AB: Six Metrics Light the Path to Sustainability for Emerging-Market Sovereigns

Published 12-13-23

Submitted by AllianceBernstein

Patrick O'Connell, CFA| Director—Fixed Income Responsible Investing Research

Christian DiClementi| Portfolio Manager—Emerging Market Debt

Elizabeth Bakarich, CFA| Portfolio Manager—Emerging Market Corporate Debt

Just six metrics can effectively assess sovereign issuers’ sustainability and provide guidance for both issuers and investors.

From a sustainability perspective, investing in sovereign emerging-market (EM) debt can feel messy. Most investors feel just familiar enough with individual EM countries to fall prey to subjective judgments when making comparisons. The market tends to overreact to news—good news, bad news and often both at once. And huge, complex data sets bog down analyses and muddy the view.

That’s why we’ve charted a new path: one that sheds light on sovereign EM investing through a small set of concrete metrics that help identify potential value and provide guidance for both issuers and sustainable investors.

Gauging Sustainability with Precision Metrics

To solve the problems of subjectivity, reactivity and obscurity, we’ve identified six measures by which a sovereign issuer may be ruled in or out of an investable universe of sustainable sovereign debt.

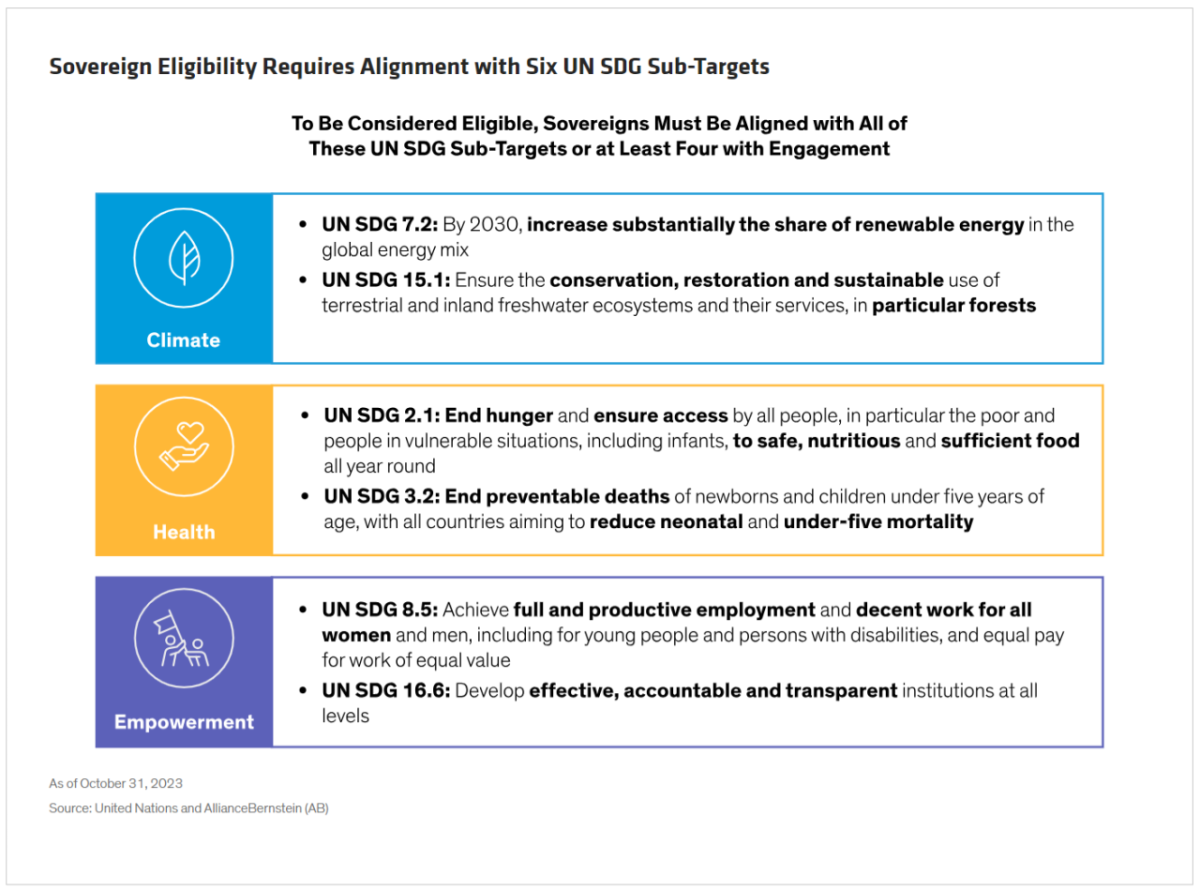

We began with the 17 UN Sustainable Development Goals (SDGs), which we recognize as a blueprint for identifying sustainable investments. Together, these 17 SDGs comprise 169 specific sub-targets. From these, we selected six that represent the broader investment themes of climate, health and empowerment. We believe that these six sub-targets capture the spirit of the larger list. They cover the transition to low-emissions energy consumption; biodiversity; hunger; infant mortality; equal employment opportunities; and institutional strength (Display).

For each of these six sub-targets, we identified a specific measure. For example, to be considered in alignment with UN SDG 3.2 (one of the two health sub-targets), countries should reduce newborn mortality to 12 or fewer deaths per 1,000 live births—a threshold set by the UN. Roughly half of all countries pass this metric.

Applying the Framework to Narrow the Investable Universe

The result is a robust analytical framework anchored in specific UN SDG targets. A country that passes all six metrics qualifies for sustainable EM investing. Countries that fail three or more metrics should not be considered for inclusion in a sustainable investing universe.

In our analysis, countries that fall just short of passing, failing only one or two of the six metrics, deserve a closer look. If we believe we can engage* with the country to improve in that fifth or sixth category, that country may become eligible for inclusion.

Just how rigorous is this methodology? Only about half of all countries pass any single metric. Fewer than 20% of countries globally, including developed markets, pass all six metrics.

Further, thanks to the materiality of the identified metrics over the long run, we believe that countries that pass this framework can deliver better risk and return outcomes over time than those that fail.

Putting the Framework into Practice

Three countries—Chile, Brazil and the Philippines—exemplify the rigor of this framework.

Chile hits the mark by passing all six metrics. The country’s sustainable development is on par with that of many developed countries. For example, from 2010 through 2019, Chile increased wind and solar energy from around 1% to 14% of total electricity. Since 2000, it has increased its forested land by around 15%. It recently met UN goals around lowering preventable infant deaths. And it has a strong female participation rate in the labor force.

Brazil fails one critical metric: deforestation. Since 2000, the country’s forest cover has declined by 10%, due mostly to destruction of the Amazon rainforest. (Almost 20% of the Amazon rainforest has been destroyed since 1970.) In our framework, this signals the need for investors and asset managers such as ourselves to actively engage with Brazil to make needed improvements on this front.

After all, Brazil leads the world in many other sustainability measures: increasing wind and solar from around 0% to 10% of total electricity; meeting the UN threshold on preventable infant deaths; and having a fairly strong labor force participation rate from women.

By contrast, the Philippines fails on three metrics and thus is not yet eligible for inclusion in our sustainable universe, despite having a dynamic economy and an investment-grade rating. From 2010 through 2019, the country increased wind and solar only marginally to just 2% of its electricity matrix. Though the Philippines has worked to reduce preventable infant deaths, at the current rate the country will fail to meet UN goals by 2030. And the labor force participation rate from women is below our threshold.

The Benefits of a Sustainable Framework

Not only is this framework robust, but unlike many existing approaches to defining a sustainable investment universe, our approach is simple, transparent and objective, with data drawn from neutral sources such as the World Bank.

What’s more, our approach positions the investable universe to grow as more countries meet more metrics, because it uses absolute, rather than relative, thresholds. In addition, five of the six metrics are forward-looking, so that we are able to assess not only where a country is now (static measure) but where it is going (dynamic measure). And the approach allows for targeted, effective engagement on material and relevant issues—helping an issuer move the needle from nearly to fully qualified.

Lastly, our framework for sustainable sovereign investing aligns with investor objectives and intentions. Where the goal is to improve sustainable practices around the world, we believe our framework stands out as both effective and credible.

*AB engages issuers where it believes the engagement is in the best interest of its clients.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams. Views are subject to revision over time.

Learn more about AB’s approach to responsibility here.

AllianceBernstein

AllianceBernstein

AllianceBernstein (AB) is a leading global investment management firm that offers diversified investment services to institutional investors, individuals, and private wealth clients in major world markets.

To be effective stewards of our clients’ assets, we strive to invest responsibly—assessing, engaging on and integrating material issues, including environmental, social and governance (ESG) considerations into most of our actively managed strategies (approximately 79% of AB’s actively managed assets under management as of December 31, 2024).

Our purpose—to pursue insight that unlocks opportunity—describes the ethos of our firm. Because we are an active investment manager, differentiated insights drive our ability to design innovative investment solutions and help our clients achieve their investment goals. We became a signatory to the Principles for Responsible Investment (PRI) in 2011. This began our journey to formalize our approach to identifying responsible ways to unlock opportunities for our clients through integrating material ESG factors throughout most of our actively managed equity and fixed-income client accounts, funds and strategies. Material ESG factors are important elements in forming insights and in presenting potential risks and opportunities that can affect the performance of the companies and issuers that we invest in and the portfolios that we build. AB also engages issuers when it believes the engagement is in the best financial interest of its clients.

Our values illustrate the behaviors and actions that create our strong culture and enable us to meet our clients' needs. Each value inspires us to be better:

- Invest in One Another: At AB, there’s no “one size fits all” and no mold to break. We celebrate idiosyncrasy and make sure everyone’s voice is heard. We seek and include talented people with diverse skills, abilities and backgrounds, who expand our thinking. A mosaic of perspectives makes us stronger, helping us to nurture enduring relationships and build actionable solutions.

- Strive for Distinctive Knowledge: Intellectual curiosity is in our DNA. We embrace challenging problems and ask tough questions. We don’t settle for easy answers when we seek to understand the world around us—and that’s what makes us better investors and partners to our colleagues and clients. We are independent thinkers who go where the research and data take us. And knowing more isn’t the end of the journey, it’s the start of a deeper conversation.

- Speak with Courage and Conviction: Collegial debate yields conviction, so we challenge one another to think differently. Working together enables us to see all sides of an issue. We stand firmly behind our ideas, and we recognize that the world is dynamic. To keep pace with an ever changing world and industry, we constantly reassess our views and share them with intellectual honesty. Above all, we strive to seek and speak truth to our colleagues, clients and others as a trusted voice of reason.

- Act with Integrity—Always: Although our firm is comprised of multiple businesses, disciplines and individuals, we’re united by our commitment to be strong stewards for our people and our clients. Our fiduciary duty and an ethical mind-set are fundamental to the decisions we make.

As of December 31, 2024, AB had $792B in assets under management, $555B of which were ESG-integrated. Additional information about AB may be found on our website, www.alliancebernstein.com.

Learn more about AB’s approach to responsibility here.

More from AllianceBernstein