AB: Governance Matters - The Proof Is in the Proxy

Our research shows a correlation between strong governance and higher stock returns.

Published 03-21-24

Submitted by AllianceBernstein

Bob Herr| Director of Corporate Governance—Responsibility

Ryan Oden| Research Analyst—US Growth Equities

Investors have long theorized that companies with poor corporate governance practices may be more prone to mismanagement and weak returns. To investigate further, we’ve looked inward to a key data source: our proxy votes.

Specifically, we draw a correlation example between governance and returns through AllianceBernstein’s (AB’s) proxy-voting track record in recent years. We think proxy voting is one of the most expressive tools investors can use to communicate a view on the quality of a firm’s governance, providing that it’s based on careful analysis and accountability, not a rubber stamp.

Specifically, leveraging proxy voting and direct engagement* with companies can help to improve them, ideally resulting in better long-term outcomes. Several studies, which include our own findings, have made this connection much more apparent.

The Governance-Return Nexus

In one study, professors at Harvard Law School constructed an entrenchment index, or “E-index,” based on six key governance provisions. Their findings linked poorer E-index ratings with reductions in firm value and returns across US equities from 1990 to 2003.

More recently, S&P Global found that, between 2000 and 2017, companies in the bottom quartile of S&P Dow Jones Indices’ Governance Scores underperformed those in the top quintile by about 2% on an annualized basis.

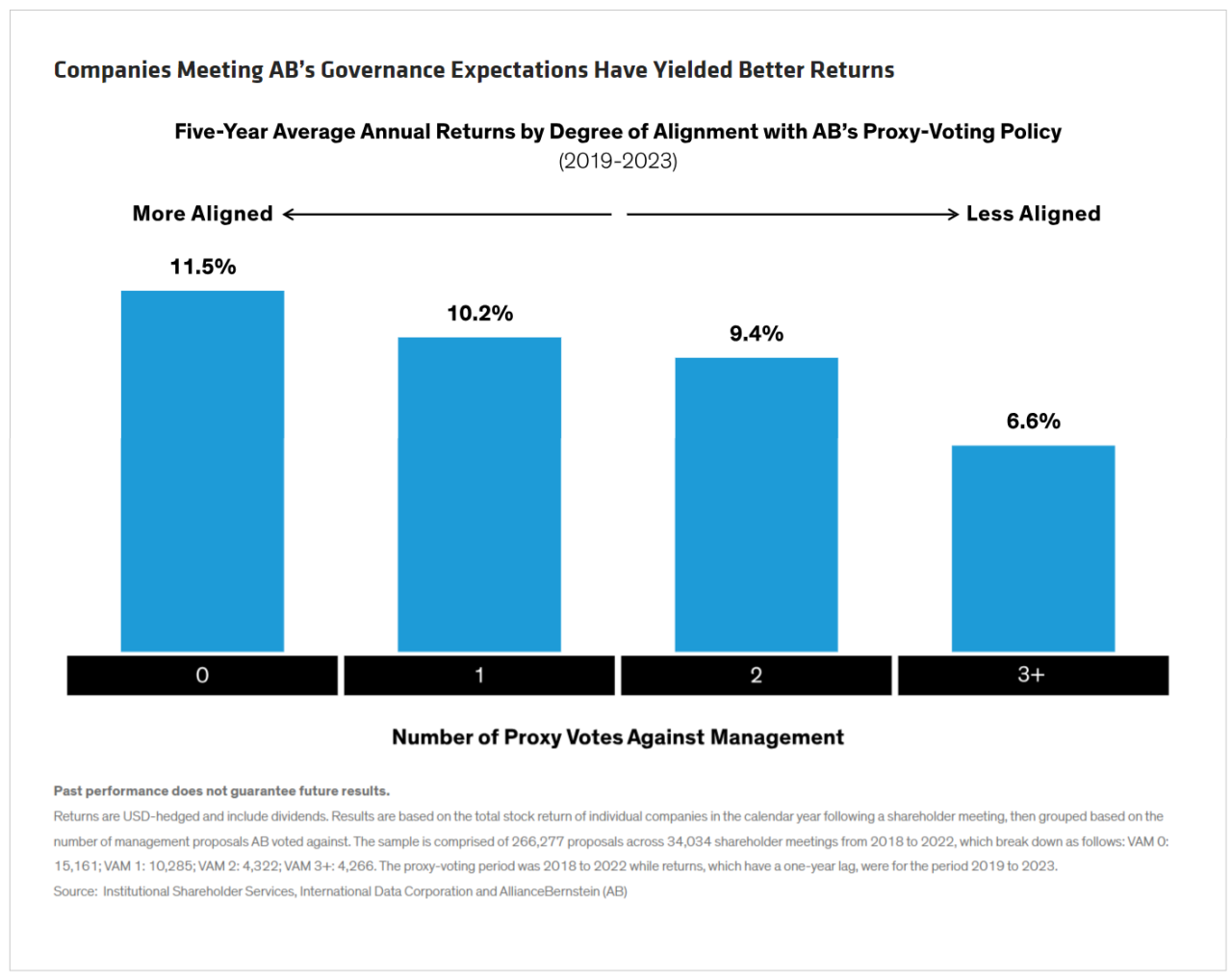

Inspired by these observations and our own experience, we built an internal study to determine if a similar association exists between our proxy-voting record and returns. We found that on average companies for which we voted against management on any number of proposals later underperformed those with which we were more strongly aligned.

Standing Up for Governance—One Company at a Time

Evaluating governance isn’t a one-size-fits-all proposition. We utilize a proprietary proxy-voting policy to vet each company’s alignment with our basic expectations, followed by a collaborative review process that leverages analyst expertise and engagement data. This two-pronged approach enables us to incorporate company-specific fundamental insights to implement more constructive voting strategies.

When we surmise a company’s governance practices aren’t supporting our clients’ best interests, we may vote against management to signal our objection. For instance, seeing internal accounting problems, we may record our opposition to the chair of the audit committee; if executive compensation is misaligned with performance, we vote against it. Some governance issues may warrant a stance against the specific board member(s) responsible–also known as an “accountability vote.”

Entered into Evidence, Thousands of AB Proxy Votes

Within this backdrop, our study retraced approximately 34,000 shareholder meetings, consisting of votes on more than 266,000 individual proposals across global firms from 2018 through 2022. Then, we linked each proxy vote to the company’s total stock return the following calendar year.

To help categorize our degree of alignment with management, we grouped the companies into equal-weighted baskets based on our number of votes against management (VAMs). For example, zero VAMs may reflect stronger alignment based on what we believe is sound governance and oversight across the firm. One VAM indicates a single “no” vote on any of the proposed matters, from capitalization and audits to compensation and director elections. Two VAMs reflects our disapproval on two such measures and so forth.

Zero VAMs occurred in 45% of all shareholder meetings during the period, which means we pushed back—whether on minor issues or proposals of greater consequence—a majority of the time. This reflects our rigorous standards and desire to improve upon the status quo. Multiple VAMs can be vital to voice material concerns, especially if a firm’s governance has been a growing issue for several years.

We found that zero-VAM companies—those we fully supported—outperformed those in the other VAM baskets by at least 250 basis points per year. We observed this general trend among similarly sized peers and across most—but not all—sectors and regions. For the five-year period, the average annualized return for zero-VAM companies was 11.5%, almost double that for companies in the three+ VAM basket (Display).

Mind over Matter—Proxy Voting Should Be Thoughtful

Proxy voting should be more than a compliance exercise. It’s a fundamental tool in active management, empowering investors to sway companies from pitfalls that can impede long-term performance. In matters of governance especially, we’ve found that well-thought-out proxy votes can make a positive impact on important business decisions, from leadership and disclosures to compensation and capitalization.

Landon Shea, Proxy and ESG Engagement Associate at AB, and Peter Højsteen-Ljungbeck, ESG Data Research Associate at AB, were instrumental in the research that formed the basis for this blog.

*AB engages issuers where it believes the engagement is in the best interest of its clients.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams. Views are subject to revision over time.

Learn more about AB’s approach to responsibility here.

AllianceBernstein

AllianceBernstein

AllianceBernstein (AB) is a leading global investment management firm that offers diversified investment services to institutional investors, individuals, and private wealth clients in major world markets.

To be effective stewards of our clients’ assets, we strive to invest responsibly—assessing, engaging on and integrating material issues, including environmental, social and governance (ESG) considerations into most of our actively managed strategies (approximately 79% of AB’s actively managed assets under management as of December 31, 2024).

Our purpose—to pursue insight that unlocks opportunity—describes the ethos of our firm. Because we are an active investment manager, differentiated insights drive our ability to design innovative investment solutions and help our clients achieve their investment goals. We became a signatory to the Principles for Responsible Investment (PRI) in 2011. This began our journey to formalize our approach to identifying responsible ways to unlock opportunities for our clients through integrating material ESG factors throughout most of our actively managed equity and fixed-income client accounts, funds and strategies. Material ESG factors are important elements in forming insights and in presenting potential risks and opportunities that can affect the performance of the companies and issuers that we invest in and the portfolios that we build. AB also engages issuers when it believes the engagement is in the best financial interest of its clients.

Our values illustrate the behaviors and actions that create our strong culture and enable us to meet our clients' needs. Each value inspires us to be better:

- Invest in One Another: At AB, there’s no “one size fits all” and no mold to break. We celebrate idiosyncrasy and make sure everyone’s voice is heard. We seek and include talented people with diverse skills, abilities and backgrounds, who expand our thinking. A mosaic of perspectives makes us stronger, helping us to nurture enduring relationships and build actionable solutions.

- Strive for Distinctive Knowledge: Intellectual curiosity is in our DNA. We embrace challenging problems and ask tough questions. We don’t settle for easy answers when we seek to understand the world around us—and that’s what makes us better investors and partners to our colleagues and clients. We are independent thinkers who go where the research and data take us. And knowing more isn’t the end of the journey, it’s the start of a deeper conversation.

- Speak with Courage and Conviction: Collegial debate yields conviction, so we challenge one another to think differently. Working together enables us to see all sides of an issue. We stand firmly behind our ideas, and we recognize that the world is dynamic. To keep pace with an ever changing world and industry, we constantly reassess our views and share them with intellectual honesty. Above all, we strive to seek and speak truth to our colleagues, clients and others as a trusted voice of reason.

- Act with Integrity—Always: Although our firm is comprised of multiple businesses, disciplines and individuals, we’re united by our commitment to be strong stewards for our people and our clients. Our fiduciary duty and an ethical mind-set are fundamental to the decisions we make.

As of December 31, 2024, AB had $792B in assets under management, $555B of which were ESG-integrated. Additional information about AB may be found on our website, www.alliancebernstein.com.

Learn more about AB’s approach to responsibility here.

More from AllianceBernstein