Regions Next Step Reality Check Roundup: Showing Financial Education Is FUNdamental

Regions Bank associates are teaching financial literacy to help set up students for future financial success.

Published 12-11-23

Submitted by Regions Bank

By Nestor Mato

The scenarios are make-believe, but the lessons are of real value.

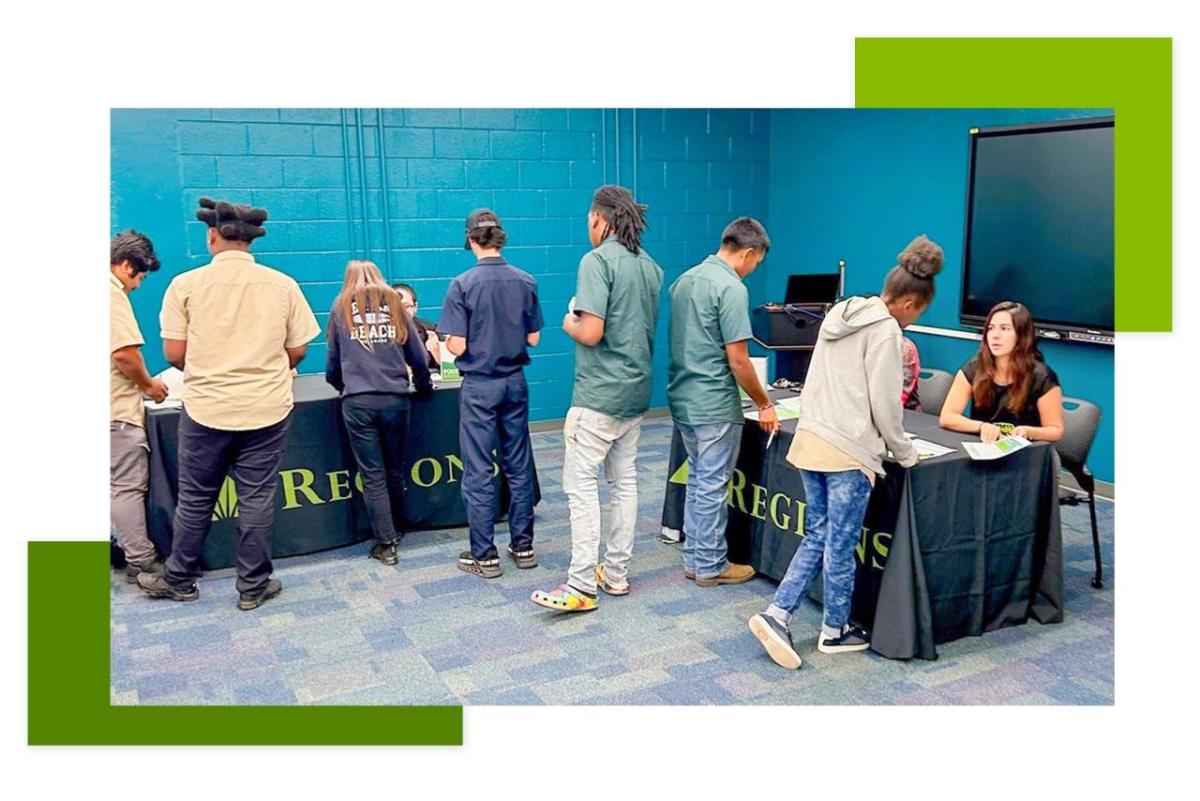

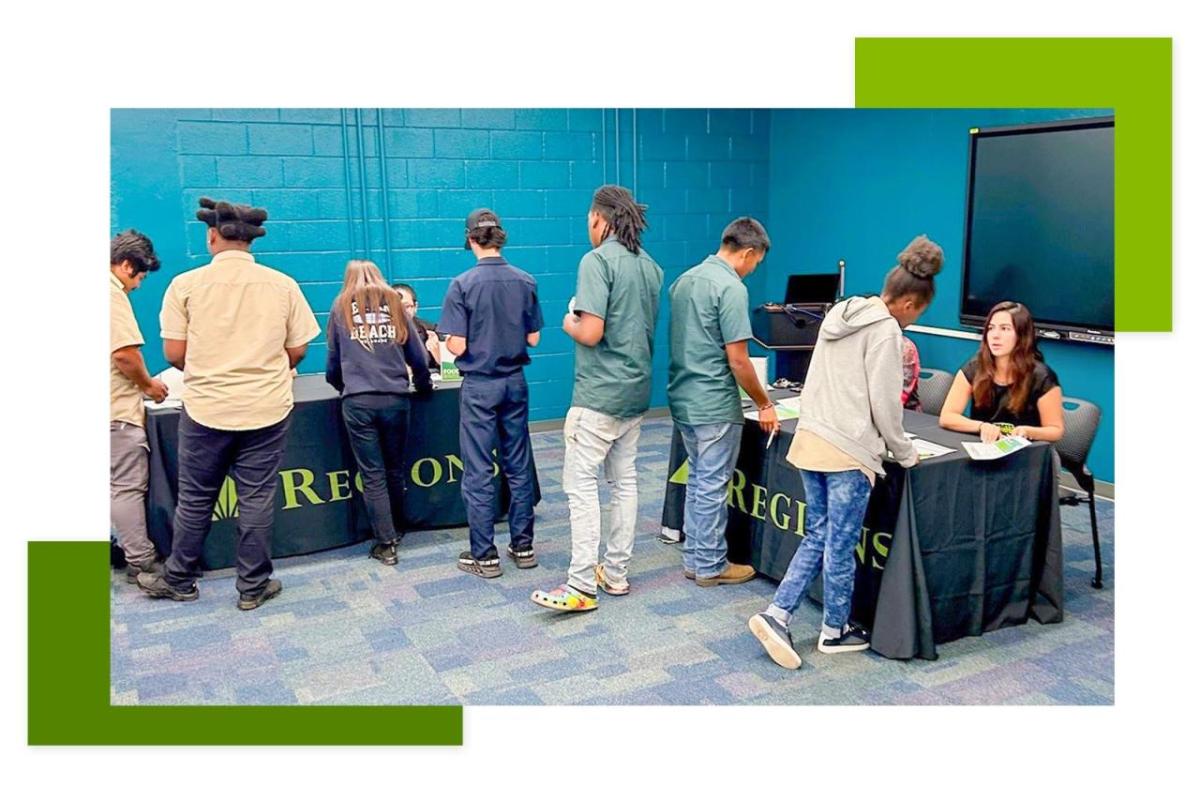

Regions associates kicked off November by holding events that gave youth a reality check. Regions Next Step Reality Check is an interactive and engaging way for students to learn about building and balancing a budget. The goal is to make the assigned decisions during the course and complete the experience with a budget surplus. During Regions Next Step Reality Check, students are assigned a persona and then select real-life options that will directly impact their budget.

Regions Bank teams have been busy taking the Regions Next Step Reality Check program all over Southwest Florida. Their latest stop was at Fort Myers Technical College.

“We collaborated with various departments, including Mortgage, Commercial, Retail and Wealth, and Community Affairs, to bring these enlightening events to the region,” said Earnest Wilks, market executive for Regions Bank in Sarasota, Bradenton, Fort Myers and surrounding areas. “These presentations are designed to empower young individuals with the knowledge and skills they need to make informed financial decisions.”

In this session, Regions associates guided students through various aspects of managing monthly financial obligations. These include categories like Housing, Utilities, Transportation, Food, Savings, Charitable Contributions, Entertainment, Loans, and the concept of taking on a second job.

“The students at Fort Myers Technical College were very excited with the opportunity to learn more about financial wellness from Regions Bank,” said Renato Freitas of Fort Myers Technical College. “Many students entering technical colleges may have limited exposure to financial literacy and planning, and this is an enjoyable way to engage with them.”

Typically hosted every six to eight weeks throughout the year, these presentations have been a success in Lee and Collier counties, prompting the expansion of the program to Charlotte County in the coming year.

Together, we work to make financial education fun for youth all over our area.

Cynthia Valenti Smith, Regions Mortgage Production Officer and Naples Market Executive

“Regions Bank’s commitment is further demonstrated through its collaboration with community organizations, including Quality Life Center, Urban Strategies, Guadalupe Center, Goodwill and Pace Center for Girls,” said Cynthia Valenti Smith, the bank’s Mortgage Production Officer and Naples Market Executive. “Together, we work to make financial education fun for youth all over our area.”

Regions Bank teamed up with Volunteers of America of North Louisiana for two Regions Next Step Reality Check events in Shreveport. At LightHouse, the afterschool program at Booker T. Washington High School, volunteers taught students about avoiding financial pitfalls and understanding how to manage debt to help save students from costly errors.

“Here it is about more than just counting coins; it’s about appreciating the value of money,” said Regions’ Shreveport market executive, Denny Moton. “It is especially helpful for these students as many prepare to go off to college. Between loans, books and other expenses, this exercise really does help set them up for future success.”

The second Regions Next Step Reality Check was at Teen Club, which provides a safe haven for high school students to meet positive and encouraging people who help them prepare for their future.

It was the right place for Regions volunteers to interact with a dozen more teenagers to learn about building and balancing a budget – putting the math taught in the classroom into real-world practice.

“These presentations can serve as a valuable source of education on various financial topics, including saving, investing, and debt management,” said Anna Whittenbarger who is not only Vice President-Trust Advisor in Private Wealth Management for Regions Bank but is also on the leadership board of Volunteers of America North Louisiana. “I am so proud of the work done here, which can last a lifetime. This is helping lead to greater financial stability, well-being and success in both their academic and professional lives.”

Regions Bank

Regions Bank

Regions Financial Corporation (NYSE:RF), with $147 billion in assets, is a member of the S&P 500 Index and is one of the nation’s largest full-service providers of consumer and commercial banking, wealth management, and mortgage products and services. Regions serves customers across the South, Midwest and Texas , and through its subsidiary, Regions Bank, operates more than 1,300 banking offices and 2,000 ATMs. Regions Bank is an Equal Housing Lender and Member FDIC. Additional information about Regions and its full line of products and services can be found at www.regions.com.

More from Regions Bank