AllianceBernstein: Sustainability-Linked Bonds: The Good, the Bad and the Ugly

Published 07-12-23

Submitted by AllianceBernstein

Patrick O'Connell, CFA| Director—Fixed Income Responsible Investing Research

Tiffanie Wong, CFA| Director—Fixed Income Responsible Investing Portfolio Management; Director—US Investment-Grade Credit

Markus Peters| Senior Investment Strategist—Fixed Income

Corporate bonds that fund environmental, social and governance (ESG) initiatives continue to capture investor hearts and minds. But ESG-labeled bonds come in different stripes, so investors need to discern among the good, the bad and the occasional ugly ones merely posing as ESG bonds.

Two types in particular offer bookend examples of why extra scrutiny is important: use-of-proceeds bonds (UOPs) and sustainability-linked bonds (SLBs).

Project-Based vs. Target-Based: ESG Bond Goals Have Expanded

ESG-labeled bonds have come a long way quickly, and innovation shows no signs of slowing. Two primary segments now drive the universe: project-based and target-based. UOPs, which are project-based, include green bonds and social bonds that firms issue to finance their environmental or social programs. The nearly $1 trillion UOP bond market has a longer history and is relatively price efficient.

SLBs are a more nascent submarket that still suffers from growing pains, in our view. One reason is that SLBs are target-based, more flexible in their intent and therefore subject to broader interpretation of whether they’re working as advertised.

For instance, rather than using bond proceeds for a specific initiative, SLBs are designed to incentivize issuers to raise ESG standards across their business. Issuers set key performance indicators (KPIs) to help gauge progress toward the goals, and nearly all SLBs provision a potential coupon step-up if the goals aren’t met. But since KPIs are self-determined, ensuring consistent and ambitious results can be challenging, and step-ups may not occur even if ESG targets are seemingly missed.

Further, when issuers miss relevant KPIs, we view the step-up much like compensation for a credit quality downgrade, in which the higher coupon helps insulate investors from bond price deterioration. Missing KPIs also means that investors aren’t meeting their ESG goals—a key reason they invested—which we believe warrants further investigation.

Thus, SLBs—more than most other ESG-labeled bonds—need close watching for potential greenwashing, the practice of a company misleading investors about its commitments to environmental improvement. And until these challenges work themselves out, the SLB market is subject to disparate spreads and other idiosyncrasies, our research shows.

Side by Side, ESG-Labeled Bond Differences Jump Out

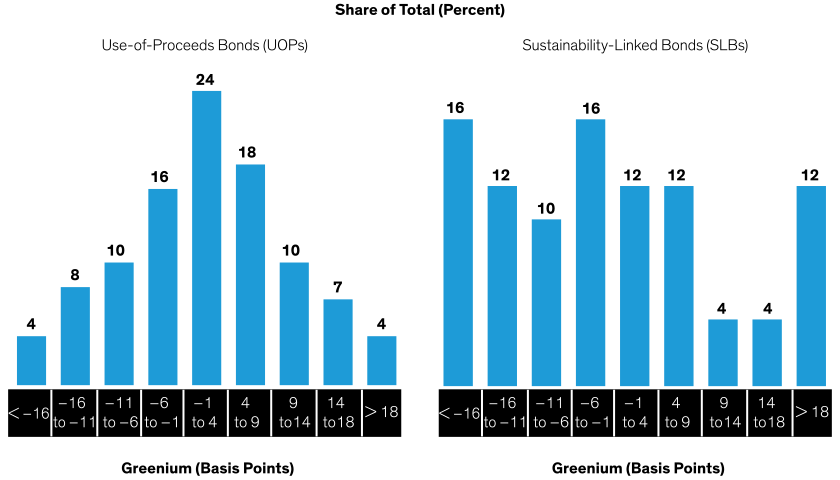

A comparison of greeniums—the negative yield premium of a green bond relative to conventional bonds issued by the same company—illustrates the SLB market’s less mature and inconsistent nature.

Given the SLB market’s nascency, its sample size is significantly smaller. Still, we found that UOPs currently have an average greenium of 1.5 basis points (bps), higher than the negative premium, or discount, of -2 bps for SLBs, on average. But more strikingly, the distribution of greeniums in the UOP market is much more normal (Display, left) than in the SLB market, where greeniums seem sporadic (Display, right). We attribute this difference partially to the UOP market’s relatively greater depth and, in part, to disparate KPI ambition levels. As the SLB market matures and the number of SLBs grows, we expect this disparity to moderately shrink and its market to become more orderly.

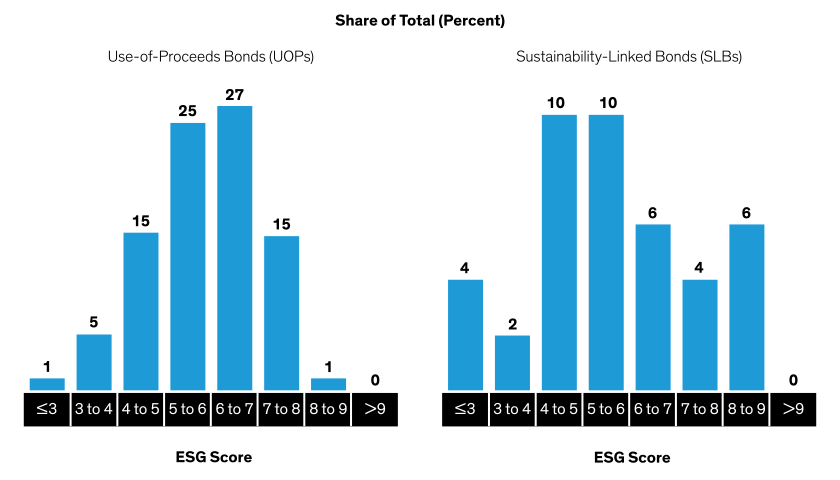

ESG scoring also helps investors compare issuers—and better gauge potential success. We apply our proprietary ESG scores to firms based on multiple criteria, such as industry type, ESG goals and policies and pending legal actions, to name a few.

Today, UOPs’ ESG score averages 6 on a 10-point scale—1 point better than that of SLBs. But as with greeniums, the distribution of ESG scores for SLBs appears more erratic (Display). In our analysis, this suggests a greater risk for greenwashing among SLBs. Like greeniums, however, the distortion also reflects the current scarcity of SLBs in a newer market.

Three Sustainability-Linked Bonds in Practice

The SLB market’s Wild West characteristics call for investor vigilance and careful selection. Some issuers struggle, others recover after stumbling and still others do a fine job meeting their KPIs.

For example, Italian utility Enel was an early innovator of SLBs, with targets based on the United Nations Sustainable Development Goals, such as greenhouse gas (GHG) reductions and using more renewable energy sources. Enel met its ambitious sustainability goals in 2022, avoiding a coupon step-up or negative impact on spreads versus its conventional bonds.

Missed targets aren’t the end-all, but they should warrant closer review. Greece-based Public Power Corporation, for instance, missed its 2022 year-end decarbonization target, and as a result its coupon was stepped up 25 bps in March 2023. The company missed its ambitious target (a 40% reduction in GHGs from 2019 to 2022) mainly due to the Russia-Ukraine conflict. PPC had planned to shutter its coal plants and replace them with natural gas, which it suddenly couldn’t procure from Russia. However, the firm has reiterated its plans to grow renewables and shut all coal facilities by 2028. The market seemed to look past this hiccup: PPC’s greenium had reached new highs by June 2023.

Not every challenging situation gets a pass. Brazil’s JBS, the world’s largest meat processor, was hit by a whistleblower complaint about alleged misrepresentations behind its $3.2 billion in SLBs. In January 2023, the global advocacy group Mighty Earth pointed to JBS’s rising GHG output—particularly Scope 3, or indirect, emissions—which contradicts its pledge to reduce GHGs annually toward net zero by 2040. As the Securities and Exchange Commission investigates, the bonds are being scrutinized by the market. The SLBs’ greenium tumbled once news broke in January 2023, and aside from a brief recovery, they continued to underperform the firm’s comparable unlabeled issues as of June 2023.

The SLB market is dotted with opportunity. But because SLBs are the newcomer to the ESG space, the market will take time to settle down, much like the breaking-in period we saw for UOPs. Meantime, the good SLBs can offer compelling yield and close alignment with investors’ ESG objectives, while the bad and the ugly ones should be approached with caution. To know the difference, it’s up to investors to do their homework, including fundamental credit research and closely monitoring each company’s progress toward its sustainability goals.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams and are subject to revision over time.

Learn more about AB’s approach to responsibility here.

AllianceBernstein

AllianceBernstein

AllianceBernstein (AB) is a leading global investment management firm that offers diversified investment services to institutional investors, individuals, and private wealth clients in major world markets.

To be effective stewards of our clients’ assets, we strive to invest responsibly—assessing, engaging on and integrating material issues, including environmental, social and governance (ESG) considerations into most of our actively managed strategies (approximately 79% of AB’s actively managed assets under management as of December 31, 2024).

Our purpose—to pursue insight that unlocks opportunity—describes the ethos of our firm. Because we are an active investment manager, differentiated insights drive our ability to design innovative investment solutions and help our clients achieve their investment goals. We became a signatory to the Principles for Responsible Investment (PRI) in 2011. This began our journey to formalize our approach to identifying responsible ways to unlock opportunities for our clients through integrating material ESG factors throughout most of our actively managed equity and fixed-income client accounts, funds and strategies. Material ESG factors are important elements in forming insights and in presenting potential risks and opportunities that can affect the performance of the companies and issuers that we invest in and the portfolios that we build. AB also engages issuers when it believes the engagement is in the best financial interest of its clients.

Our values illustrate the behaviors and actions that create our strong culture and enable us to meet our clients' needs. Each value inspires us to be better:

- Invest in One Another: At AB, there’s no “one size fits all” and no mold to break. We celebrate idiosyncrasy and make sure everyone’s voice is heard. We seek and include talented people with diverse skills, abilities and backgrounds, who expand our thinking. A mosaic of perspectives makes us stronger, helping us to nurture enduring relationships and build actionable solutions.

- Strive for Distinctive Knowledge: Intellectual curiosity is in our DNA. We embrace challenging problems and ask tough questions. We don’t settle for easy answers when we seek to understand the world around us—and that’s what makes us better investors and partners to our colleagues and clients. We are independent thinkers who go where the research and data take us. And knowing more isn’t the end of the journey, it’s the start of a deeper conversation.

- Speak with Courage and Conviction: Collegial debate yields conviction, so we challenge one another to think differently. Working together enables us to see all sides of an issue. We stand firmly behind our ideas, and we recognize that the world is dynamic. To keep pace with an ever changing world and industry, we constantly reassess our views and share them with intellectual honesty. Above all, we strive to seek and speak truth to our colleagues, clients and others as a trusted voice of reason.

- Act with Integrity—Always: Although our firm is comprised of multiple businesses, disciplines and individuals, we’re united by our commitment to be strong stewards for our people and our clients. Our fiduciary duty and an ethical mind-set are fundamental to the decisions we make.

As of December 31, 2024, AB had $792B in assets under management, $555B of which were ESG-integrated. Additional information about AB may be found on our website, www.alliancebernstein.com.

Learn more about AB’s approach to responsibility here.

More from AllianceBernstein