AB: Breaking the ESG Barrier Empowering Credit Investors Through Better and Faster Data

Published 02-21-24

Submitted by AllianceBernstein

ESG in Action

A new approach to environmental, social and governance (ESG) research could ease investors’ frustrations with sourcing and evaluating the data required for objective credit analysis. Thanks to a surge in company reporting, ESG metrics can now be quantified and incorporated into analyses that were historically rooted in fundamental research alone. AllianceBernstein’s proprietary research tool, PRISM, does just that, putting robust, contextualized ESG data at portfolio managers’ fingertips to enable better—and faster—decision-making.

75% more companies reported ESG metrics in 2021 than in 2015

179 metrics that PRISM draws on in its ESG assessments

95%–99% coverage by PRISM of the global credit universe

Authors

Patrick O'Connell, CFA| Director—Fixed Income Responsible Investing Research

Tiffanie Wong, CFA| Director—Fixed Income Responsible Investing Portfolio Management; Director—US Investment-Grade Credit

Markus Peters| Director of Fixed Income Business Development and Strategy—Responsible Investing

Investors weighing companies’ ESG exposures often feel frustrated by the challenges of either sourcing data from third-party providers or attempting to do their own research. But their frustrations may be about to ease, thanks to a new approach to ESG research.

A Murky—and Challenging—Data Landscape

There are several inherent difficulties with using third-party ESG scorers. Not all cater to the needs of investors; those that do, tend to overly focus on risks that are relevant to equity, not fixed-income, investors. Data providers are notoriously tight-lipped about how they arrive at their scores. And investors often find that there’s little similarity between different providers’ assessments of the same company; it’s hard to say whose score is more accurate.

The in-house research solution has also presented challenges. Without clear frameworks and processes for sorting and managing data (or lack thereof), ESG analyses tend to be both highly subjective and vague.

Thankfully, there’s been a proliferation of ESG data in recent years: since 2015, roughly 75% more companies in the major credit universe1 now report at least some ESG metrics. This heralds a sea change in how credit investors can conduct ESG analysis. How can investors capture, analyze and effectively evaluate so much additional information?

The answer, in our view, lies in rethinking the approach to ESG analysis. It’s been deeply rooted in fundamental credit research for a long time, but that must evolve if investors are to harvest the ESG data opportunity without falling victim to the same shortcomings as before. Making sense of the vast volume of data requires a scalable and consistent approach.

PRISM Shines a Brighter Light

This can be achieved by incorporating quantitative research into the process, as we do with PRISM, our proprietary credit research tool, which includes ESG in its broader credit assessments and provides an ESG score for nearly every issuer. PRISM takes advantage of the fact that the increase in ESG data has created the critical mass necessary for data to be inputted quantitatively.

There are, in our view, a number of benefits to this approach:

- It performs transparent, scalable and consistent processing of large volumes of ESG data that would be beyond the capacity of most fundamental credit research teams.

- Combined with big data capabilities, it covers 95% to 99%2 of the universe of investment-grade, high-yield and emerging-market corporate bonds, including small and unlisted companies—more than is typically available through third-party providers.

- It provides meaningful comparisons between issuers’ ESG risks, even when the issuers are from different industries.

- It creates insights specifically tailored to credit investors.

- By enabling nuanced comparisons between companies and industries, and by freeing analysts from data-gathering to do more valuable work, it adds to the power of active investment strategies.

To understand these benefits, it helps to know a little about how PRISM works.

A More Systematic, Less Subjective Approach

PRISM uses a map or matrix that illustrates the materiality of ESG factors according to industries and companies. The matrix draws on the fundamental research of AB’s in-house securities analysts, as well as specialist ESG perspectives provided by AB’s Responsibility team and Columbia University’s Climate School, with which AB has had a close working relationship since 2017.

The map helps to generate suggested factor weights and scoring ranges for individual industries, which are used to determine individual issuers’ ESG scores. (We describe how the scoring works in more detail below.)

Using big-data analysis, specialist ESG expertise and comprehensive financial research, PRISM can capture relevant data systematically. And, by inputting the data quantitatively, it can generate ESG scores that are consistent and comparable across industries and issuers, and less subjective than would be the case for scores arrived at solely by fundamental research.

This frees up credit research analysts from the time-consuming task of researching multiple ESG data points manually. They can focus instead on responsibilities that add more value, such as engaging directly with corporate issuers to gain unique, forward-looking insights.

The combined quantitative and fundamental approach, in our view, can lead to sharper insights and more nuanced evaluations of risk and opportunity than would be possible with a fundamental-only analysis.

Making ESG Comparisons Meaningful

The suggested ESG industry scoring ranges not only help to ensure consistency but also provide for comparison across industries and issuers. An alternative approach, which some data providers take, is to score individual issuers against other issuers in their own industries. But siloing industries can lead to anomalies: For example, an oil company that emits high levels of CO2 may receive a lower environmental score than a less emissions-intensive software company. It doesn’t take much for the oil company’s lower E score to be mistaken for having lower environmental risk than the software company. PRISM’s industry scores ensure that comparisons between companies are meaningful.

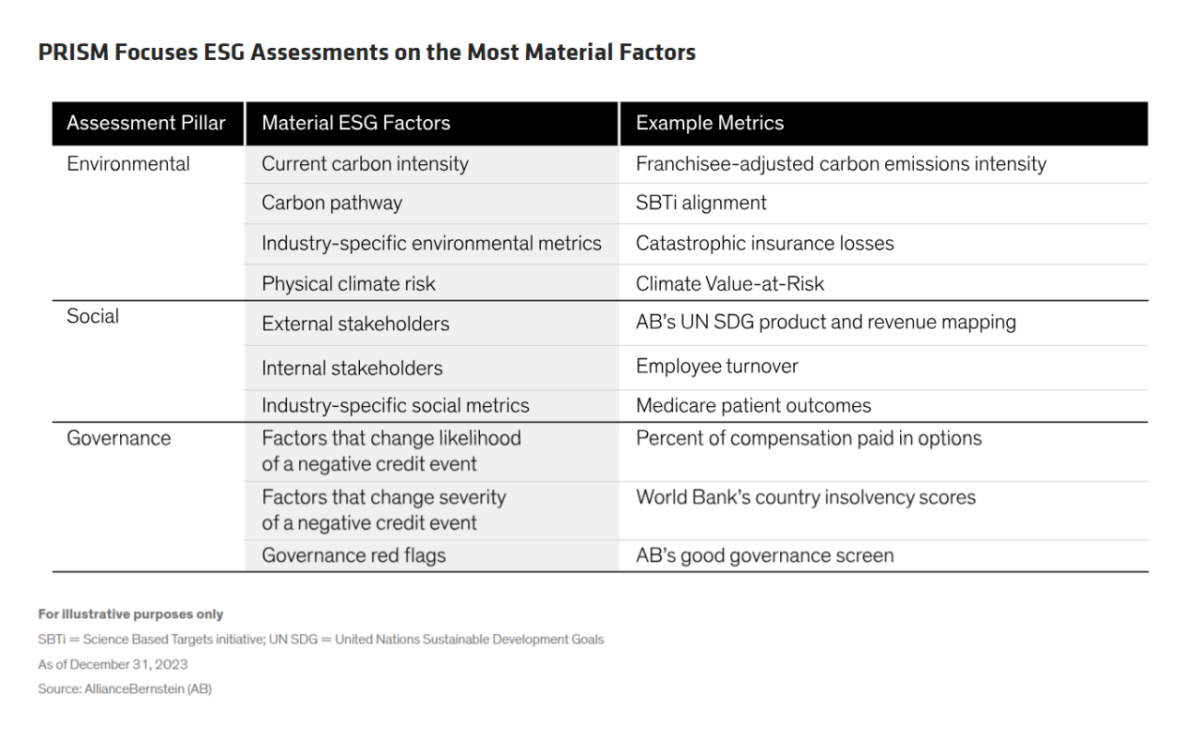

The scoring process links the materiality matrix to measurable ESG metrics. PRISM can draw on 179 metrics in total, but not all are relevant, or evenly relevant, across industries, because industries are differently exposed to environmental or social risks and opportunities. On the other hand, governance issues tend not to be industry specific, so PRISM takes an industry-agnostic approach to G scores.

Using only those metrics considered to be financially material, PRISM weights them according to their materiality for each industry. It assigns scores in each ESG assessment pillar based on 10 overarching material factors (Display), including governance factors that are specifically tailored to credit investors.

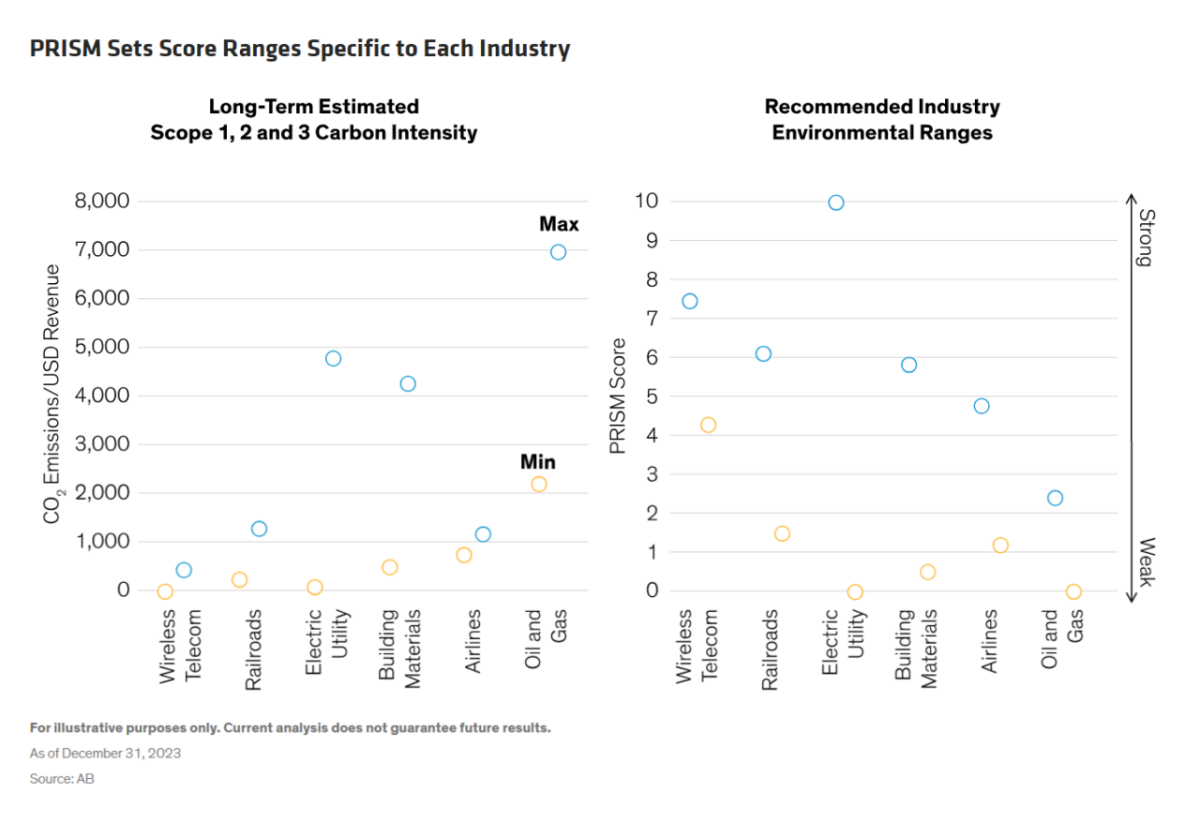

This approach allows us to compare, for example, industries’ environmental risks against a commonly used carbon intensity metric, such as CO2 emissions per sales in US-dollar terms. This results in suggested score ranges for each industry. The range for airlines, for example, is 1.2 to 4.7 (Display).

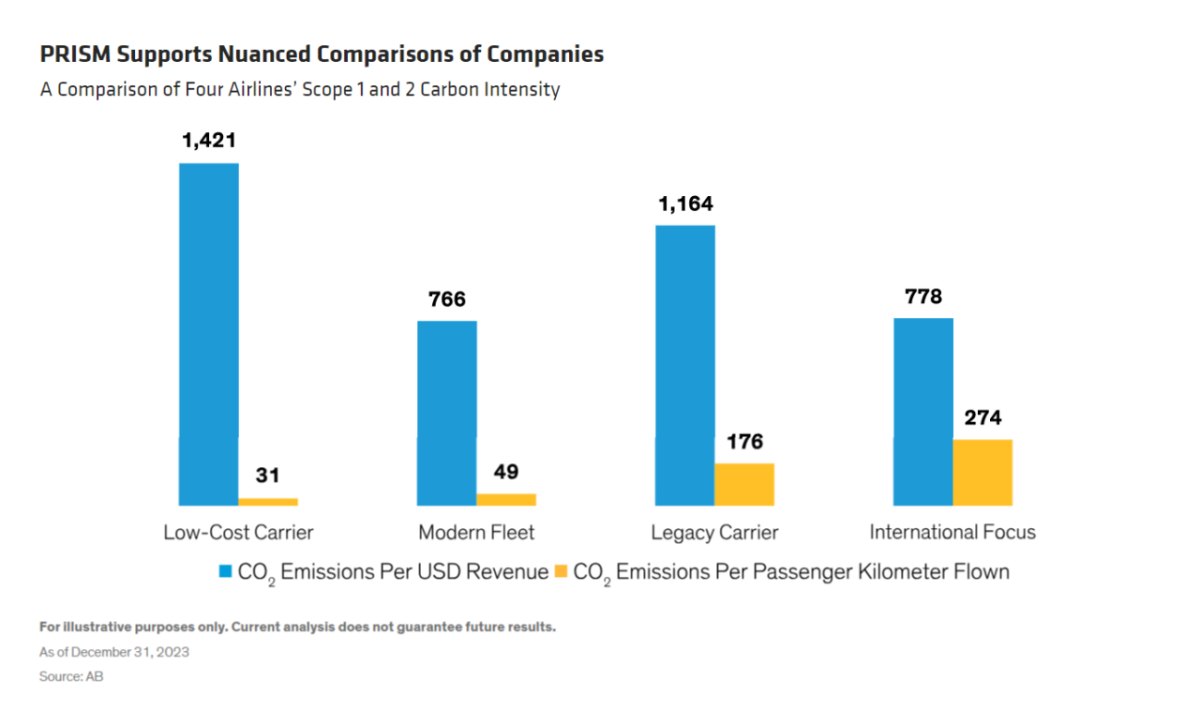

But nuance is important. Simple carbon intensity figures may generate conclusions that could mislead investors on the risks and opportunities faced by different airlines. We believe that emissions per passenger kilometer flown is a better representation of an airline’s ability to be fuel efficient, because it strips out the impact of ticket-pricing power. For example, while the low-cost carrier in the Display above falls toward the high end in terms of emissions per revenue, its emissions per passenger kilometer flown are low relative to its competitors.

In this way, an issuer’s E and S scores depend on both the absolute suggested scoring range for its industry and where the issuer falls within that range.

Better Engagement, Faster Decision-Making

In our own experience as active investors, we’ve found that PRISM better arms our analysts for their engagements with issuers, making it more difficult for companies’ management teams to cherry-pick data that puts their ESG credentials in the most favorable light.

And ultimately, PRISM puts robust, contextualized ESG data at portfolio managers’ fingertips to enable better—and faster—decision-making.

1The data are sourced from a count of issuer companies’ reporting of four ESG datapoints (Scope 1 & 2 emissions, Scope 3 emissions, water usage, and health and safety “Lost Time Incident Rate”) represented in the following indices: Bloomberg Global Aggregate Bond, Bloomberg US High Yield 2% Issuer Cap, Bloomberg Euro High Yield 2% Issuer Cap, JP Morgan Corporate Emerging Market Bond Broad Diversified and FTSE TMX Canada Universal Bond. The universe represents a sample size of approximately 3,800 unique issuing entities (as of December 31, 2021) and summarizes the total data points reported. Source: MSCI and AB

2Bloomberg Global Aggregate Bond Index: 96%; Bloomberg US High Yield 2% Issuer Ca: 98%; Bloomberg Euro High Yield 2% Issuer Cap: 98%; JP Morgan Corporate Emerging Market Bond Index Broad Diversified: 96%; and FTSE TMX Canada Universal Bond Index: 96%.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams. Views are subject to change over time.

Learn more about AB’s approach to responsibility here.

AllianceBernstein

AllianceBernstein

AllianceBernstein (AB) is a leading global investment management firm that offers diversified investment services to institutional investors, individuals, and private wealth clients in major world markets.

To be effective stewards of our clients’ assets, we strive to invest responsibly—assessing, engaging on and integrating material issues, including environmental, social and governance (ESG) considerations into most of our actively managed strategies (approximately 79% of AB’s actively managed assets under management as of December 31, 2024).

Our purpose—to pursue insight that unlocks opportunity—describes the ethos of our firm. Because we are an active investment manager, differentiated insights drive our ability to design innovative investment solutions and help our clients achieve their investment goals. We became a signatory to the Principles for Responsible Investment (PRI) in 2011. This began our journey to formalize our approach to identifying responsible ways to unlock opportunities for our clients through integrating material ESG factors throughout most of our actively managed equity and fixed-income client accounts, funds and strategies. Material ESG factors are important elements in forming insights and in presenting potential risks and opportunities that can affect the performance of the companies and issuers that we invest in and the portfolios that we build. AB also engages issuers when it believes the engagement is in the best financial interest of its clients.

Our values illustrate the behaviors and actions that create our strong culture and enable us to meet our clients' needs. Each value inspires us to be better:

- Invest in One Another: At AB, there’s no “one size fits all” and no mold to break. We celebrate idiosyncrasy and make sure everyone’s voice is heard. We seek and include talented people with diverse skills, abilities and backgrounds, who expand our thinking. A mosaic of perspectives makes us stronger, helping us to nurture enduring relationships and build actionable solutions.

- Strive for Distinctive Knowledge: Intellectual curiosity is in our DNA. We embrace challenging problems and ask tough questions. We don’t settle for easy answers when we seek to understand the world around us—and that’s what makes us better investors and partners to our colleagues and clients. We are independent thinkers who go where the research and data take us. And knowing more isn’t the end of the journey, it’s the start of a deeper conversation.

- Speak with Courage and Conviction: Collegial debate yields conviction, so we challenge one another to think differently. Working together enables us to see all sides of an issue. We stand firmly behind our ideas, and we recognize that the world is dynamic. To keep pace with an ever changing world and industry, we constantly reassess our views and share them with intellectual honesty. Above all, we strive to seek and speak truth to our colleagues, clients and others as a trusted voice of reason.

- Act with Integrity—Always: Although our firm is comprised of multiple businesses, disciplines and individuals, we’re united by our commitment to be strong stewards for our people and our clients. Our fiduciary duty and an ethical mind-set are fundamental to the decisions we make.

As of December 31, 2024, AB had $792B in assets under management, $555B of which were ESG-integrated. Additional information about AB may be found on our website, www.alliancebernstein.com.

Learn more about AB’s approach to responsibility here.

More from AllianceBernstein