AB: A Changing World: The New Psychological Workplace Contract

Published 12-06-23

Submitted by AllianceBernstein

Saskia Kort-Chick| Director of Social Research and Engagement—Responsibility

Ariel Avgar, PhD| David M. Cohen Professor of Labor Relations, Law and History, and Senior Associate Dean for Outreach and Sponsored Research—ILR School at Cornell University

A new psychological contract is transforming the modern workplace, highlighted by an increase in collective actions and changing employee expectations.

A central feature of the employment relationship is the set of expectations that employers and workers have of one another. Sometimes less visible are the expectations that workers have of their employers. It’s all part of a psychological contract between employers and their workers. We are currently undergoing a fundamental change in the core foundation of the existing psychological contract—one that is likely to have material implications for investors.

The Importance of Psychological Contracts at Work

Irrespective of industry, workers and their employers operate within the context of a general psychological contract—informal, implicit, trust-based agreements about reciprocal commitments and expectations. Although they’re stable in the short run, these unwritten contracts evolve and shift over decades.

Traditionally, psychological contracts have been internally focused. Employers were willing to offer their employees job security, competitive pay and mobility within the firm in exchange for effort, commitment and company loyalty.

Owing to competitive pressures, psychological contracts in the developed world began to change in the late 1990s. In an effort to adapt to changing employer needs, the terms of the psychological contract were revised to include providing transferable job skills and real-world experience in exchange for effort and employee engagement.

At the same time, companies weakened job security and abandoned long-term commitments like defined benefit pension plans. Firms also shifted their focus from job security to employability security. Perhaps not surprisingly, employee loyalty declined as these pacts became less relational and more transactional.

The New Values-Based Psychological Contract

Today, the psychological contract at work may be undergoing another once-in-a-generation change. Emboldened in part by the tight labor market of recent years, employees are using their newfound leverage to craft a new contract—one that focuses more on worker expectations than merely on employer needs.

Key among these expectations is that employers take a firm stand on political and value-based debates. These include issues like social justice; diversity, equity and inclusion (DEI); human rights; sexual harassment; and a range of political issues, such as voting rights. As a result, the boundary between work-focused activities and social causes is blurring in ways that are upending existing organizational models.

A case in point: In 2021, leaders of more than 100 firms issued public statements voicing opposition to voter suppression efforts in the US—due in part to pressure from their own employees. And, following nationwide protests and social movements during the height of the COVID-19 pandemic, many companies responded with enhanced investments in DEI initiatives.

As part of the new psychological contract, workers also expect employers to allow for individual expression and to accommodate family commitments and work-life balance. Increasingly, this includes flexible work arrangements, which would’ve been unheard of only a few years ago. The shifting power dynamic is prompting employers to accede to workers in fundamentally different ways.

And what happens when employees’ needs aren’t being met? This is perhaps the most impactful dimension of the new psychological contract—an expectation for collective representation in the workplace.

Collective Actions Are on the Rise

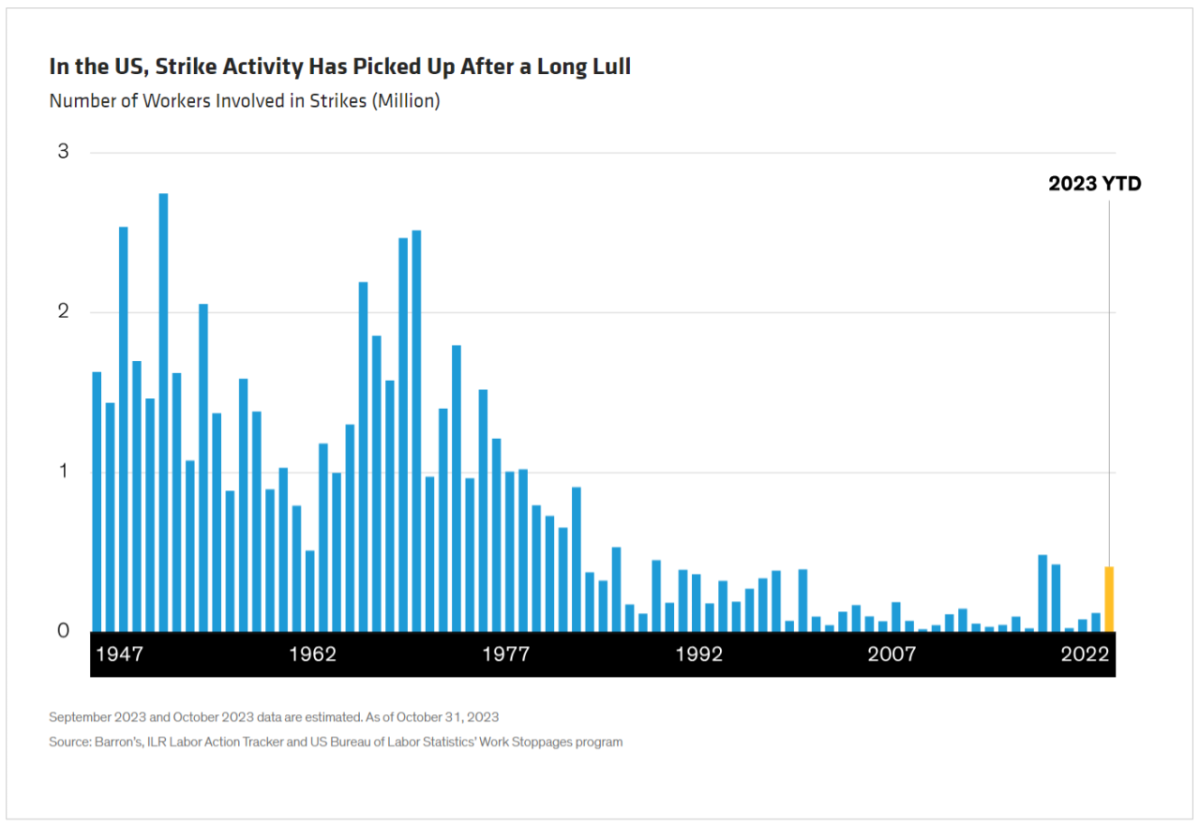

In many parts of the developed world—particularly the US—collective actions are gaining steam. This has taken on different forms, including a resurgence in traditional unions; representation petitions within industries not historically associated with unions; and even the growth of employee resource groups. In some cases, the movement is still in the early stages. In recent years, a number of well-known companies such as Uber Technologies, Lyft, Starbucks and Amazon have seen an uptick in collective actions.

In fact, since the pandemic, there has been a 40% increase in worker activism—primarily in the form of petitions to unionize. According to the National Labor Relations Board, Starbucks alone saw more than 7,000 employees file for union elections by July 2022—up from near zero just one year earlier. As a result, 360 Starbucks stores have unionized to date.

To be sure, the US is still well behind its contemporaries, however, making it an exception in its low union membership and coverage rates. This divide stems in part from less-restrictive legal frameworks in Europe and, in some cases, the involvement of European unions in the administration of social benefits like unemployment insurance. By contrast, right-to-work laws and a host of other factors have created structural barriers in the US that have contributed to declining union membership over the past 50 years.

But even with these barriers, the US is seeing a resurgence in collective action, sometimes within the traditional union model, and sometimes in alternative collective representation forms (Display).

One of the hallmarks of the shifting psychological contract is the increase in collective action taken by workers outside of the traditional union model. Thus, even where unions are not being formed, groups of employees are gathering collectively to discuss issues that affect the entire organization. Sometimes, these take the form of employee resource groups comprising employees with a shared set of interests. Other times, workers may collectively place pressure on employers to act on political or social issues.

Investors Should Take Heed of Collective Actions

Tension between employers and workers is nothing new. As the labor market weakens or strengthens, it’s normal to see workers’ power ebb and flow. But in our view, the new psychological contract is more than a response to cyclical economic conditions. It reflects a confluence of social, political, generational and, yes, even economic forces that should give it staying power—even when the labor market weakens.

And given today’s evolving psychological contract, traditional labor-relations tools and processes may no longer be sufficient. Across industries, companies are under pressure to develop new organizational strategies aimed at addressing the new set of employee expectations. This is upending the delicate balance between workers and their employers.

In the coming years, we believe investors will need to reconsider how companies address employment and labor relations. Traditionally, firms have managed their workforces with an eye toward company-specific concerns. But as employees become more vocal in their expectations, investors should expect the line between external public relations and internal labor relations to become hazier.

Investors will also need to come to terms with the scale of unionization, which is no longer occurring on a one-off basis. Collective actions are likely to continue expanding into industries not traditionally associated with organized labor. This trend could materially affect labor costs, organizational structures and operational strategies.

It could also benefit employers. Across many decades, voluntary turnover in unionized organizations has been shown to be lower than with non-union employers, while productivity is also higher in a number of different settings and industries.

Regardless, collective actions are here to stay, and the demarcation lines between labor and management are shifting in ways that few could have imagined in decades past. With the boundaries blurring, investors will need to sharpen their focus.

The authors would like to thank Roxanne Low, ESG Analyst with AB’s Responsible Investing team, for her invaluable contributions.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams. Views are subject to change over time.

Learn more about AB’s approach to responsibility here.

AllianceBernstein

AllianceBernstein

AllianceBernstein (AB) is a leading global investment management firm that offers diversified investment services to institutional investors, individuals, and private wealth clients in major world markets.

To be effective stewards of our clients’ assets, we strive to invest responsibly—assessing, engaging on and integrating material issues, including environmental, social and governance (ESG) considerations into most of our actively managed strategies (approximately 79% of AB’s actively managed assets under management as of December 31, 2024).

Our purpose—to pursue insight that unlocks opportunity—describes the ethos of our firm. Because we are an active investment manager, differentiated insights drive our ability to design innovative investment solutions and help our clients achieve their investment goals. We became a signatory to the Principles for Responsible Investment (PRI) in 2011. This began our journey to formalize our approach to identifying responsible ways to unlock opportunities for our clients through integrating material ESG factors throughout most of our actively managed equity and fixed-income client accounts, funds and strategies. Material ESG factors are important elements in forming insights and in presenting potential risks and opportunities that can affect the performance of the companies and issuers that we invest in and the portfolios that we build. AB also engages issuers when it believes the engagement is in the best financial interest of its clients.

Our values illustrate the behaviors and actions that create our strong culture and enable us to meet our clients' needs. Each value inspires us to be better:

- Invest in One Another: At AB, there’s no “one size fits all” and no mold to break. We celebrate idiosyncrasy and make sure everyone’s voice is heard. We seek and include talented people with diverse skills, abilities and backgrounds, who expand our thinking. A mosaic of perspectives makes us stronger, helping us to nurture enduring relationships and build actionable solutions.

- Strive for Distinctive Knowledge: Intellectual curiosity is in our DNA. We embrace challenging problems and ask tough questions. We don’t settle for easy answers when we seek to understand the world around us—and that’s what makes us better investors and partners to our colleagues and clients. We are independent thinkers who go where the research and data take us. And knowing more isn’t the end of the journey, it’s the start of a deeper conversation.

- Speak with Courage and Conviction: Collegial debate yields conviction, so we challenge one another to think differently. Working together enables us to see all sides of an issue. We stand firmly behind our ideas, and we recognize that the world is dynamic. To keep pace with an ever changing world and industry, we constantly reassess our views and share them with intellectual honesty. Above all, we strive to seek and speak truth to our colleagues, clients and others as a trusted voice of reason.

- Act with Integrity—Always: Although our firm is comprised of multiple businesses, disciplines and individuals, we’re united by our commitment to be strong stewards for our people and our clients. Our fiduciary duty and an ethical mind-set are fundamental to the decisions we make.

As of December 31, 2024, AB had $792B in assets under management, $555B of which were ESG-integrated. Additional information about AB may be found on our website, www.alliancebernstein.com.

Learn more about AB’s approach to responsibility here.

More from AllianceBernstein