AllianceBernstein: Water Scarcity Sustainable Investors Address a Growing Scourge

Published 05-09-23

Submitted by AllianceBernstein

Water scarcity is no longer just a problem for developing countries in desert climes. As demand for water solutions grows, equity investors will find opportunities in companies that help quench the thirst of parched communities around the world with innovative solutions.

The world has a serious liquidity problem—and it isn’t on financial markets. About 2 billion people on the planet don’t have access to safe drinking water, while 3.6 billion lack access to safely managed sanitation, according to the World Bank. In recent years, severe water shortages have made global headlines, hitting a growing list of communities from Cape Town, South Africa, to Scottsdale, Arizona. Major infrastructure upgrades and products to alleviate water stress are badly needed.

Growing Thirst for Dwindling Supply

Climate change, population growth and urbanization are intensifying the challenges. “Gaps in access to water supply and sanitation, growing populations, more water-intensive patterns of growth, increasing rainfall variability, and pollution are combining in many places to make water one of the greatest risks to economic progress, poverty eradication and sustainable development,” the World Bank reports.

Across emerging markets, water scarcity is an ever-present scourge. In Somalia, a regional drought led to an estimated 43,000 deaths last year, according to the World Health Organization. In Argentina, a punishing drought is devastating economic growth, with the International Monetary Fund recently lowering its 2023 GDP growth estimate from 2.0% to 0.2%. In Asia, about 1 billion people and $2 trillion of GDP are in areas of high water stress.

In the US, the Colorado River is running at drastically low levels, threatening water supplies to millions of people. The residents of Rio Verde Foothills, Arizona, are a recent casualty of the parched Southwest, as the community was cut off from neighboring Scottsdale’s supply in January.

Businesses also need water. For example, producing semiconductor wafers is very water intensive. Intel’s construction of two semiconductor-manufacturing facilities in Arizona—not far from Rio Verde Foothills—will put even more pressure on dwindling supply.

Meanwhile, in Europe, a dry summer followed by a winter drought has depleted lakes and rivers. Low water levels throttled French nuclear power production (responsible for 70% of the country’s electricity) and Norwegian hydro power output (90% of its electricity). In Germany, the shallow Rhine is disrupting a key shipping route.

Super-Cycle in Water Solutions Spending Ahead

For decades, the world has dramatically underinvested in water infrastructure and technologies, contributing to water scarcity and quality challenges. Developed markets have aging and deteriorating pipeline systems, while emerging markets lack transportation and treatment systems. For example, in the US, annual spending on water infrastructure runs at around $50 billion, but the actual investment needed is north of $100 billion, according to studies by McKinsey and others—a massive gap.

Efforts are under way to close that gap. We believe that investments in water solutions are poised to accelerate substantially in the years ahead. This will be driven by a combination of government programs, increased private capital investment and new innovative technological solutions. US government stimulus for water investments includes $80 billion in the US Infrastructure Investment and Jobs Act of 2021, $20 billion in the Inflation Reduction Act and additional funds for water treatment and recycling in the CHIPS and Science Act.

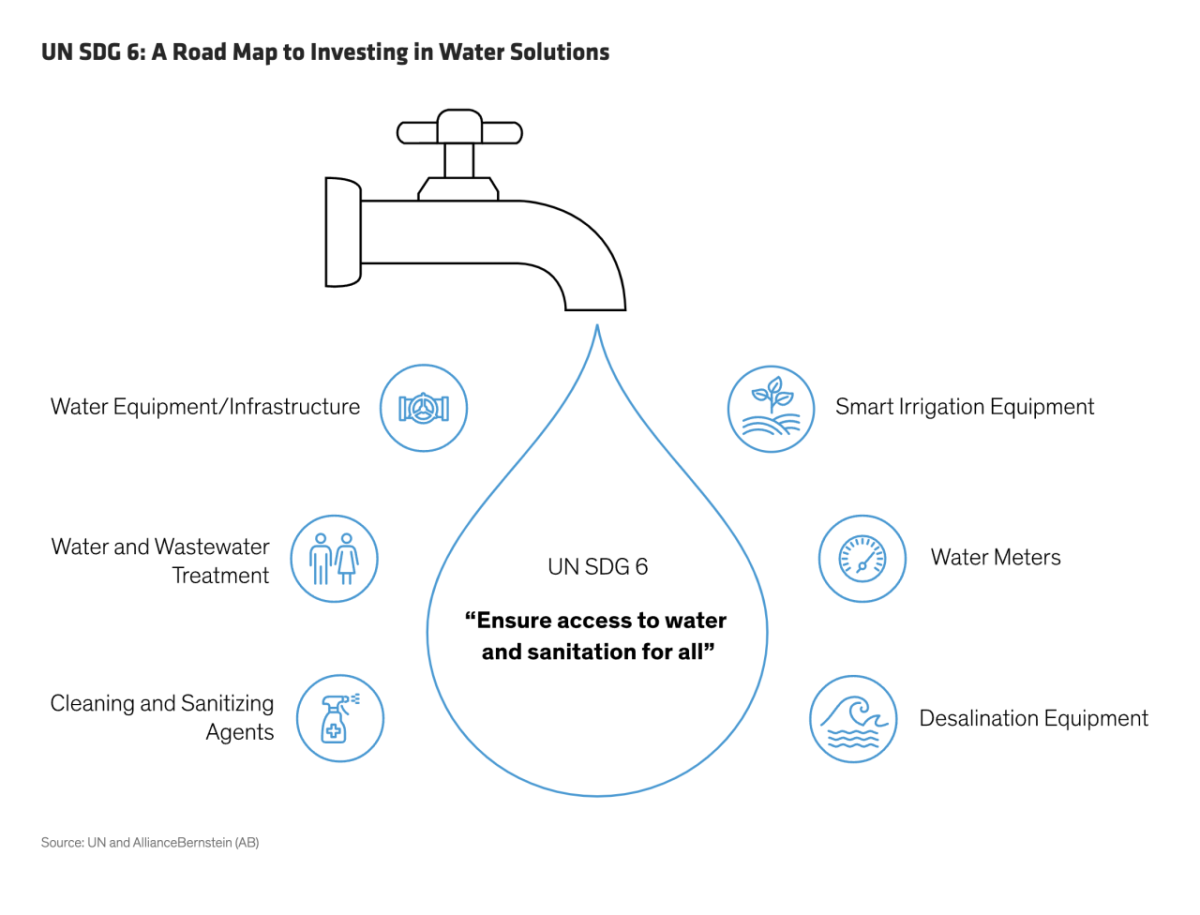

Increasing government support can help address the relatively weak spending to date on pursuing United Nations (UN) Sustainable Development Goal (SDG) 6 (Display). While philanthropy and government spending are important for meeting the SDGs, we believe the private sector—and equity investors—must play a leading role.

Water solutions are needed to address both demand and supply issues. On the demand side, water metering, efficient irrigation systems and precision agriculture technologies can make use of existing water more efficient. On the supply side, wastewater treatment, leak detection and desalination can increase the availability of clean water.

Key Water Solutions: From Wastewater Treatment to Desalination

As changing rainfall patterns threaten fields, farmers need smarter agricultural irrigation machinery. Sprinkler and drip irrigation systems, used for sustaining crop growth and moisture, are benefiting from new technologies that reduce water wastage and improve productivity. With help from government subsidies, supportive policies and innovation, the market is forecast to post a compound annual growth rate (CAGR) of 9.5% through 2030, according to Mordor Intelligence, a market research firm. The US is the fastest-growing market for irrigation machinery. Lindsay, based in Omaha, Nebraska, sells an automated, more efficient irrigation system that saved customers more than 164 billion gallons of water in 2021.

Far from the fields that feed the planet, wastewater is another key component of water sustainability. It may sound repulsive to some, but treating and reusing wastewater—for agriculture, industry and nonpotable applications like street cleaning—is actually a massive opportunity. The UN estimates that 80% of the world’s wastewater isn’t reused, and in many emerging markets, it is released directly into the environment with devastating consequences.

Treating wastewater is a growing business. The global wastewater treatment–equipment market was worth $63.5 billion in 2022 and is projected to grow at a 4.5% CAGR rate through 2030, reports Grand View Research. Some countries are ahead of the curve, including Singapore, where recycled wastewater now supplies 40% of the country’s demand. Israel reuses 90% of its wastewater, meeting a quarter of the country’s water needs in a region that has no rainfall several months each year. Danaher, based in Washington, D.C., manufactures precision instrumentation and advanced purification technology to help analyze, treat and manage drinking water and wastewater treatment facilities.

Hotter deserts and more frequent droughts are diminishing fresh water sources. Desalination technologies are an effective way to boost supply, and they have become much more economic and less energy intensive, thanks to significant improvements in pressure exchangers and reverse osmosis filtration. Massive desalination plants are already common across the Middle East, and new, huge initiatives in countries like India offer hope for a thirsty populace. The desalination market, estimated to be worth $15.5 billion in 2022, is projected to grow by 9.4% annually through 2030.

Some diversified water companies address multiple issues. Xylem, based in Washington, D.C., provides equipment and services for transportation, treatment, testing, efficiency of use, reuse and desalination. With products that increase access to clean drinking water, reduce pollution and combat waterborne diseases, Xylem addresses key issues in both emerging and developed markets.

Keep the Taps Flowing for Growth Potential

What makes for an attractive water solutions company? Like in any industry, leading technology and products can help cement competitive advantages. Products must be extremely reliable, as drinking water, wastewater treatment and agricultural water are critical services, and product safety is paramount. Often, customers prefer to stick with technologies and products over the long term rather than switch providers for short-term cost benefits. As a result, solid business models require tight relationships with customers, from utilities to industrial companies to farmers.

Equity investors will find that water solutions offer attractive growth opportunities in an area that may be overshadowed by higher-profile climate-focused companies. But just like home plumbing is essential for modern life, companies that help keep the world’s taps flowing are integral for a more sustainable future. Investors who can find innovative providers of water solutions will be able to capture long-term growth potential that should withstand economic weakness, while addressing a fundamental problem facing humanity in developed and emerging countries alike.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams and are subject to revision over time.

References to specific securities are presented to illustrate the application of our investment philosophy only and are not to be considered recommendations by AB. The specific securities identified and described do not represent all of the securities purchased, sold or recommended for the portfolio, and it should not be assumed that investments in the securities identified were or will be profitable.

Learn more about AB’s approach to responsibility here.

AllianceBernstein

AllianceBernstein

AllianceBernstein (AB) is a leading global investment management firm that offers diversified investment services to institutional investors, individuals, and private wealth clients in major world markets.

To be effective stewards of our clients’ assets, we strive to invest responsibly—assessing, engaging on and integrating material issues, including environmental, social and governance (ESG) considerations into most of our actively managed strategies (approximately 79% of AB’s actively managed assets under management as of December 31, 2024).

Our purpose—to pursue insight that unlocks opportunity—describes the ethos of our firm. Because we are an active investment manager, differentiated insights drive our ability to design innovative investment solutions and help our clients achieve their investment goals. We became a signatory to the Principles for Responsible Investment (PRI) in 2011. This began our journey to formalize our approach to identifying responsible ways to unlock opportunities for our clients through integrating material ESG factors throughout most of our actively managed equity and fixed-income client accounts, funds and strategies. Material ESG factors are important elements in forming insights and in presenting potential risks and opportunities that can affect the performance of the companies and issuers that we invest in and the portfolios that we build. AB also engages issuers when it believes the engagement is in the best financial interest of its clients.

Our values illustrate the behaviors and actions that create our strong culture and enable us to meet our clients' needs. Each value inspires us to be better:

- Invest in One Another: At AB, there’s no “one size fits all” and no mold to break. We celebrate idiosyncrasy and make sure everyone’s voice is heard. We seek and include talented people with diverse skills, abilities and backgrounds, who expand our thinking. A mosaic of perspectives makes us stronger, helping us to nurture enduring relationships and build actionable solutions.

- Strive for Distinctive Knowledge: Intellectual curiosity is in our DNA. We embrace challenging problems and ask tough questions. We don’t settle for easy answers when we seek to understand the world around us—and that’s what makes us better investors and partners to our colleagues and clients. We are independent thinkers who go where the research and data take us. And knowing more isn’t the end of the journey, it’s the start of a deeper conversation.

- Speak with Courage and Conviction: Collegial debate yields conviction, so we challenge one another to think differently. Working together enables us to see all sides of an issue. We stand firmly behind our ideas, and we recognize that the world is dynamic. To keep pace with an ever changing world and industry, we constantly reassess our views and share them with intellectual honesty. Above all, we strive to seek and speak truth to our colleagues, clients and others as a trusted voice of reason.

- Act with Integrity—Always: Although our firm is comprised of multiple businesses, disciplines and individuals, we’re united by our commitment to be strong stewards for our people and our clients. Our fiduciary duty and an ethical mind-set are fundamental to the decisions we make.

As of December 31, 2024, AB had $792B in assets under management, $555B of which were ESG-integrated. Additional information about AB may be found on our website, www.alliancebernstein.com.

Learn more about AB’s approach to responsibility here.

More from AllianceBernstein