AB: From the Ground Up

Sowing the Seeds of Biodiversity Investment

Published 08-02-23

Submitted by AllianceBernstein

What You Need to Know

Biodiversity is taking on increasing importance as a consumer concern, but it isn’t always top of mind for investors. We think that could soon change. Beyond the obvious environmental benefits, there’s an economic case to be made for protecting biodiversity. New, innovative technologies are disrupting age-old systems that are both lower-yielding and environmentally destructive. We believe the next wave of innovation will be fueled by secular growth trends that could reshape the way we think about the world’s ecosystems. Ultimately, we believe protecting and maintaining biodiversity is an attractive financial proposition for growers, consumers and investors alike.

90%

Percentage of global deforestation attributable to farmland expansion.

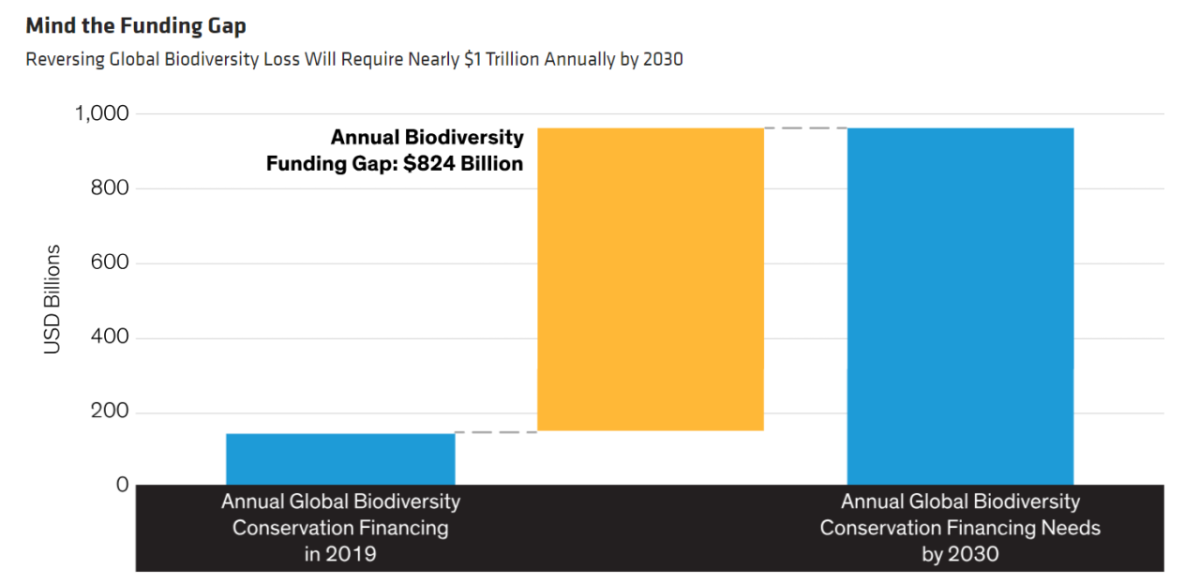

$824 Billion

Annual amount required to bridge current funding levels with what’s needed to reverse biodiversity loss.

10 Billion

Earth’s projected human population by 2050.

Author

Joseph Sun, CFA| Senior Research Analyst—Sustainable Thematic Equities

Just outside Gibson City, Illinois, a modern-day farmer named Greg is tasked with the responsibility of helping to feed America. Back when Greg’s father managed their farm, it took a full day to harvest just one bushel of corn by hand. Over the years, the introduction of innovative farm tools and equipment significantly enhanced production speed and efficiency, and when Greg eventually took over the farm, he benefited from the improved machinery and industrial chemicals. As a result, the farm’s yield and productivity experienced exponential growth.

But as Greg transitions the family’s assets to his son, their multigenerational farm faces the global challenge of biodiversity loss. Across the North American corn belt and beyond, a decline in soil health from years of excessive agrochemicals has impaired growers’ ability to deliver higher yields to feed the world’s expanding population.

Greg’s story highlights the power of technology in addressing farm productivity. But technology can also help us understand the dangerous loss of biodiversity in the ground beneath our feet—the very soil that feeds the world. Across every industry, we must look to technology to solve the challenges of declining marginal yields and the loss of ecosystem services.

As biodiversity awareness grows, companies that provide effective solutions to biodiversity loss are enjoying substantial growth potential. When science and industry combine to address sustainable development issues, exciting opportunities arise for investors. In recent decades, we’ve seen the decoding of the human genome open new markets in biotech and pharmaceuticals. Today, the nascent synthetic biology revolution is building on those developments to create new products in areas ranging from consumer goods to industrials. We’re now on the cusp of a new agricultural revolution that can harness the power of science to address these invisible threats to human sustenance.

It's not too soon for investors to start discovering the opportunities that can be created by addressing the growing biodiversity funding gap. The market could be sizable. By some estimates, more than $800 billion annually will be required to bridge current funding levels with what’s needed to reverse biodiversity loss (Display). That could add up to roughly $8 trillion by 2030.

Past performance, historical and current analyses, and expectations do not guarantee future results.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams. Views are subject to revision over time.

Learn more about AB’s approach to responsibility here

AllianceBernstein

AllianceBernstein

AllianceBernstein (AB) is a leading global investment management firm that offers diversified investment services to institutional investors, individuals, and private wealth clients in major world markets.

To be effective stewards of our clients’ assets, we strive to invest responsibly—assessing, engaging on and integrating material issues, including environmental, social and governance (ESG) considerations into most of our actively managed strategies (approximately 79% of AB’s actively managed assets under management as of December 31, 2024).

Our purpose—to pursue insight that unlocks opportunity—describes the ethos of our firm. Because we are an active investment manager, differentiated insights drive our ability to design innovative investment solutions and help our clients achieve their investment goals. We became a signatory to the Principles for Responsible Investment (PRI) in 2011. This began our journey to formalize our approach to identifying responsible ways to unlock opportunities for our clients through integrating material ESG factors throughout most of our actively managed equity and fixed-income client accounts, funds and strategies. Material ESG factors are important elements in forming insights and in presenting potential risks and opportunities that can affect the performance of the companies and issuers that we invest in and the portfolios that we build. AB also engages issuers when it believes the engagement is in the best financial interest of its clients.

Our values illustrate the behaviors and actions that create our strong culture and enable us to meet our clients' needs. Each value inspires us to be better:

- Invest in One Another: At AB, there’s no “one size fits all” and no mold to break. We celebrate idiosyncrasy and make sure everyone’s voice is heard. We seek and include talented people with diverse skills, abilities and backgrounds, who expand our thinking. A mosaic of perspectives makes us stronger, helping us to nurture enduring relationships and build actionable solutions.

- Strive for Distinctive Knowledge: Intellectual curiosity is in our DNA. We embrace challenging problems and ask tough questions. We don’t settle for easy answers when we seek to understand the world around us—and that’s what makes us better investors and partners to our colleagues and clients. We are independent thinkers who go where the research and data take us. And knowing more isn’t the end of the journey, it’s the start of a deeper conversation.

- Speak with Courage and Conviction: Collegial debate yields conviction, so we challenge one another to think differently. Working together enables us to see all sides of an issue. We stand firmly behind our ideas, and we recognize that the world is dynamic. To keep pace with an ever changing world and industry, we constantly reassess our views and share them with intellectual honesty. Above all, we strive to seek and speak truth to our colleagues, clients and others as a trusted voice of reason.

- Act with Integrity—Always: Although our firm is comprised of multiple businesses, disciplines and individuals, we’re united by our commitment to be strong stewards for our people and our clients. Our fiduciary duty and an ethical mind-set are fundamental to the decisions we make.

As of December 31, 2024, AB had $792B in assets under management, $555B of which were ESG-integrated. Additional information about AB may be found on our website, www.alliancebernstein.com.

Learn more about AB’s approach to responsibility here.

More from AllianceBernstein