AB: The Connection Between Climate Change and Modern Slavery

Published 10-18-23

Submitted by AllianceBernstein

Saskia Kort-Chick| Director of Social Research and Engagement—Responsibility

Matthew Coghlan| Financial Sector Engagement Manager—Walk Free

Climate change is traditionally regarded as an environmental issue. But climate change also threatens human rights, with material implications for investors.

Climate change is one of the most pressing challenges of our time, but it’s often seen as strictly an environmental cause. We believe that needs to change. That’s because climate change is also a human rights issue that threatens everyone’s lives and livelihoods, while putting the most vulnerable people at risk of human trafficking and modern slavery.

What’s more, neglecting to account for climate-related modern slavery threats may present material financial risks to investors. AllianceBernstein recently partnered with Walk Free, an international human rights group working to accelerate the end of all forms of modern slavery, on a report, Bridging ESG Silos: The Intersection of Climate Change and Modern Slavery, that explores climate-related modern slavery risks in depth.

Making the Climate Connection to Human Rights

Around 50 million people were living in modern slavery on any given day in 2021. But despite this shocking figure, the connection between climate change and modern slavery isn’t well-understood. The World Bank predicts that by 2050, 216 million people will be forced to migrate within their own countries solely because of climate change. This forced migration will make them more vulnerable to the risk of human trafficking and modern slavery.

We’ve made recommendations and developed tools to help investors assess, disclose and manage climate-related modern slavery risks. The first step is to identify the risks.

Physical and Transition Risks to Human Rights

Climate change poses two primary sources of risk to human rights:

Physical risks. Acute physical risks relate to “sudden onset” events such as storms and bushfires. Chronic physical risks involve gradual long-term changes, or “slow onset” events, including drought, desertification, rising sea levels and ocean acidification.

Sudden- and slow-onset events can destroy homes, infrastructure, food and water sources, and livelihoods. People affected by severe weather events can find themselves working in poor job conditions or forced to migrate in search of new work. This increases their susceptibility to human traffickers and can also result in labor exploitation.

Transition risks. The shift from high-carbon fossil fuels to decarbonized, renewable energy sources creates two types of transition risk:

- Phasing out fossil fuels can affect workers who either lack the skills for the green economy or are not in the right location. This increases their vulnerability to poor working conditions and human trafficking.

- Phasing in renewable energy can create human rights risks in the project-implementation and supply chain stages, such as land acquisition, resource extraction, material processing and equipment manufacturing. Examples include reported practices of child labor in cobalt mining and forced labor in polysilicon production.

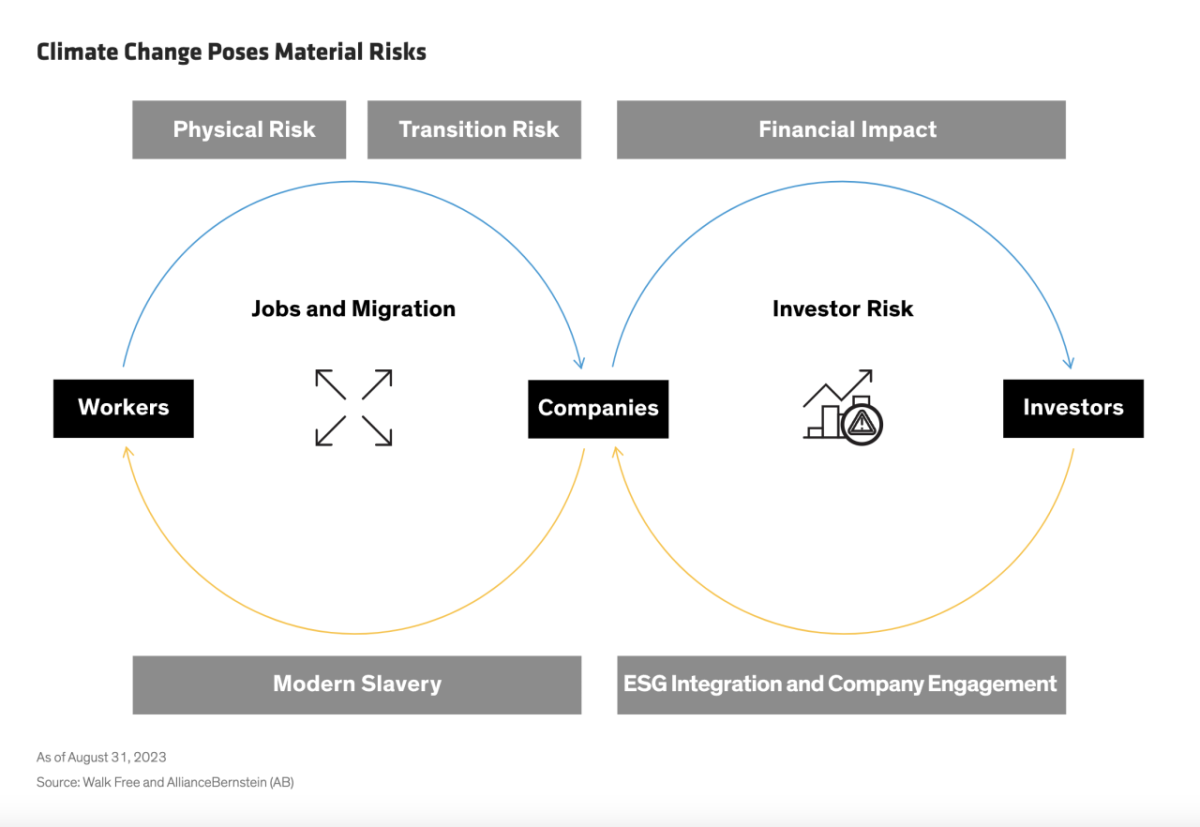

Climate-related modern slavery and human rights risks can also create risks to businesses and investors. These include legal risks (running afoul of modern slavery disclosure law or human rights due diligence), reputational risks (harming a brand by falling short of client, shareholder and customer expectations) and operational risks (destabilizing a company’s operations and supply chains).

These risks can result in legal fees, fines, penalties and declining shareholder value—and could divert resources from a firm’s core business activities (Display).

Of course, the transition to renewable energy also presents opportunities to improve economic and social outcomes. Related technological innovations can help communities adapt better to weather events, while creating clean energy jobs and opening new avenues for economic development. But the transition is bumpy—particularly in emerging markets where the vulnerability of fossil fuel industry workers might be greater—and investors should be aware of the risks.

Climate Change and Human Rights Risks: Real-World Examples

To put human rights risks from climate change into context, consider two real-world case studies, one related to physical risk and the other to transition risk.

Case Study: Super Typhoon Haiyan

Super Typhoon Haiyan killed 6,300 people and displaced 4.4 million others when it struck the Philippines in November 2013. The hardest-hit region, the Eastern Visayas, was one of the country’s poorest, and its people were among the most susceptible to human trafficking.

The super typhoon forced tens of thousands of residents to flee devastated areas, with many heading to the capital city of Manila. In the wake of the storm, reports of human trafficking surged, with 54% of surveyed villages reporting children working in dangerous conditions and 39% of villages reporting a spike in the number of child-labor cases.

Case Study: Extracting Cobalt for Renewable Energy

Cobalt is an important mineral used in lithium-ion batteries, which power the renewable-energy industry. But serious human rights violations have been reported in cobalt mining. It’s estimated that at least 35,000 children are working in cobalt mines worldwide. These mines frequently operate illegally, and miners are exposed to toxic dust, which can lead to hard-metal lung disease.

Companies that use modern slavery—either directly or indirectly—in renewable-energy supply chains could face legal consequences, including fines, penalties or lawsuits. In 2019, a US class-action lawsuit was filed against five major technology companies, alleging they knowingly benefited from the use of child labor in their cobalt supply chains. Beyond litigation risks, increased regulatory scrutiny can bring more stringent supply chain reporting requirements and audits, with severe penalties for non-compliant firms.

A Game Plan for Investors to Identify Risks

The relationship between climate change and human rights risks can be opaque. Given the high stakes, we believe that investors should take a systematic approach to identifying climate-related modern slavery risks and ensure that their due diligence includes:

- Identifying whether a company’s most labor-intensive operations are located in regions susceptible to slow- and sudden-onset climate-related events

- Assessing how companies located in high-risk regions account for labor considerations, such as the risk of large-scale migration following sudden-onset climate-related events, or the risk of forced labor in renewable energy supply chains

- Understanding how companies located in high-risk regions conduct human rights due diligence to identify modern slavery risks, and how firms work to reduce those risks

- Exploring how companies engage and collaborate with employees, suppliers, customers and affected communities to assess and address the impact of decarbonization plans

Climate change can have complex, far-reaching human rights repercussions beyond its environmental impact. We believe that these risks can and should be an integral component of investors’ fundamental research. With awareness and tools that include relevant frameworks and supplementary metrics, investors can improve risk assessments and make better-informed capital allocation decisions.

The authors would like to thank Roxanne Low, ESG Analyst with AB’s Responsible Investing team, for her invaluable contributions.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams. Views are subject to revision over time.

Learn more about AB’s approach to responsibility here.

AllianceBernstein

AllianceBernstein

AllianceBernstein (AB) is a leading global investment management firm that offers diversified investment services to institutional investors, individuals, and private wealth clients in major world markets.

To be effective stewards of our clients’ assets, we strive to invest responsibly—assessing, engaging on and integrating material issues, including environmental, social and governance (ESG) considerations into most of our actively managed strategies (approximately 79% of AB’s actively managed assets under management as of December 31, 2024).

Our purpose—to pursue insight that unlocks opportunity—describes the ethos of our firm. Because we are an active investment manager, differentiated insights drive our ability to design innovative investment solutions and help our clients achieve their investment goals. We became a signatory to the Principles for Responsible Investment (PRI) in 2011. This began our journey to formalize our approach to identifying responsible ways to unlock opportunities for our clients through integrating material ESG factors throughout most of our actively managed equity and fixed-income client accounts, funds and strategies. Material ESG factors are important elements in forming insights and in presenting potential risks and opportunities that can affect the performance of the companies and issuers that we invest in and the portfolios that we build. AB also engages issuers when it believes the engagement is in the best financial interest of its clients.

Our values illustrate the behaviors and actions that create our strong culture and enable us to meet our clients' needs. Each value inspires us to be better:

- Invest in One Another: At AB, there’s no “one size fits all” and no mold to break. We celebrate idiosyncrasy and make sure everyone’s voice is heard. We seek and include talented people with diverse skills, abilities and backgrounds, who expand our thinking. A mosaic of perspectives makes us stronger, helping us to nurture enduring relationships and build actionable solutions.

- Strive for Distinctive Knowledge: Intellectual curiosity is in our DNA. We embrace challenging problems and ask tough questions. We don’t settle for easy answers when we seek to understand the world around us—and that’s what makes us better investors and partners to our colleagues and clients. We are independent thinkers who go where the research and data take us. And knowing more isn’t the end of the journey, it’s the start of a deeper conversation.

- Speak with Courage and Conviction: Collegial debate yields conviction, so we challenge one another to think differently. Working together enables us to see all sides of an issue. We stand firmly behind our ideas, and we recognize that the world is dynamic. To keep pace with an ever changing world and industry, we constantly reassess our views and share them with intellectual honesty. Above all, we strive to seek and speak truth to our colleagues, clients and others as a trusted voice of reason.

- Act with Integrity—Always: Although our firm is comprised of multiple businesses, disciplines and individuals, we’re united by our commitment to be strong stewards for our people and our clients. Our fiduciary duty and an ethical mind-set are fundamental to the decisions we make.

As of December 31, 2024, AB had $792B in assets under management, $555B of which were ESG-integrated. Additional information about AB may be found on our website, www.alliancebernstein.com.

Learn more about AB’s approach to responsibility here.

More from AllianceBernstein