits all” and no mold to break. We celebrate idiosyncrasy and make sure everyone’s voice is heard. We seek and include talented people with diverse skills, abilities and backgrounds, who expand our thinking. A mosaic of perspectives makes us stronger, helping us to nurture enduring relationships and build actionable solutions.

- Strive for Distinctive Knowledge: Intellectual curiosity is in our DNA. We embrace challenging problems and ask tough questions. We don’t settle for easy answers when we seek to understand the world around us—and that’s what makes us better investors and partners to our colleagues and clients. We are independent thinkers who go where the research and data take us. And knowing more isn’t the end of the journey, it’s the start of a deeper conversation.

- Speak with Courage and Conviction: Collegial debate yields conviction, so we challenge one another to think differently. Working together enables us to see all sides of an issue. We stand firmly behind our ideas, and we recognize that the world is dynamic. To keep pace with an ever changing world and industry, we constantly reassess our views and share them with intellectual honesty. Above all, we strive to seek and speak truth to our colleagues, clients and others as a trusted voice of reason.

- Act with Integrity—Always: Although our firm is comprised of multiple businesses, disciplines and individuals, we’re united by our commitment to be strong stewards for our people and our clients. Our fiduciary duty and an ethical mind-set are fundamental to the decisions we make.

As of December 31, 2024, AB had $792B in assets under management, $555B of which were ESG-integrated. Additional information about AB may be found on our website, www.alliancebernstein.com.

Learn more about AB’s approach to responsibility here.

More from AllianceBernstein