AB: Investing With Impact - How Municipal Bonds Are Leading the Way

Issues like water scarcity are felt most intensely at the local level. That makes it incumbent on municipal bond issuers to lead the response.

Published 03-06-24

Submitted by AllianceBernstein

Municipal bond issuers are responsible for building and supporting the physical infrastructure and the public goods and services that enable citizens to participate more in an inclusive economy. That makes the roughly $4 trillion US municipal bond market fertile ground for impact investing. Challenges like supplying clean water and improving access to quality healthcare can both be tackled through environmentally, socially, and financially productive investments in communities and institutions.

Leading When Water Is Lacking

As we’ve seen over the past few years, access to water can’t be taken for granted. The country faces historic drought conditions in the West and other regions. For instance, the Rio Grande, a river that countless Southwestern US communities depend on, faces persistent drought and increased water demand.

These challenges disproportionately impact low-income communities. In one study, 14% of respondents said a $12 monthly increase in water bills would lead them to cut back spending on groceries and basic medical care.1 Long-term investments in projects that diversify water sources, combined with water conservation strategies, can go a long way toward improving drought resiliency and reducing the financial burden communities face.

Take El Paso Water, which provides water, wastewater, reclaimed water and drainage services to more than 678,000 residents of El Paso, Texas, and surrounding areas. El Paso’s median household income is 76% of the state’s median; its 18% poverty rate is 29% higher than the statewide rate.

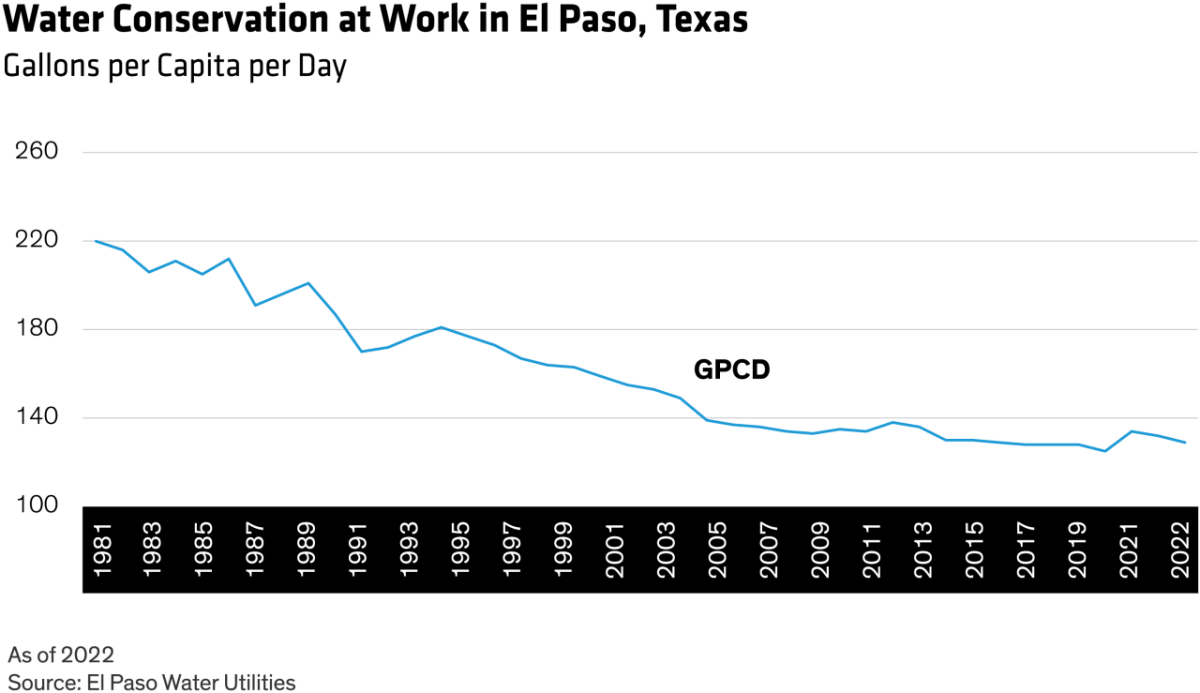

Since El Paso adopted its Water Conservation Ordinance in the early 1990s, per capita water consumption has fallen by roughly 35% and peak water demand by 17% (Display). Strategies implemented include reducing water waste in utility operations through initiatives such as leak detection and maintaining a rate structure that encourages conservation. Education is a lynchpin in galvanizing residential and commercial customers to be more efficient.

The issuer understands the population it serves, so its rates are affordable relative to national medians. And a change in the most recent budget waives the water-supply replacement charge for El Paso’s lowest water users. In fiscal year 2018–19, roughly 50% of all goods and services bought by the issuer were sourced from small, minority, and women-owned businesses, and almost 34% of its construction-project spending was directed to those vendors. By understanding the unique needs of the communities they serve and implementing long-term strategies to address them, municipal issuers like El Paso Water create more equitable and sustainable systems. It’s a model that also applies to healthcare institutions.

Opening Access to Care

Consider that for patients, roughly 20% of health outcomes are determined by the quality of healthcare from providers. The other 80% stem from factors often referred to as social determinants of health (SDoH): substandard housing, poor education systems, neighborhood violence, drug addiction, violence, and food insecurity.2

Recognizing this, many healthcare institutions are transitioning their missions from treating disease to also helping prevent it. For example, Temple University Health—a safety-net hospital—was originally founded to care for patients with limited incomes and ensure access to care in its surrounding Philadelphia neighborhoods. Today, it serves a population in which 45% of households are below the federal poverty level3—versus only 7% in adjacent Montgomery County. Roughly 33% of Temple Health’s gross revenues come from Medicaid—that’s more than double the average share among the nonprofit hospitals tracked by Moody’s (Display).

Temple Health’s impact extends well beyond the bedside. Its Center for Population Health, established in 2014, includes patient-centered medical homes, chronic-disease management programs for high-risk populations using nurse navigators, an inpatient and outpatient community-health work program, peer coaching, and central access for scheduling and follow-ups.

To help patients with complex social and medical-health issues, Temple’s Community Health Worker team visits homes, schedules and attends doctor appointments, coordinates transportation, and connects with other social supports to improve quality-of-life and treatment outcomes.

In 2020, Temple launched the Multi-Visit Patient Clinic to provide a full continuum of care for patients with high emergency-department use and frequent inpatient admissions. On discharge, community health workers link patients with follow-up healthcare, provide meals and transportation, visit homes, and connect with other social supports. Clinic patients have reduced emergency department use by 40% and inpatient use by 21% while increasing the use of outpatient services by 50%,4 demonstrating that they’re seeking more appropriate care in effective settings.

Temple Health also collaborated with local nonprofits, launching a two-year program to help 25 homeless Medicaid patients who frequent hospital emergency departments. Patients are provided free housing and caseworkers to connect them with health and social services. Caseworkers assist patients by furnishing apartments, connecting them with healthy meals, and helping them apply for income assistance such as Social Security.

This program isn’t large, but its impact is. When we compare the first five months that participants were housed to their experience before the program, there was a 75% reduction in emergency department use, a 79% reduction in inpatient hospital admissions, and a 50% increase in outpatient services use.5

Clear, Measurable Impact

Ultimately, the municipal bond market and impact strategies can play huge roles in channeling capital to financially productive uses that also help address environmental and social issues disproportionately affecting marginalized communities. The key is to identify strategies that employ meaningful data and project relevant key performance indicators. These play a vital role in developing better insights on investments and judging how effective they are. Investors play a critical role in supporting municipal issuers that are making a positive impact in their communities. By putting capital to work thoughtfully, they can help build a more equitable and sustainable future for all.

1 https://www.nature.com/articles/s44221-022-00009-w

2 https://www.uclahealth.org/sustainability/our-commitment/social-determinants-health

3 https://cph.temple.edu/about/news-events/news/temple-commits-1-million-immigrant-and-vulnerable-populations-healthcare

4https://www.templehealth.org/sites/default/files/2022-06/FY22-CHNA-Temple-University-Hospital.pdf

5 https://www.templehealth.org/about/news/program-aimed-at-providing-housing-support-services-for-people-experiencing-homelessness-sees-75-decrease-in-emergency-department-visits-and-79-decrease-in-admissions

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams. Views are subject to revision over time.

Learn more about AB’s approach to responsibility here.

AllianceBernstein

AllianceBernstein

AllianceBernstein (AB) is a leading global investment management firm that offers diversified investment services to institutional investors, individuals, and private wealth clients in major world markets.

To be effective stewards of our clients’ assets, we strive to invest responsibly—assessing, engaging on and integrating material issues, including environmental, social and governance (ESG) considerations into most of our actively managed strategies (approximately 79% of AB’s actively managed assets under management as of December 31, 2024).

Our purpose—to pursue insight that unlocks opportunity—describes the ethos of our firm. Because we are an active investment manager, differentiated insights drive our ability to design innovative investment solutions and help our clients achieve their investment goals. We became a signatory to the Principles for Responsible Investment (PRI) in 2011. This began our journey to formalize our approach to identifying responsible ways to unlock opportunities for our clients through integrating material ESG factors throughout most of our actively managed equity and fixed-income client accounts, funds and strategies. Material ESG factors are important elements in forming insights and in presenting potential risks and opportunities that can affect the performance of the companies and issuers that we invest in and the portfolios that we build. AB also engages issuers when it believes the engagement is in the best financial interest of its clients.

Our values illustrate the behaviors and actions that create our strong culture and enable us to meet our clients' needs. Each value inspires us to be better:

- Invest in One Another: At AB, there’s no “one size fits all” and no mold to break. We celebrate idiosyncrasy and make sure everyone’s voice is heard. We seek and include talented people with diverse skills, abilities and backgrounds, who expand our thinking. A mosaic of perspectives makes us stronger, helping us to nurture enduring relationships and build actionable solutions.

- Strive for Distinctive Knowledge: Intellectual curiosity is in our DNA. We embrace challenging problems and ask tough questions. We don’t settle for easy answers when we seek to understand the world around us—and that’s what makes us better investors and partners to our colleagues and clients. We are independent thinkers who go where the research and data take us. And knowing more isn’t the end of the journey, it’s the start of a deeper conversation.

- Speak with Courage and Conviction: Collegial debate yields conviction, so we challenge one another to think differently. Working together enables us to see all sides of an issue. We stand firmly behind our ideas, and we recognize that the world is dynamic. To keep pace with an ever changing world and industry, we constantly reassess our views and share them with intellectual honesty. Above all, we strive to seek and speak truth to our colleagues, clients and others as a trusted voice of reason.

- Act with Integrity—Always: Although our firm is comprised of multiple businesses, disciplines and individuals, we’re united by our commitment to be strong stewards for our people and our clients. Our fiduciary duty and an ethical mind-set are fundamental to the decisions we make.

As of December 31, 2024, AB had $792B in assets under management, $555B of which were ESG-integrated. Additional information about AB may be found on our website, www.alliancebernstein.com.

Learn more about AB’s approach to responsibility here.

More from AllianceBernstein