AB: Help Wanted - Why Smart Companies Recruit for Diversity

Published 07-26-23

Submitted by AllianceBernstein

Gayle Baldwin| Senior Research Analyst and Portfolio Manager—Equities

Vivian Lubrano| Portfolio Manager—Equities

Recruiting talent is a basic ingredient for business success. Companies that are more inclusive in their recruiting will discover better-qualified employees, which can bolster competitive advantages and help deliver better outcomes for investors.

More companies are discovering that policies promoting diversity, equity and inclusion (DEI) are good for business. Increasing evidence shows how companies that score high on measures of ethnic, cultural and gender diversity have delivered stronger profitability than lower-ranked peers.

But what’s the best way to create a diverse workforce? Many companies focus on meeting defined diversity quotas. That may not be the best approach, in our view. In the race to add more women or minorities to the payroll, human resources (HR) departments won’t necessarily get the right people for the job.

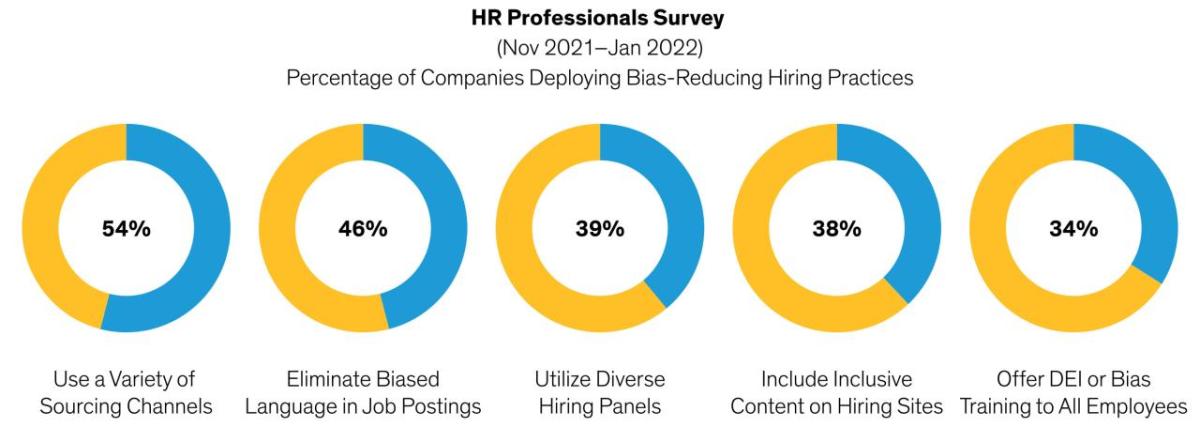

Instead, we think the key is to develop more creative methods to identify the most talented people for positions, by neutralizing biases that may prevent getting diverse talent on board. Even though many employers say they strive to make their recruiting processes fairer, most don’t do this systematically, according to a survey by the HR Research Institute (Display).

Investors should look for three types of inclusive recruitment tactics that signal a strategic fusion of forward-looking hiring and a diversity-driven mindset.

Redefining Qualifications: Behaviors, Not Pedigrees

Recruiters are easily swayed by flashy resumes. Degrees from top universities or professional experience at well-known companies can flatter a candidate. Yet many softer skills don’t show up on a CV and can make the difference between success or failure in a new hire.

Does the candidate have the creativity needed for the role? Is she comfortable questioning conventional wisdom? What about problem solving and intellectual curiosity? If a company could test for these aptitudes, it might find highly qualified workers that don’t meet the standard template for a given job.

Infosys, an Indian IT services company, did just that. The company wanted to expand its roster of US-based client-facing staff and identified critical thinking as a more important success factor for entry-level positions than an engineering degree. So, it partnered with community and liberal arts colleges in the US to identify students with critical-thinking skills who could then be taught how to code. These colleges tend to have proportionally more female and minority students. Tapping this pool of students enabled Infosys to grow and diversify its US employee base, better reflecting the diversity of its clients.

Diversity isn’t typically found behind the wheel of a delivery truck—widely seen as a man’s job. But SG Holdings, a Japanese trucking and logistics company, broke that mold. As it struggled to find enough male drivers in Japan’s aging population, SG invested in technology that helped redefine what capacities are required for roles that historically were more physically demanding. For example, investing in swap body trucks with interchangeable containers allowed the company to separate the tasks of loading trucks from driving them. As a result, SG now has more women, elderly and even disabled drivers steering its fleet.

Turning to Nontraditional Talent

HR departments often get stuck in familiar hiring patterns. Candidates are selected from similar types of colleges and companies, which limits diversity. Creative recruitment processes should be open to searching for pools of suitable talent in atypical places.

Consider the military, where safety and procedural compliance are paramount. Those are perfect attributes for a company like Herc Holdings, which rents heavy equipment for construction. Herc looked to US military veterans, reservists and National Guard members for new employees, and found what they were looking for in a very diverse pool of trained soldiers.

In Europe, refugees from the war in Ukraine and other hotspots might not seem like an obvious place to hire employees. Yet refugees are highly motivated people looking to rebuild their lives after fleeing home. Capgemini, the France-based IT company, launched a program in the UK to train and place refugees in digital jobs, helping to address a huge skills shortage in the sector. French cosmetics group L’Oréal also started to integrate refugees into its workforce in 2022. “The goal is to shift mentalities on migration and turn the challenge of integrating refugees and exiled people into an opportunity for businesses and the economy,” L’Oréal said at the time.

Reducing Bias from the Recruitment Process

Biases are perhaps one of the biggest obstacles to building a diverse workforce. Growing awareness of the issues has led to the creation of various tools that can help reduce bias and drive inclusivity.

Thermo Fisher Scientific, a US supplier of scientific instruments, scores all job postings with a tool that helps reduce language bias—words that might unintentionally inhibit potential candidates from applying. In the UK, industrial company IMI offers training in unconscious biases and requires headhunters to deliver gender-balanced slates of candidates; for three years in a row, half of the engineering graduates hired by IMI have been female.

Getting recruitment right is perhaps one of the most undervalued components of business health. We think investors with a diversity focus should pay closer attention to how companies find the right talent. Those that crack the recruitment formula will naturally diversify their staff base with employees who are a better fit for their jobs—and can help propel a company toward a more profitable future.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams and are subject to revision over time.

References to specific securities are presented to illustrate the application of our investment philosophy only and are not to be considered recommendations by AB. The specific securities identified and described do not represent all of the securities purchased, sold or recommended for the portfolio, and it should not be assumed that investments in the securities identified were or will be profitable.

Learn more about AB’s approach to responsibility here

AllianceBernstein

AllianceBernstein

AllianceBernstein (AB) is a leading global investment management firm that offers diversified investment services to institutional investors, individuals, and private wealth clients in major world markets.

To be effective stewards of our clients’ assets, we strive to invest responsibly—assessing, engaging on and integrating material issues, including environmental, social and governance (ESG) considerations into most of our actively managed strategies (approximately 79% of AB’s actively managed assets under management as of December 31, 2024).

Our purpose—to pursue insight that unlocks opportunity—describes the ethos of our firm. Because we are an active investment manager, differentiated insights drive our ability to design innovative investment solutions and help our clients achieve their investment goals. We became a signatory to the Principles for Responsible Investment (PRI) in 2011. This began our journey to formalize our approach to identifying responsible ways to unlock opportunities for our clients through integrating material ESG factors throughout most of our actively managed equity and fixed-income client accounts, funds and strategies. Material ESG factors are important elements in forming insights and in presenting potential risks and opportunities that can affect the performance of the companies and issuers that we invest in and the portfolios that we build. AB also engages issuers when it believes the engagement is in the best financial interest of its clients.

Our values illustrate the behaviors and actions that create our strong culture and enable us to meet our clients' needs. Each value inspires us to be better:

- Invest in One Another: At AB, there’s no “one size fits all” and no mold to break. We celebrate idiosyncrasy and make sure everyone’s voice is heard. We seek and include talented people with diverse skills, abilities and backgrounds, who expand our thinking. A mosaic of perspectives makes us stronger, helping us to nurture enduring relationships and build actionable solutions.

- Strive for Distinctive Knowledge: Intellectual curiosity is in our DNA. We embrace challenging problems and ask tough questions. We don’t settle for easy answers when we seek to understand the world around us—and that’s what makes us better investors and partners to our colleagues and clients. We are independent thinkers who go where the research and data take us. And knowing more isn’t the end of the journey, it’s the start of a deeper conversation.

- Speak with Courage and Conviction: Collegial debate yields conviction, so we challenge one another to think differently. Working together enables us to see all sides of an issue. We stand firmly behind our ideas, and we recognize that the world is dynamic. To keep pace with an ever changing world and industry, we constantly reassess our views and share them with intellectual honesty. Above all, we strive to seek and speak truth to our colleagues, clients and others as a trusted voice of reason.

- Act with Integrity—Always: Although our firm is comprised of multiple businesses, disciplines and individuals, we’re united by our commitment to be strong stewards for our people and our clients. Our fiduciary duty and an ethical mind-set are fundamental to the decisions we make.

As of December 31, 2024, AB had $792B in assets under management, $555B of which were ESG-integrated. Additional information about AB may be found on our website, www.alliancebernstein.com.

Learn more about AB’s approach to responsibility here.

More from AllianceBernstein