KeyCorp 2022 ESG Report Highlights Women In Business

Key4Women®: Empowering women in business

Published 05-22-23

Submitted by KeyBank

Originally published in Key’s 2022 Environmental, Social, and Governance report

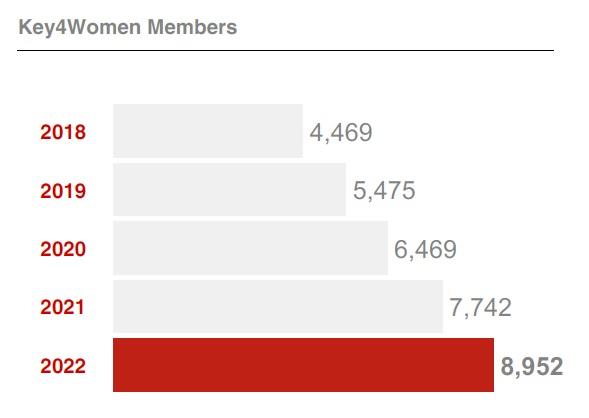

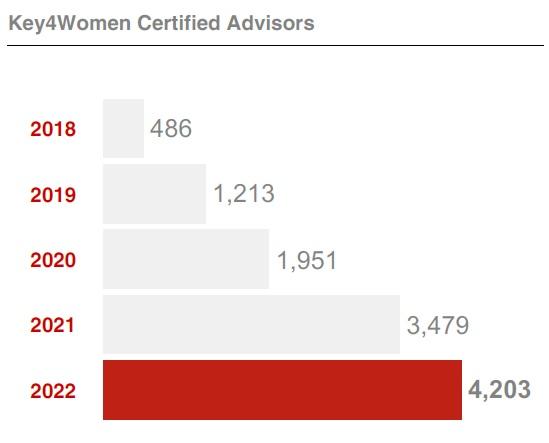

Through advocacy, connections, and empowerment, Key4Women supports the financial progress and empowerment of businesswomen, providing a wealth of resources to help them meet their personal and professional goals. Since its launch in 2005, our certified advisors have facilitated more than $12 billion in loans to women-owned businesses.

The program offers members:

- Customized financial services and advice from Key4Women certified advisors

- Exclusive member events and forums with industry experts to help foster professional and business development while creating lasting connections with industry leaders and professionals

- Timely and robust thought leadership content and insights, covering the latest in financial and business trends to help women succeed

- Strong support of national and local women organizations

With thousands of Key4Women Certified Advisors throughout Key’s footprint, we understand the unique needs of women entrepreneurs and leaders. Access to capital and mentorship continue to be two critical needs of women-owned businesses, which is why Key4Women expanded its pitch contest from Northeast Ohio to Washington State in 2022. Through the competition, nearly $70,000 in cash prizes were awarded to 20 finalists.

To learn more about Key’s commitments to empowering businesswomen, read the 2022 Environmental, Social, and Governance Report here.

KeyBank

KeyBank

KeyCorp's roots trace back nearly 200 years to Albany, New York. Headquartered in Cleveland, Ohio, Key is one of the nation's largest bank-based financial services companies, with assets of approximately $187 billion at June 30, 2024.

Key provides deposit, lending, cash management, and investment services to individuals and businesses in 15 states under the name KeyBank National Association through a network of approximately 1,000 branches and approximately 1,200 ATMs. Key also provides a broad range of sophisticated corporate and investment banking products, such as merger and acquisition advice, public and private debt and equity, syndications and derivatives to middle market companies in selected industries throughout the United States under the KeyBanc Capital Markets trade name. For more information, visit https://www.key.com/. KeyBank Member FDIC.

More from KeyBank