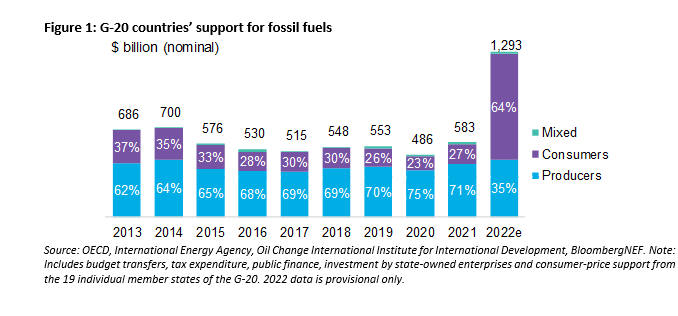

G-20 Member States More Than Doubled Fossil-Fuel Support in 2022 to $1.3 Trillion

Published 12-05-23

Submitted by Bloomberg

Originally published on about.bnef.com

Read the full factbook here

NEW YORK, December 5, 2023 /CSRwire/ - Governments and state-owned companies in the 19 individual G-20 member states provided $1.3 trillion of support for fossil fuels last year, according to a new report produced by research provider BloombergNEF (BNEF) in partnership with Bloomberg Philanthropies. Much of the increase came as a result of the global energy crisis, with governments stepping in to offer energy price support for consumers, totaling $830 billion. However, such subsidies often benefit wealthier energy users disproportionately. The remaining $446 billion went to fossil-fuel producers, even though many enjoyed record profits. Oil and gas majors [1] saw their net income jump 84% in 2022.

BNEF’s Climate Policy Factbook evaluates the G-20 members’ progress in three concrete policy areas: 1) phasing out support for fossil fuels, 2) putting a price on emissions, and 3) implementing climate risk policy. The report aims to increase transparency and inform priorities ahead of the COP28 climate summit, where countries will conclude the first ‘stocktake’ of global progress toward the Paris Agreement and deliver policy recommendations to encourage governments to ratchet up their climate plans.

Michael R. Bloomberg, Special Envoy to the UN Secretary-General on Climate Ambition and Solutions, and founder of Bloomberg LP and Bloomberg Philanthropies, said: “While cities and states race ahead on climate action, national governments are falling behind – in part because fossil fuels subsidies are hurting the transition to clean power and raising longer-term energy costs for citizens. To blunt the worst health and economic harms of climate change, the world needs more governments to step up and stick to their pledges – and end fossil fuel subsidies. This new report highlights some of the actions they can take right away.”

Despite increased support for fossil fuels in 2022, the share of G-20 fossil-fuel support allocated to coal is slowly shrinking – from 8% in 2017, to 2% in 2022. But $21 billion was still provided for the most emissions-intensive fossil fuel last year. Oil and gas producers and consumers attracted just over $1 trillion in public support in 2022, with the remaining $250 billion going to fossil-fuel-fired power.

“The G-20’s public fossil-fuel support could have funded 1.9 terawatts of solar power plants last year, based on BNEF’s analysis. That’s 10 times the actual volume of solar capacity built across the G-20 last year and is approximately the same size as the entire power-plant fleet of North and South America combined,” said Victoria Cuming, head of global policy at BNEF and lead author of the factbook. “It’s hard to see how this aligns with the many pledges made by governments at recent G-7 and G-20 summits and COPs.”

The G-20 members are moving at vastly different speeds. Two states – Brazil and South Korea – achieved a substantial reduction in fossil-fuel support over 2017-2021 (the last year for which country-level data is available). In contrast, Indonesia, Mexico, South Africa and Turkey all more than their doubled their funding over this period, with momentum especially driven by the expenditure of state-owned companies. China was the biggest contributor to G-20 fossil-fuel support in 2021, accounting for a quarter of the overall sum. But it had the fifth-lowest total on a per-capita basis at $97, compared with $2,309 for Saudi Arabia.

To effectively lead the phase-out of coal and other fossil fuels, G-20 members must introduce a meaningful carbon price so that companies and consumers pay for their greenhouse gas emissions. Thirteen of the G-20 economies have rolled out nationwide carbon taxes or markets, while Brazil, India and Turkey are planning such schemes. However, most of the existing programs are ineffective due to low prices or generous concessions such as free carbon permits or tax exemptions.

The third priority area is to implement policies and regulations to drive companies and financial institutions to assess and mitigate their exposure to climate-related risks. Climate change poses ever-growing risks to banks, investors and insurers, as well as corporations, ultimately threatening the financial stability of economies. While some G-20 policymakers are convinced of these perils, few have taken effective actions to require businesses to reduce their exposure.

BNEF’s report reveals that G-20 member states are at significantly different stages in this process. The European Union and UK are ahead of the curve, but other nations are still building their regulatory frameworks through voluntary guidance and pilot groups. Meanwhile, some countries, like the US, Saudi Arabia and Turkey, are trailing even further behind.

The complete Climate Policy Factbook is available via the following link.

[1] BloombergNEF analysis of BP, Chevron, ExxonMobil, Shell and TotalEnergies.

Contacts

Oktavia Catsaros

BloombergNEF

+1-212-617-9209

ocatsaros@bloomberg.net

Daphne Wang

Bloomberg Philanthropies

+1-212-205-0314

daphne@bloomberg.net

About Bloomberg on Climate

Led by Michael R. Bloomberg, a global climate champion and Special Envoy to the UN Secretary-General on Climate Ambition and Solutions, Bloomberg Philanthropies and Bloomberg L.P. are tackling the climate crisis from every angle. Bloomberg Philanthropies is at the forefront of U.S. and global efforts to fight climate change and protect the environment, bringing together mayors and other government and business leaders, grassroots partners, and environmental advocates and scientists across a key array of issues. These philanthropic efforts are accelerating the transition from coal to clean energy, improving air quality and public health, advancing city and local climate action, protecting and preserving ocean ecosystems, and helping unlock billions of dollars in sustainable finance. At the same time, Bloomberg LP is providing the global financial community with data-driven insights, news, and analysis on climate-related issues. As a company, Bloomberg LP is also leading by example, including committing to 100% renewable energy by 2025 and taking action in the communities where its employees live and work. And through stewardship of the Climate Finance Leadership Initiative, the Glasgow Financial Alliance for Net Zero, and the Task Force on Climate-related Financial Disclosures, dedicated personnel from Bloomberg L.P. are helping to harness the power of the capital markets to address climate change and support the transition to a net-zero economy.

About Bloomberg Philanthropies

Bloomberg Philanthropies invests in 700 cities and 150 countries around the world to ensure better, longer lives for the greatest number of people. The organization focuses on five key areas for creating lasting change: the Arts, Education, Environment, Government Innovation, and Public Health. Bloomberg Philanthropies encompasses all of Michael R. Bloomberg’s giving, including his foundation, corporate, and personal philanthropy as well as Bloomberg Associates, a pro bono consultancy that works in cities around the world. In 2022, Bloomberg Philanthropies distributed US$ 1.7 billion. For more information, please visit bloomberg.org, sign up for our newsletter, or follow us on Facebook, Instagram, YouTube, Twitter, and LinkedIn.

About BloombergNEF

BloombergNEF (BNEF) is a strategic research provider covering global commodity markets and the disruptive technologies driving the transition to a low-carbon economy. Our expert coverage assesses pathways for the power, transport, industry, buildings and agriculture sectors to adapt to the energy transition. We help commodity trading, corporate strategy, finance and policy professionals navigate change and generate opportunities.

Bloomberg

Bloomberg

Bloomberg delivers business and markets news, data, analysis, and video to the world, featuring stories from Businessweek and Bloomberg News.

More from Bloomberg