AB: Why ESG Investors Should Look Beyond the Obvious Choices

Companies that are on course to overcome ESG controversies deserve closer attention from investors.

Published 08-30-23

Submitted by AllianceBernstein

Sustainable equity funds tend to shy away from sectors and companies that are deemed to be controversial. Yet by targeting challenged sectors with room for improvement and overlooked companies that enable positive change, we think investors can access more diverse sources of return potential in portfolios focused on environmental, social and governance (ESG) issues.

For many ESG-focused investors, buying shares of companies that are good actors seems a natural choice. After all, shouldn’t we reward companies with low CO2 emissions, positive social policies and good governance? By doing so, bad actors will be incentivized to behave better.

When executed properly and backed by a coherent engagement agenda, this strategy is an effective way to support ESG goals and source equity returns. But there’s another road to ESG investing that is much less travelled—and offers access to an entirely different set of companies.

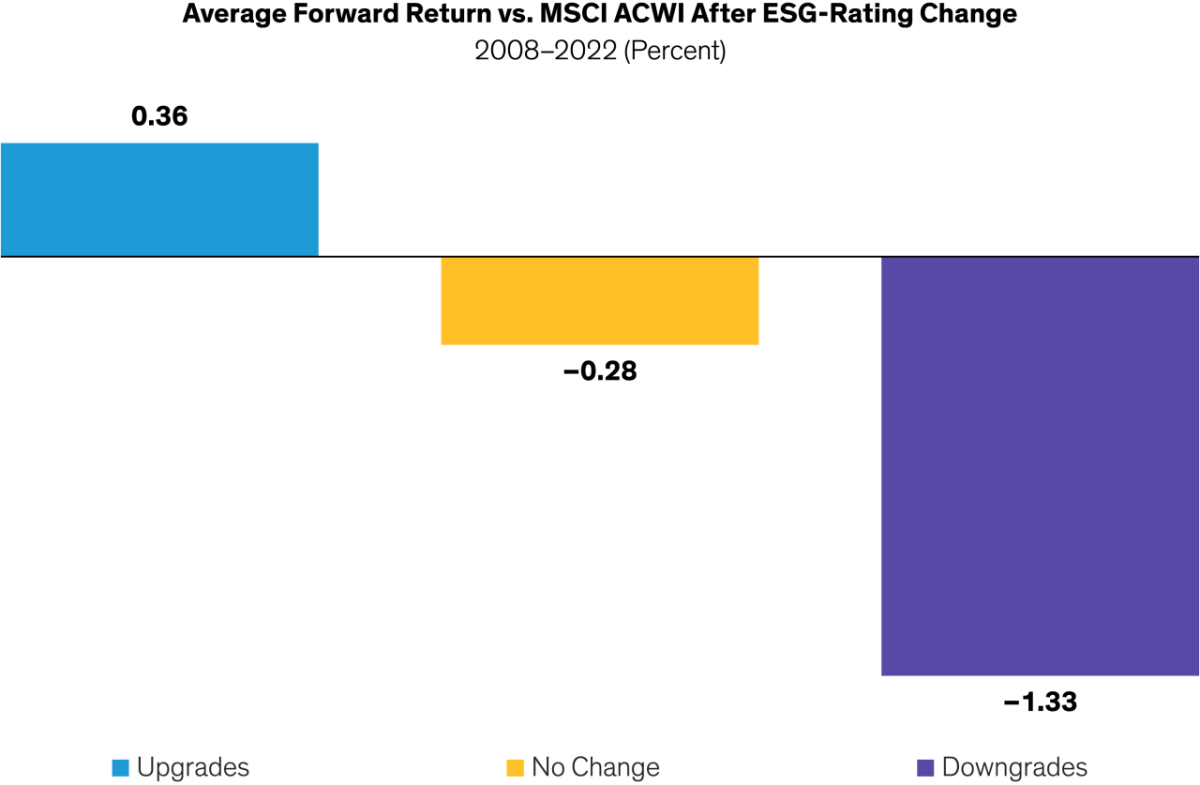

ESG Upgrades Help Support Outperformance

Despite conventional wisdom, we think companies with lower ESG ratings deserve closer attention. That’s because many companies with high ESG ratings can’t realistically improve much more, while lower-rated companies have more room for improvement, which can also support returns.

Our research shows that shares of companies receiving an ESG rating upgrade outperformed the MSCI All Country World Index (ACWI) by 0.36% over the subsequent 12-month period, while those that were downgraded underperformed by 1.33% (Display). In other words, companies likely to see an increase to their ESG rating can be a source of return potential—for investors who can find them.

New academic research supports this approach. Kelly Shue, professor of finance at Yale University, has studied how low-emission “green” firms and high-emission “brown” firms changed their environmental impact given changes in their cost of capital. “What we’ve found is even if it gets easier for these green firms to access capital, their environmental impact barely changes,” Shue said in a Freakonomics Radio podcast entitled “Are ESG Investors Actually Helping the Environment?” “When the cost of capital increases for brown firms, they seem to react by becoming more brown.”

Divesting from brown firms is counterproductive, according to Shue. That’s because a higher cost of capital makes these companies more concerned about short-term survival, so they will be less likely to focus on long-term initiatives to cut emissions. Brown companies often have innovative ideas for reducing emissions—but need capital to implement them.

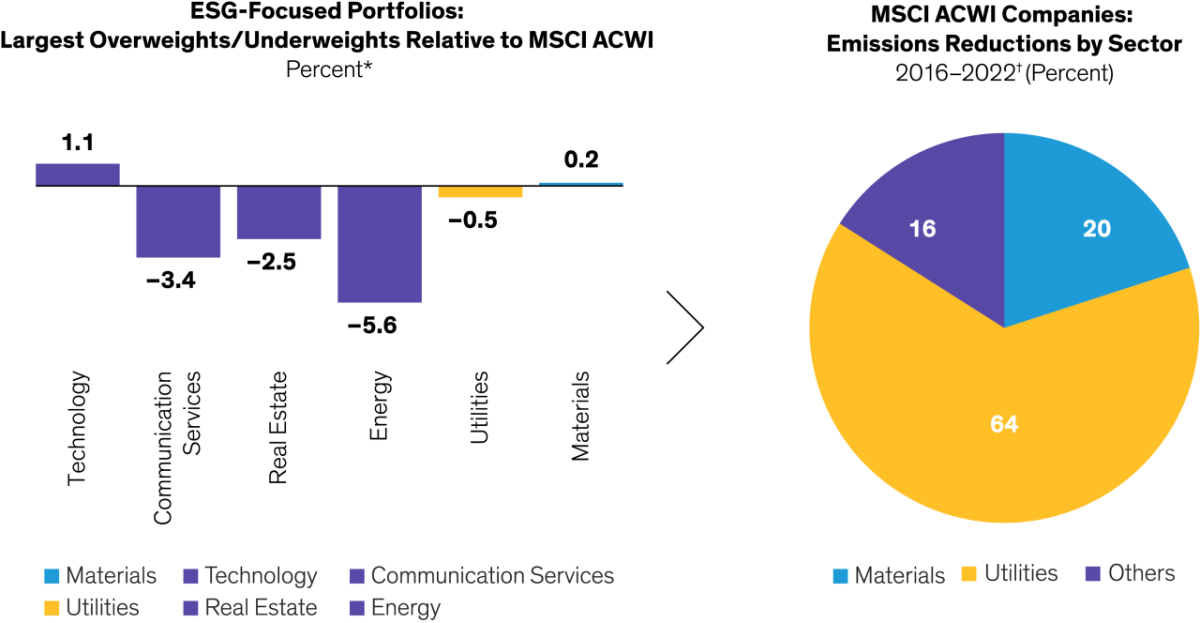

Which Sectors Reduce Emissions Most?

Not surprisingly, companies with high CO2 emissions are found in sectors such as energy, materials and utilities. Sustainable funds generally avoid these sectors (Display), even though the companies at the heart of the problem are actually part of the solution, in our view. Materials and utilities companies accounted for 84% of emissions reductions among MSCI ACWI companies from 2016 to 2022.

Active equity investors can help support future improvements. By taking a position in a polluting power generator or a high-CO2-emitting chemicals manufacturer, investors also gain an opportunity to influence management. These engagements can help point an ESG laggard in the right direction, by showing how cleaning up their act can benefit the business—and their shareholders.

To find overlooked ESG opportunities, we think investors should look for two types of companies: those with unrecognized ratings upgrades, and neglected enablers.

Looking Ahead—Not Back

ESG ratings are inherently backward looking. They paint an incomplete picture of a company’s ESG credentials because they don’t tell you how a company might be bettering itself. Using fundamental research and deep industry expertise, active investors can identify companies that are on track to deliver positive change before it is reflected in their ratings.

For example, Graphic Packaging of Atlanta, Georgia, had a low-BB ESG rating in 2020, owing to concerns over its heavy water usage and carbon intensity. MSCI has since raised its rating three times to AA and shares of Graphic Packaging have outperformed the market in this period. Investors who identified the company’s potential to improve its ESG record in advance would have benefited.

Maple Leaf Foods, a Canadian producer of animal- and plant-based foods, had a modest A ESG rating in 2020 despite its industry leadership in ethical meat production. Investors who researched the company could have also identified potential improvements in its water-usage and energy efficiency. Following improvements in its water use, MSCI upgraded the company’s ESG rating in August 2021. Engaged investors can aim to promote more improvements in carbon reduction at Maple Leaf’s facilities and other ESG targets for management incentives, which we believe could lead to further rating upgrades.

Supporting Sustainability Behind the Scenes

Some companies that support sustainability simply don’t register on ESG radars. For example, MYR Group, based in Thornton, Colorado, provides construction services for electricity networks and isn’t widely owned by ESG-focused portfolios. Yet in our view, MYR is poised to benefit from the accelerated build-out of wind and solar farms, which will require new grid connections that could boost demand for the company’s services. Similarly, some companies manufacture materials that are essential ingredients in green technologies ranging from electric vehicle batteries to solar panels, which should benefit from increased demand as the global energy transition unfolds.

Diversifying Factor Exposures in ESG-Focused Portfolios

These types of companies can also provide diversification benefits. That’s because many unrecognized improvers and neglected enablers are classified as value stocks, which are underrepresented in sustainable portfolios. Most sustainable and ESG-focused equity funds have a growth-equities tilt. So investors seeking to broaden style diversification in ESG-focused stocks can combine these two approaches and achieve a complementary, more balanced style exposure in their allocations.

Investing in ESG improvers and enablers requires a mindset shift. Simply excluding sectors and companies that produce huge emissions or score low on ESG ratings probably won’t help facilitate the world’s energy transition or other sustainability goals. By developing investment theses that view ESG improvements as central to capturing return potential, investors can find new routes to companies and stocks that can help move the most stubborn needles for a more sustainable future.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AllianceBernstein portfolio-management teams. Views are subject to revision over time.

References to specific securities discussed are not to be considered recommendations by AllianceBernstein L.P.

Learn more about AB’s approach to responsibility here.

AllianceBernstein

AllianceBernstein

AllianceBernstein (AB) is a leading global investment management firm that offers diversified investment services to institutional investors, individuals, and private wealth clients in major world markets.

To be effective stewards of our clients’ assets, we strive to invest responsibly—assessing, engaging on and integrating material issues, including environmental, social and governance (ESG) considerations into most of our actively managed strategies (approximately 79% of AB’s actively managed assets under management as of December 31, 2024).

Our purpose—to pursue insight that unlocks opportunity—describes the ethos of our firm. Because we are an active investment manager, differentiated insights drive our ability to design innovative investment solutions and help our clients achieve their investment goals. We became a signatory to the Principles for Responsible Investment (PRI) in 2011. This began our journey to formalize our approach to identifying responsible ways to unlock opportunities for our clients through integrating material ESG factors throughout most of our actively managed equity and fixed-income client accounts, funds and strategies. Material ESG factors are important elements in forming insights and in presenting potential risks and opportunities that can affect the performance of the companies and issuers that we invest in and the portfolios that we build. AB also engages issuers when it believes the engagement is in the best financial interest of its clients.

Our values illustrate the behaviors and actions that create our strong culture and enable us to meet our clients' needs. Each value inspires us to be better:

- Invest in One Another: At AB, there’s no “one size fits all” and no mold to break. We celebrate idiosyncrasy and make sure everyone’s voice is heard. We seek and include talented people with diverse skills, abilities and backgrounds, who expand our thinking. A mosaic of perspectives makes us stronger, helping us to nurture enduring relationships and build actionable solutions.

- Strive for Distinctive Knowledge: Intellectual curiosity is in our DNA. We embrace challenging problems and ask tough questions. We don’t settle for easy answers when we seek to understand the world around us—and that’s what makes us better investors and partners to our colleagues and clients. We are independent thinkers who go where the research and data take us. And knowing more isn’t the end of the journey, it’s the start of a deeper conversation.

- Speak with Courage and Conviction: Collegial debate yields conviction, so we challenge one another to think differently. Working together enables us to see all sides of an issue. We stand firmly behind our ideas, and we recognize that the world is dynamic. To keep pace with an ever changing world and industry, we constantly reassess our views and share them with intellectual honesty. Above all, we strive to seek and speak truth to our colleagues, clients and others as a trusted voice of reason.

- Act with Integrity—Always: Although our firm is comprised of multiple businesses, disciplines and individuals, we’re united by our commitment to be strong stewards for our people and our clients. Our fiduciary duty and an ethical mind-set are fundamental to the decisions we make.

As of December 31, 2024, AB had $792B in assets under management, $555B of which were ESG-integrated. Additional information about AB may be found on our website, www.alliancebernstein.com.

Learn more about AB’s approach to responsibility here.

More from AllianceBernstein