Investing in Gender Equity Is Smart Investing

Published 12-14-23

Submitted by GreenMoney Journal

by Joe Keefe, President of Impax Asset Management

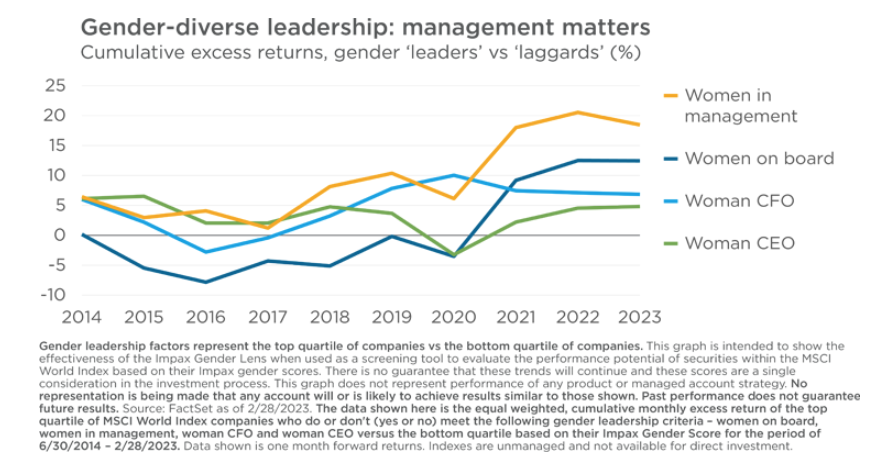

In 2014, in partnership with Sallie Krawcheck and Ellevate, we adopted a more systematic investment approach that we believed would better isolate the contribution that what we call the ‘gender factor’ can make to company performance. We hoped to make an apples-to-apples comparison between gender diverse companies and the broader market, and to prove that companies with greater gender equity outperform less enlightened competitors and the overall market over time. I believe we have met that burden of proof. There was now decades of research demonstrating that gender diversity and equity are correlated with stronger financial performance.

My colleague, Julie Gorte, publishes an annual review of the research linking gender equity, and diversity, equity and inclusion more broadly, with financial performance. Her most recent paper, “The Financial Impact of Diversity and Culture” was published in August 2023. In it, Julie not only reviews the literature on board diversity and management diversity, but on diversity and innovation, measured by such things as the number of patents, patent citations, research and development spending, and profits derived from new products. She also reviews the research linking diversity with sustainability, with better HR policies and increased productivity, and with stronger corporate cultures.

Suffice it to say that the literature supports a positive correlation between diversity – particularly gender diversity in executive teams – and better corporate financial performance. A strong relationship between corporate culture and human resources policies, and their correlation with financial performance, is another emerging theme. Finally, Julie finds that diversity supports both environmental and social aspects of the transition to a more sustainable economy, as it is positively correlated with more robust financial accounting and better sustainability outcomes, including environmental reporting and climate disclosures.

Read Joe's full article that includes insightful graphs and more on Gender Diverse leadership and workforces as well as about how it leads to a more sustainable economy. All here - https://greenmoney.com/investing-in-gender-equity-is-smart-investing

========

GreenMoney Journal

GreenMoney Journal

GreenMoney Journal is an award-winning eJournal and website that focuses on sustainable investing and business. GreenMoney Journal was founded by Cliff Feigenbaum in 1992 and today he serves as Publisher and Managing Editor of this very trusted brand. Cliff is also the co-author of "Investing With Your Values" (Bloomberg Press, NYC). In 2017 Mr. Feigenbaum he was chosen as the co-winner of the "SRI Service Award" by his peers at The SRI Conference. In 2021, He won the "Media Innovator Award" from Corporate Vision and most recently in early 2022, Mr. Feigenbaum was named one of the Top 100 DEI Leaders for 2021 by Mogul.

More from GreenMoney Journal