AB: Homing In on Quality in Climate Investing Strategies

Published 05-19-23

Submitted by AllianceBernstein

Kent Hargis, PhD| Co-Chief Investment Officer—Strategic Core Equities

David Wheeler, CFA| Portfolio Manager—Sustainable Climate Solutions; Senior Research Analyst—Sustainable Thematic Equities

Teresa Keane| Managing Director—Equities

Stock selection in a climate investing strategy takes more than just avoiding companies exposed to global warming risks. The process should intersect with an active search for diverse opportunities among companies helping to fight climate change, but with high-quality business models, too.

Concerns and action to stem global warming are decades in the making, although efforts have increased in recent years. The German city of Freiburg, for instance, pioneered the move to solar power in the 1980s and is quickly approaching its goal to nearly halve its greenhouse gas emissions by 2030. Freiburg’s early awareness is uncommon, however, and many economies and industries today are just waking up to climate-related risks.

Climate Risks Are High but There’s Still Time to Act

Europe experienced its second-hottest year on record in 2022; globally it was the fifth warmest. Against this backdrop, the UN’s environmental experts intensified demands to fast-track climate-fighting efforts by “every country and every sector on every timeframe.”

On a positive note, the same UN report underscored that it’s not too late. First, the widely adopted goal to limit annual rising temperatures to 1.5 degrees Celsius by 2030 is still within reach. And by mobilizing funds and sharing best practices, technology and effective policy measures, any entity can better manage, even prevent, carbon output.

More top-down support via government initiatives is helping, too, and the incentive is clear; research shows that climate change can strain or benefit economic output to the tune of –8% to 15% annually, depending on how governments and industries respond.

At last year’s UN COP27 conference, for example, delegates agreed to establish a multinational financial backstop for loss and damage, ideally to help poorer countries recover from climate-related impact. The US Inflation Reduction Act and the pending European Green Deal include well-funded incentives to shepherd economies toward low-carbon mode. China, arguably a top greenhouse gas producer, is also on board. Its 2060 carbon-neutral framework, while addressing climate change, also reveals its vision for the country’s economic future in light of it.

Many Industries Benefit From Climate-Related Economic Drivers

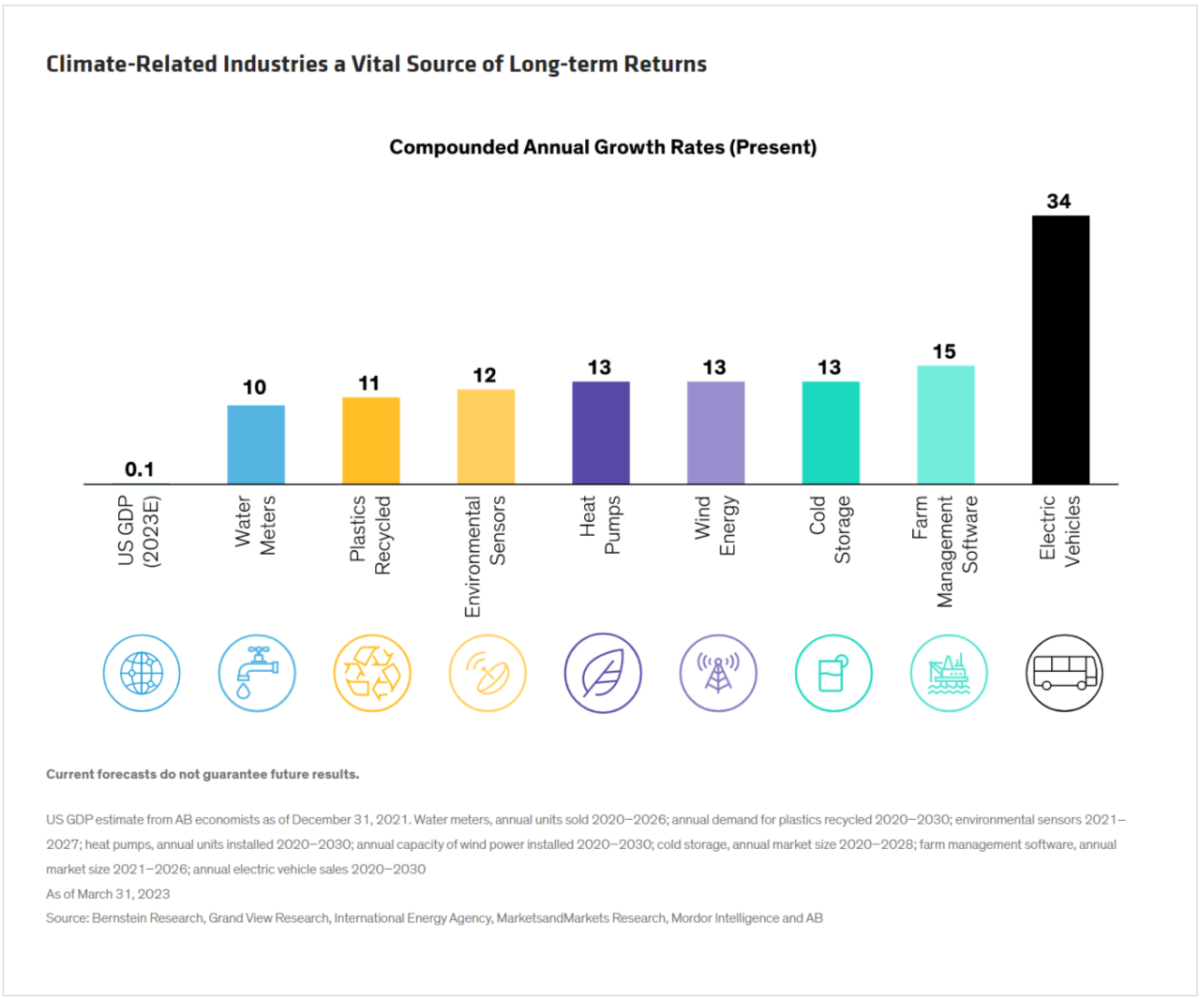

Combatting climate change goes deeper than macroeconomic policies. A growing number of industries, from electric vehicles to wind farms, are also on the front lines of a decarbonizing economy—and all are growing at a faster rate than the US economy (Display).

These are the innovative companies that will lead the way with climate-transition-specific business models, as well as products and services that enable the achievement of global decarbonization. And we expect they’ll enjoy multi-decade growth potential as a result.

Understandably, investors remain wary of today’s uncertain macro environment, mainly rising interest rates and high inflation. Clearly, these disruptors are factors in the investment selection process, too, but should be integrated right alongside climate risks—not in sequence—to find businesses likely to do well in the new economy.

Climate Solutions Are an Appealing Investment Factor

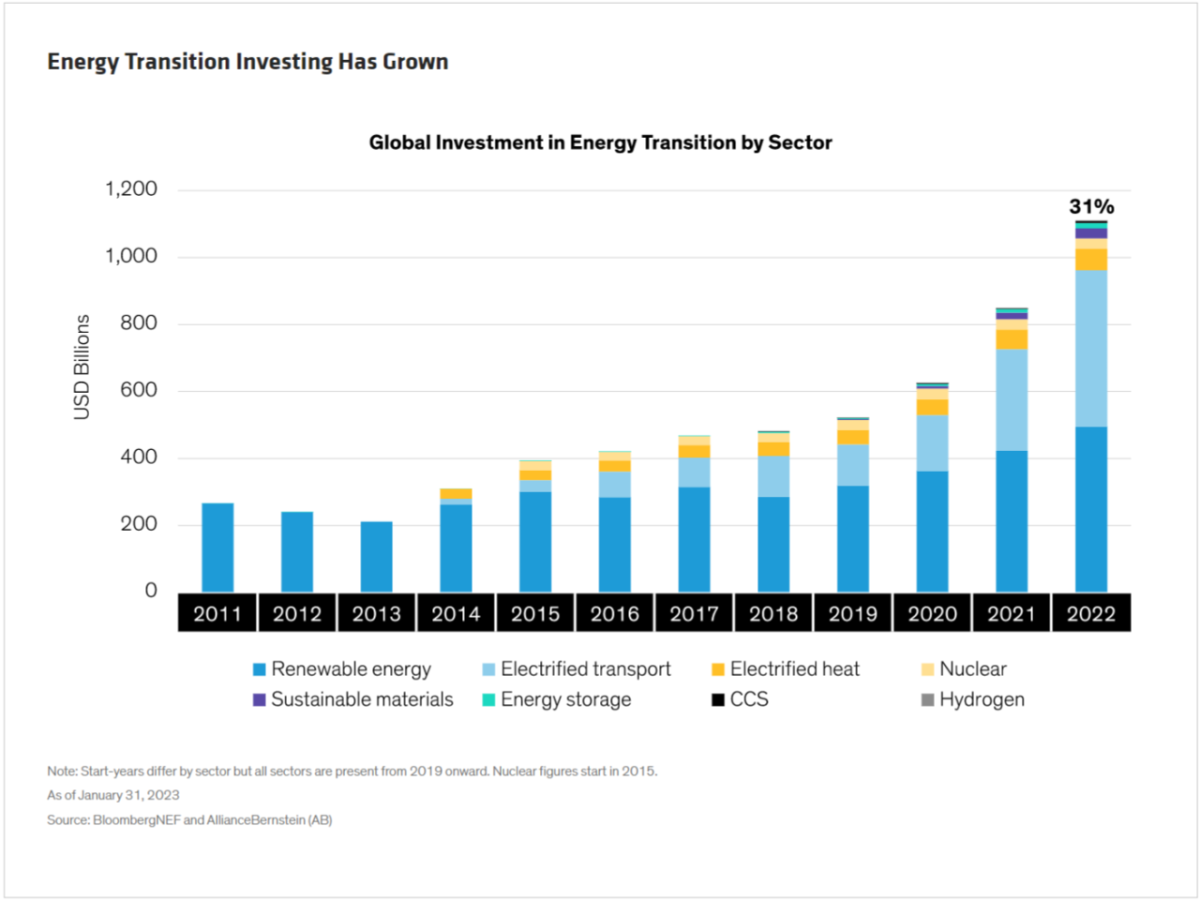

The growth potential among companies providing climate solutions is making a strong impression with investors. In 2022, for example, global investment in energy-transition products and services, such as renewable energy, electric vehicles, energy efficiency and hydrogen, reached a record $1.1 trillion, a 31% increase from the prior year (Display). China is by far the largest contributor to the growth, accounting for about half of all investment. More important, the recent groundswell put energy-transition investment levels on an even keel with fossil fuels for the first time. By the end of this decade, we anticipate investment in decarbonization products will dwarf spending on fossil fuels by at least four-fold.

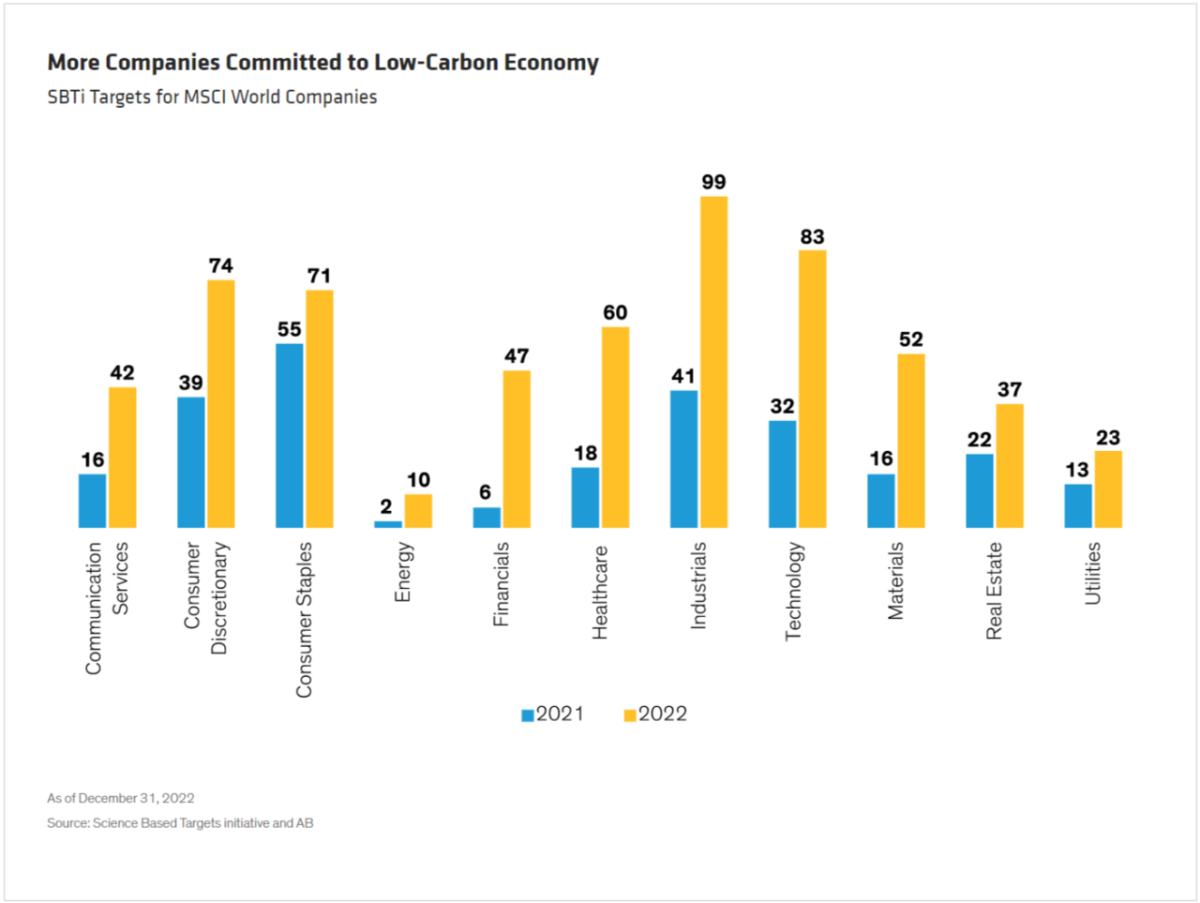

The growing commitment to global carbon-reduction goals extends well beyond climate-friendly industries. More companies than ever are signaling support for science-based greenhouse gas reduction targets, particularly in the consumer discretionary, information technology and industrials sectors (Display).

This momentum is fostering a healthy competitiveness among innovative climate-resilient and climate-focused businesses, offering attractive growth opportunities. Companies such as AECOM, based in Dallas, Texas, offer consulting for carbon-intensive industries like transportation and construction that can help deliver aggressive emissions-reduction goals, up to 50% for most projects. Hexcel, based in Stamford, Connecticut, makes lightweight carbon fiber used in airplane construction that saves fuel and cuts airline annual greenhouse gas emissions by the tonnes. Norway-based recycling firm TOMRA continues to benefit from an expanding global commitment to reusable plastic in manufacturing, retail and food packaging.

Climate Resilience Also Needs Strong Fundamentals

A company’s climate resiliency also stems from the quality of its business model, so investors should focus on both. Besides navigating the near-term impact of climate change, companies need to plan their long-term contribution, and profitability, in a low-carbon economy. In our view, strong balance sheets and effective governance are as important to active climate investing as other equity strategies. It’s not enough to mitigate the financial impact of climate change; companies must demonstrate solid bottom-up fundamentals and top-down vision to benefit from current and future opportunities in the transition to a decarbonized world.

The global population will swell to 10 billion by 2050, so our worldwide Freiburg moment is now. Innovation is more important than ever to improve the environment, ensure clean water and produce enough safe food. That’s why holistically integrating the risks and opportunities in today’s economy is the linchpin of an effective climate strategy. Companies that can find their niche in this massive effort will prosper, providing they can mitigate today’s risks while setting the groundwork for future profitability. Climate investment solutions should focus on both sides of that equation.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AllianceBernstein portfolio-management teams and are subject to revision over time.

References to specific securities are presented to illustrate the application of our investment philosophy only and are not to be considered recommendations by AB. The specific securities identified and described do not represent all of the securities purchased, sold or recommended for the portfolio, and it should not be assumed that investments in the securities identified were or will be profitable.

Learn more about AB’s approach to responsibility here

AllianceBernstein

AllianceBernstein

AllianceBernstein (AB) is a leading global investment management firm that offers diversified investment services to institutional investors, individuals, and private wealth clients in major world markets.

To be effective stewards of our clients’ assets, we strive to invest responsibly—assessing, engaging on and integrating material issues, including environmental, social and governance (ESG) considerations into most of our actively managed strategies (approximately 79% of AB’s actively managed assets under management as of December 31, 2024).

Our purpose—to pursue insight that unlocks opportunity—describes the ethos of our firm. Because we are an active investment manager, differentiated insights drive our ability to design innovative investment solutions and help our clients achieve their investment goals. We became a signatory to the Principles for Responsible Investment (PRI) in 2011. This began our journey to formalize our approach to identifying responsible ways to unlock opportunities for our clients through integrating material ESG factors throughout most of our actively managed equity and fixed-income client accounts, funds and strategies. Material ESG factors are important elements in forming insights and in presenting potential risks and opportunities that can affect the performance of the companies and issuers that we invest in and the portfolios that we build. AB also engages issuers when it believes the engagement is in the best financial interest of its clients.

Our values illustrate the behaviors and actions that create our strong culture and enable us to meet our clients' needs. Each value inspires us to be better:

- Invest in One Another: At AB, there’s no “one size fits all” and no mold to break. We celebrate idiosyncrasy and make sure everyone’s voice is heard. We seek and include talented people with diverse skills, abilities and backgrounds, who expand our thinking. A mosaic of perspectives makes us stronger, helping us to nurture enduring relationships and build actionable solutions.

- Strive for Distinctive Knowledge: Intellectual curiosity is in our DNA. We embrace challenging problems and ask tough questions. We don’t settle for easy answers when we seek to understand the world around us—and that’s what makes us better investors and partners to our colleagues and clients. We are independent thinkers who go where the research and data take us. And knowing more isn’t the end of the journey, it’s the start of a deeper conversation.

- Speak with Courage and Conviction: Collegial debate yields conviction, so we challenge one another to think differently. Working together enables us to see all sides of an issue. We stand firmly behind our ideas, and we recognize that the world is dynamic. To keep pace with an ever changing world and industry, we constantly reassess our views and share them with intellectual honesty. Above all, we strive to seek and speak truth to our colleagues, clients and others as a trusted voice of reason.

- Act with Integrity—Always: Although our firm is comprised of multiple businesses, disciplines and individuals, we’re united by our commitment to be strong stewards for our people and our clients. Our fiduciary duty and an ethical mind-set are fundamental to the decisions we make.

As of December 31, 2024, AB had $792B in assets under management, $555B of which were ESG-integrated. Additional information about AB may be found on our website, www.alliancebernstein.com.

Learn more about AB’s approach to responsibility here.

More from AllianceBernstein