Surging Electricity Demand Across UK Cities Makes a Strong Case for Investing in Rooftop Solar

Published 05-09-24

Submitted by CBRE Group, Inc.

By Jen Siebrits Toby Radcliffe

The UK transition to net zero relies on increasing the use of renewably generated electricity. But with electricity demand predicted to double the in UK by 2050, renewable energy generation and power infrastructure will have to scale up rapidly. And so, there is a clear investment opportunity. However, traditional renewables investments can be challenging, with some connection dates as far away as 2035.

This is where real estate can play an important role. Specifically, capitalising on roof space for solar energy generation. While commercial rooftop solar will always require a grid connection, the timelines tend to be significantly shorter than utility scale generation sites (albeit there are still limitations for large systems on warehouse roofs).

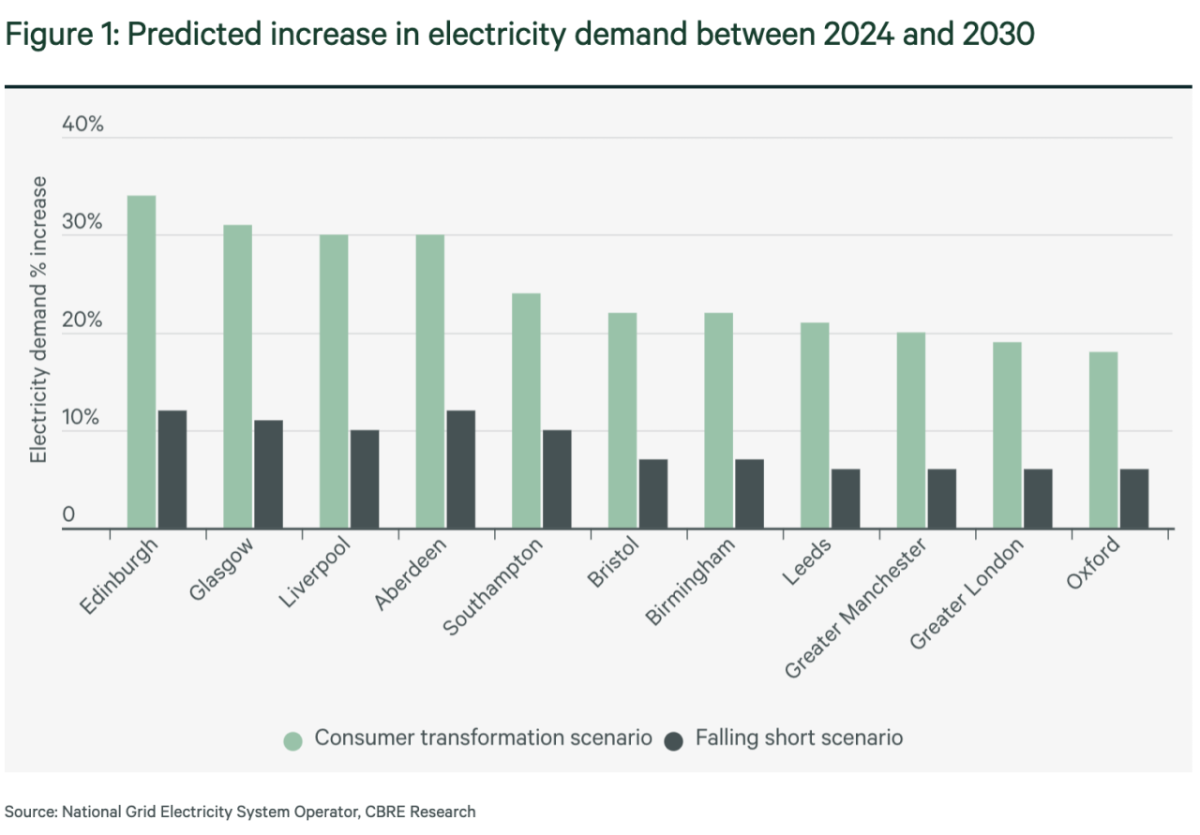

So that’s the what and why, but what about the where? We know the need will increase in all cities, but demand will rise in some more than others. For a better understanding, we analysed ESO (Electricity System Operator) data to discover the minimum and maximum increase in electricity demand at city level.

The highest forecast, which shows changes on a trajectory to achieve net zero by 2050, suggests an average 24% increase in electricity demand across our cities in the next six years alone. Edinburgh and Glasgow had the highest increases of over 30%, which partly reflects its colder temperatures, but all cities show a significant increase. However, these estimates rely on improved energy efficiency, use of electricity for heating and an overall reduction in consumer demand. If this doesn’t happen, the pattern of demand will be different. For example, under a scenario where the UK fails to achieve net zero by 2050, the demand for electricity will be lower. However, even so, there is still an estimated 8% increase in electricity demand across our cities by 2030.

Regardless, in any case, in just six years electricity demand will have risen significantly. Because growth in grid capacity moves slower than this, these forecasts suggest that investing in rooftop solar in UK cities is a good strategy for utilising unused space and securing low carbon electricity as demand surges. However, solar installation is not always straight forward so site and location assessments are recommended to find the best opportunities.

Notes: The minimum and a maximum increase in electricity use reflect the different ways in which the UK power grid decarbonises. The higher range – the consumer transformation scenario – assumes the UK is on path to achieving net zero net zero by 2050 by electrifying heating, achieving high energy efficiency and reducing consumer demand. The lower estimate reflects a ‘falling short’ scenario, whereby the UK does not achieve net zero by 2050 and only takes limited steps to decarbonise power generation.

CBRE Group, Inc.

CBRE Group, Inc.

CBRE Group, Inc. (NYSE:CBG), a Fortune 500 and S&P 500 company headquartered in Los Angeles, is the world’s largest commercial real estate services and investment firm (in terms of 2013 revenue). The Company has approximately 44,000 employees (excluding affiliates), and serves real estate owners, investors and occupiers through approximately 350 offices (excluding affiliates) worldwide. CBRE offers strategic advice and execution for property sales and leasing; corporate services; property, facilities and project management; mortgage banking; appraisal and valuation; development services; investment management; and research and consulting. Please visit our website at www.cbre.com.

More from CBRE Group, Inc.