AB: Just Transition and Emerging Markets: Weighing the Risks

Published 04-18-24

Submitted by AllianceBernstein

Saskia Kort-Chick| Director of Social Research and Engagement—Responsibility

Markus Schneider| Senior Economist—EEMEA

Understanding the social risks posed by climate transition requires discipline, nuance and a systematic approach.

The concept of a “just transition” has gained ground among responsible investors concerned about the economic consequences of the social risks that countries face in moving from fossil fuels to alternative energy sources. These risks are particularly high in emerging markets (EMs). How can investors systematically measure them?

Put simply, a just transition entails transitioning from fossil fuels in a way that is mindful of the economic impacts and not disruptive of the social fabric of economies.

The consequences of a mismanaged transition may be significant in coal- or oil-exporting countries, especially those with relatively undiversified economies. As demand for these commodities declines, such countries may face more significant transition risks. Governments may face fiscal and debt challenges that pressure their sovereign credit ratings. Worse, economic privation and civil unrest may lead to political instability and even regime change.

In developing a systematic approach to assessing these risks, it helps to focus on the sector at the center of most transition strategies: energy production, particularly coal (the most carbon-intensive fossil fuel). This has the added advantage that coal transitions already under way—such as those of Germany, Poland, the UK and the US—provide policy lessons and examples of pitfalls to avoid. These can be a useful lens through which to analyze how EMs are managing their just transitions.

Policy Lessons: Learning from Experience

Policy lessons show, for example, that a holistic and integrated government planning process is necessary, focusing on workers’ welfare, economic diversification, and social and environmental preservation. Without the help and commitment of national and local governments, a just transition is unlikely to succeed.

Planning is essential, but the reality is that macroeconomic preconditions such as existing levels of industrialization and access to infrastructure matter hugely in government efforts to diversify coal regions. Also, prevailing labor market protection and social security networks are crucial in protecting workers during their transition into alternative employment. In that context, the locations of coal mines are important too, as diversification in very remote areas (where many EM mines are situated) is difficult.

Relative Transition Risks and Specific Vulnerabilities

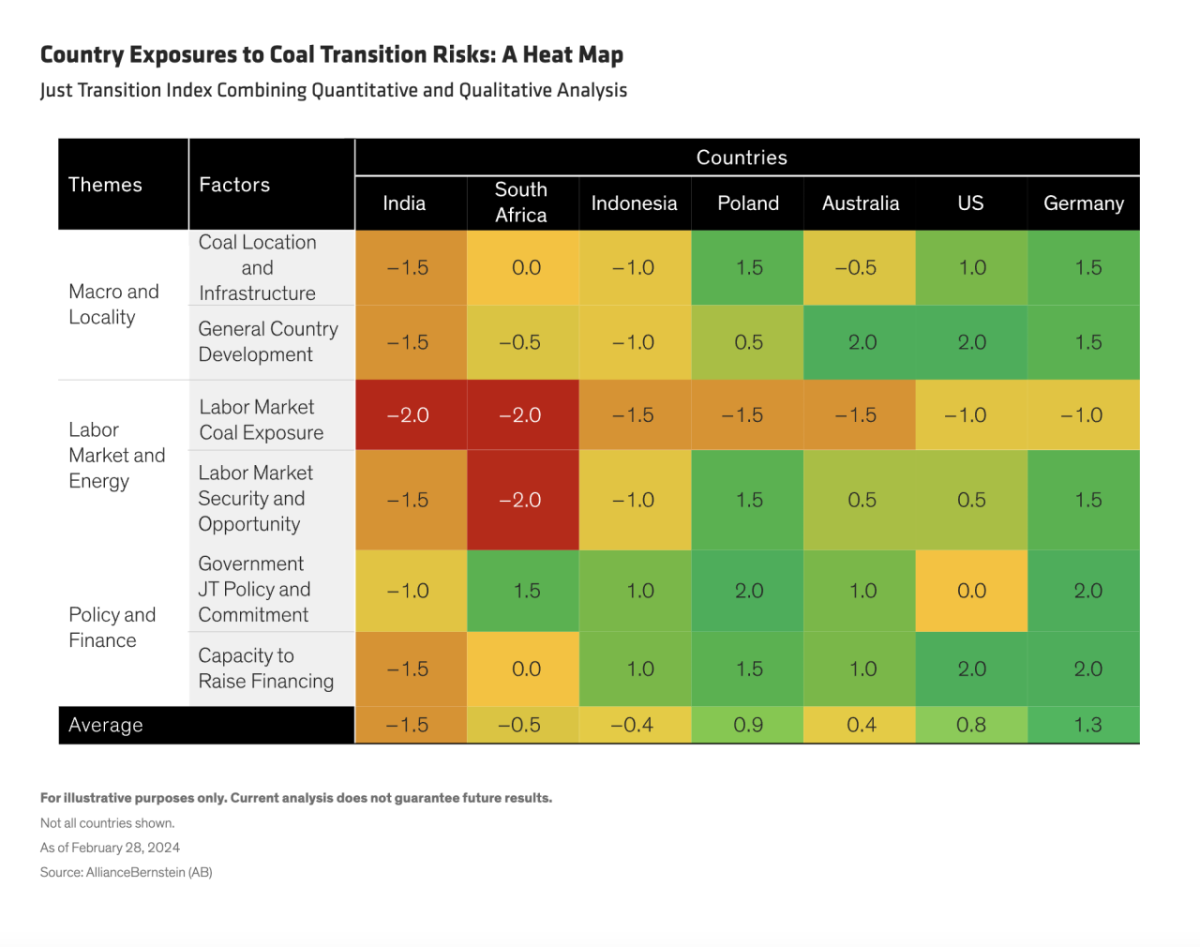

Informed by past policy lessons, we created a Just Transition Index (JTI) that scores countries across a range of key indicators. The scores are intended to capture a country’s overall level of macroeconomic development and the locations of its mines, the make-up of its labor and energy markets, government policy commitment to a just transition, and the ability to finance it.

Some indicators are relatively easy to measure quantitatively (such as a country’s level of development, exposure of its labor market to coal, and government budget capacity), while others (for example, coal mine locations and government commitment to reform) are harder to quantify.

For this reason, we opted for a qualitative index to score each country from –2 to 2, where the lowest numbers represent the most risk (Display). The JTI provides a guide not only to countries’ overall relative risk (contained in their score averages) but also specific vulnerabilities (individual factor scores).

But the value to investors of such an approach lies not only in its systematic aspects. The underlying qualitative research is critical for understanding the nuances of transition risk.

Preconditions Are a Key Variable

As noted earlier, EMs are particularly exposed. For example, EM labor rights and opportunities tend to be less extensive than those in developed countries. In India, Indonesia and China, coal production is located far from urban centers, limiting the scope for easing coal-dependent populations into alternative employment without the cost and disruption of relocation.

Poland illustrates this well. The country began its transition away from coal more than 30 years ago. Though the transition hasn’t been seamless, it has worked well in one major respect: many of Poland’s coal mining areas are co-located with key industries, such as automobile manufacturers and information and communications technology service providers.

The situation is different in Indonesia. Coal production there is heavily concentrated in Kalimantan and South Sumatra and accounts for 35% of East Kalimantan’s GDP. These areas are remote from the islands of Java and Bali, which together account for 60% of both Indonesia’s population and its GDP. But this challenge may be mitigated by plans to relocate Indonesia’s capital city—currently Jakarta, on the northwest coast of Java—to East Kalimantan.

A Practical and Potentially Rewarding Approach

Other policy lessons reflected by these examples are that stakeholders’ expectations should be managed (as Poland shows, transition can take decades) and strategies should be holistic, not piecemeal. (In Poland’s case, funding and other assistance from the European Union helped to coordinate mining-sector restructuring with the creation of new jobs.)

Just transition is a huge, complex and long-term challenge, in emerging markets and elsewhere. A systematic approach backed by solid fundamental qualitative research offers investors a practical and potentially rewarding way of engaging with it.

The authors would like to thank Roxanne Low, ESG Analyst with AB’s Responsible Investing team, and Kristian Tonev, Fixed Income Associate, for their research contributions.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams. Views are subject to change over time.

Learn more about AB’s approach to responsibility here.

AllianceBernstein

AllianceBernstein

AllianceBernstein (AB) is a leading global investment management firm that offers diversified investment services to institutional investors, individuals, and private wealth clients in major world markets.

To be effective stewards of our clients’ assets, we strive to invest responsibly—assessing, engaging on and integrating material issues, including environmental, social and governance (ESG) considerations into most of our actively managed strategies (approximately 79% of AB’s actively managed assets under management as of December 31, 2024).

Our purpose—to pursue insight that unlocks opportunity—describes the ethos of our firm. Because we are an active investment manager, differentiated insights drive our ability to design innovative investment solutions and help our clients achieve their investment goals. We became a signatory to the Principles for Responsible Investment (PRI) in 2011. This began our journey to formalize our approach to identifying responsible ways to unlock opportunities for our clients through integrating material ESG factors throughout most of our actively managed equity and fixed-income client accounts, funds and strategies. Material ESG factors are important elements in forming insights and in presenting potential risks and opportunities that can affect the performance of the companies and issuers that we invest in and the portfolios that we build. AB also engages issuers when it believes the engagement is in the best financial interest of its clients.

Our values illustrate the behaviors and actions that create our strong culture and enable us to meet our clients' needs. Each value inspires us to be better:

- Invest in One Another: At AB, there’s no “one size fits all” and no mold to break. We celebrate idiosyncrasy and make sure everyone’s voice is heard. We seek and include talented people with diverse skills, abilities and backgrounds, who expand our thinking. A mosaic of perspectives makes us stronger, helping us to nurture enduring relationships and build actionable solutions.

- Strive for Distinctive Knowledge: Intellectual curiosity is in our DNA. We embrace challenging problems and ask tough questions. We don’t settle for easy answers when we seek to understand the world around us—and that’s what makes us better investors and partners to our colleagues and clients. We are independent thinkers who go where the research and data take us. And knowing more isn’t the end of the journey, it’s the start of a deeper conversation.

- Speak with Courage and Conviction: Collegial debate yields conviction, so we challenge one another to think differently. Working together enables us to see all sides of an issue. We stand firmly behind our ideas, and we recognize that the world is dynamic. To keep pace with an ever changing world and industry, we constantly reassess our views and share them with intellectual honesty. Above all, we strive to seek and speak truth to our colleagues, clients and others as a trusted voice of reason.

- Act with Integrity—Always: Although our firm is comprised of multiple businesses, disciplines and individuals, we’re united by our commitment to be strong stewards for our people and our clients. Our fiduciary duty and an ethical mind-set are fundamental to the decisions we make.

As of December 31, 2024, AB had $792B in assets under management, $555B of which were ESG-integrated. Additional information about AB may be found on our website, www.alliancebernstein.com.

Learn more about AB’s approach to responsibility here.

More from AllianceBernstein