AllianceBernstein: Diversity and Inclusion—an Investor's Handbook

By Diana Lee

Published 03-31-23

Submitted by AllianceBernstein

ESG in Action

Companies are beefing up their DEI initiatives to attract and retain employees amid increasing regulatory requirements. DEI can contribute to an inclusive corporate culture and provide firms with a distinct edge over less-proactive competitors. For investors, the key is knowing which criteria to look for when evaluating companies.

The Issue

A new generation increasingly views DEI initiatives as an imperative, while companies are looking to DEI to gain a competitive edge in employee recruitment and retention—and because it makes good business sense.

The Investment Case

Employee turnover can be costly to a company’s bottom line, while potential new regulatory requirements could make firms that are proactive about DEI safer risks.

Engagement Goals

Companies should consider making DEI initiatives part of their corporate DNA, including buy-in from the highest levels of management and effective tools for measuring corporate engagement.

Managing a workforce has always been vital for business success. In today’s increasingly diverse society, successful people management is critical for companies seeking to retain talent and cultivate positive customer relationships.

In recent years, diversity, equity and inclusion (DEI) policies have taken on added importance in modern work environments. However, DEI is sometimes viewed as a “softer” policy topic that doesn’t factor into investor outcomes.

We think that’s a mistake.

Strong DEI policies can provide companies with a competitive edge, especially in a tight labor market where the fight for talent is fierce and a favorable corporate culture can make a difference in overcoming business hurdles.

Based on our engagement with investment management companies and former DEI executives across many sectors, we’ve mapped out key criteria that investors should look for when evaluating a company’s DEI program. The research presented here is US-centric and should be viewed with an awareness of regional nuance.

Costs of Ignoring Employee Turnover

One of the most compelling reasons for implementing DEI initiatives is from a cost-management perspective. Losing candidates and valuable employees can be expensive and, increasingly, employees are looking to companies that openly embrace DEI initiatives. In fact, according to Glassdoor, 76% of job candidates in 2021 indicated that diversity is a key criterion when evaluating job opportunities.

To the extent that DEI is viewed as a tool to attract and retain a new generation of employees, ignoring it can impose costs in the form of employee turnover, which can hurt the bottom line.

A study in Management Science outlined the costs of employee turnover, including lower productivity in the form of rising field failures in a manufacturing environment. Researchers studied staffing at a major consumer electronics firm, including the component quality of nearly 50 million consumer mobile devices over four years. During the highest-turnover weeks following paydays, field failures—products deemed to be defective—were more than 10% more common than the lowest-turnover weeks preceding paydays. In other weeks, the assembly lines experiencing the highest turnover produced an estimated 2%–3% more field failures, on average. The associated costs amounted to hundreds of millions of US dollars.

Similarly, our research suggests that among global companies that report gender diversity metrics, the top quintile in gender diversity saw their shares outperform lower-scoring companies by about 4% over a three-year period; similar results were seen over slightly longer time frames.

So how do companies get there?

We’ve looked at some of the most successful companies in both retailing and technology and have uncovered some common themes.

DEI Can Become Part of a Company’s DNA

Done right, DEI initiatives and accountability reside in every business unit, function and employee team. One group of employees can’t be accountable for the success of an entire organization on their own. We believe it’s important for the DEI function to be integrated broadly across the entire organization so that it becomes part of a company’s DNA.

To create effective accountability, however, employees must be provided with the resources and management buy-in to execute on DEI initiatives. That means placing high-profile business leaders and managers at the heart of DEI efforts—a far cry from relying solely on Human Resources functions or employee resource groups.

Minneapolis-based retailing giant Target provides an instructive example. To distribute accountability across the organization, each business group at Target has its own approach to DEI, aligned with and driven by the organization’s enterprise strategy. Each group defines its DEI goals, including how they will be executed and who specifically is accountable for the results.

A logistics services company also aligned a DEI initiative with its business objectives by identifying the need to increase its gender diversity and number of women in leadership roles. The firm established a year-end target for at least 30% of all company revenues to come from women-led teams.

Learning and Development Should Be Dynamic

Learning and development is foundational to DEI efforts and should be structured to be adaptive and evolutionary, rather than relegated to a one-off annual exercise. If the company has a distributed business model, training can be structured for relevance to the local markets in which it operates, rather than just the home office location.

Many DEI leaders are going beyond standard unconscious-bias training. For these firms, inclusive leadership is often spelled out as a core competency in job descriptions, assessed in performance reviews and supported at the organization’s highest levels.

One large multinational corporation deployed an inclusion program to help managers understand the impact of their behavior on perceptions of openness among diverse employees, and how they can contribute to fostering a positive company culture by shifting attitudes and behaviors.

Mentoring and Sponsorships Can Go Both Ways

Mentoring and sponsorship programs are also valuable tools for increasing diversity. They include programs aimed at supporting high-potential talent, both for network building and career development.

Sponsors not only provide feedback and counsel but also use their influence with other senior executives to advocate for more junior employees and ensure visibility to key decision-makers. To that end, Nike and T-Mobile have established sponsorship programs aimed at accelerating the career trajectory of women and diverse employees in the workplace.

Mentoring, too, can be effective in developing talent and building bridges across generational, race, ethnic and gender differences. In today’s multi-generational workforce, mentoring can go both ways. Reverse mentoring, which involves junior employees providing counsel, can provide senior leaders with the opportunity to gain a different perspective on their work, which should help improve their decision-making.

AB engaged with health information technology provider IQVIA to better understand its reverse inclusion mentorship program for US employees. The program is designed to help senior leaders (mentees) understand the experiences of Black employees (mentors) in the workplace. These discussions aim to be collaborative and informational, resulting in shared knowledge in a positive, trusting environment.

How to Measure DEI Progress

Regardless of their scope, the best-laid DEI plans need rigorous data analysis to be successful, including tools to measure a company’s progress toward its goals. Here are a few good examples:

- Incorporating Listening Architecture

Many firms are incorporating what’s known as listening architecture as a tool for measuring DEI progress. This involves investing in an end-to-end active listening strategy that can incorporate surveys, polls, focus groups and discussion forums. Companies can communicate the results via broad-based venues such as townhalls, leadership memos and on corporate portals, highlighting specific feedback and ideas from employees.

Exit interviews are another example of listening architecture. These interviews offer a valuable opportunity to receive feedback about a company’s DEI practices. Employees may be willing to offer more actionable information if the interview is conducted by a member of the DEI team. One semiconductor manufacturing company implemented a formal exit interview process that screens for potential DEI concerns and focuses primarily on departing underrepresented minorities and female executives. - Manager Inclusion Playbook

Managers looking to build a more inclusive culture can use an inclusion playbook. The playbook isn’t specific to one topic. It covers the entire employee lifecycle, including recruiting, onboarding, development, compensation, wellness and even assessing personality traits like empathy. The goal is to provide a set of day-to-day actions that can be taken by managers and their reports to incorporate DEI into people practices.

Importantly, the playbook is not just for mid-level managers. Rather, the most influential managers in the company should also be involved, as they often set the tone in establishing culture and employee working conditions. - DEI Analytics and Scorecards

Many companies with DEI programs allocate at least part of their analytics resources toward DEI assessment.

Chip maker NVIDIA has an Insights team focused on collecting employee data from multiple internal nodes, partnering closely with its Human Resources analytics team to identify areas for continued improvement. The company’s business leaders are encouraged to make use of this disaggregated data to drive talent decisions, including those that involve compensation and career advancement.

Assessing diversity efforts can be done using analytics scorecards, which equip managers with meaningful quantitative data. These scorecards allow managers to assess hires, attrition and promotions by race and gender in a digestible manner. It’s more than just a progress report or a high-level summary. Rather, it informs future decisions with data-rich analytics.

While the data is pushed out monthly at a minimum, managers have real-time access to the scorecard at any time. This sample scorecard assesses firm-wide diversity efforts based on a series of inputs, including job title, job satisfaction, tenure and performance.

At Johnson & Johnson, the categories within the people analytics scorecard are assigned green, yellow or red status based on each division’s progress in achieving the strategic DEI priorities the company has established.

DEI Disclosure: More Transparency Needed

Just as employees expect to be informed of their employer’s financials and other operational success measures, DEI metrics should be shared with the broader workforce as well. Transparency can promote trust and buy-in throughout the organization.

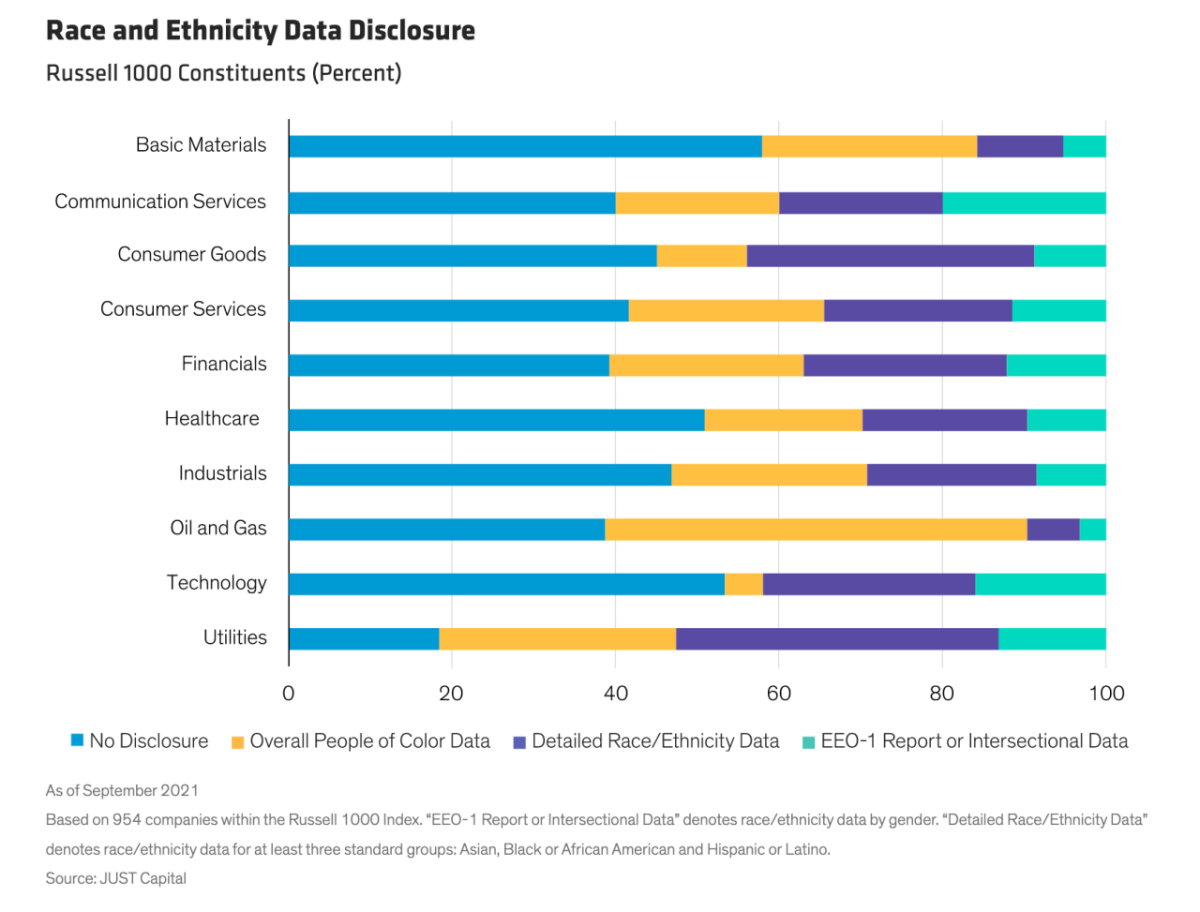

Many companies have established organizational policies that cover harassment, discrimination and codes of conduct, but far fewer have formalized DEI policies. In fact, across nearly every sector of the Russell 1000, more than one-third of firms fail to disclose data around race and ethnicity (Display).

Additionally, as of June 2022, nearly two-thirds of S&P 500 companies disclosed equal employment opportunity data, with an additional 22 companies committed to disclose before year-end. Of these more than 300 firms, 55 had no Black executives, 101 had no Black women executives, and 25 companies had no Asian executives.. Additionally, only 79 Fortune 500 companies published annual DEI reports, and 76% of companies had not established any diversity goals.

Regulatory Requirements Could Be in the Offing

As companies weigh the business and social benefits of DEI policies, there is also a regulatory impetus for action. In 2020, the Securities and Exchange Commission (SEC) amended Regulation S-K by requiring companies to disclose human capital resources, including objectives established in managing the business. Depending on an organization’s interpretation, these human capital resources could theoretically include DEI initiatives. But the SEC has never defined what constitutes human capital, leaving companies to make that decision themselves.

Now, pressure is mounting for the SEC to require companies to disclose DEI initiatives, including gender and diversity workforce data. The scope of DEI filing requirements has not been determined, nor has a firm date been set. But companies should be on notice. According to Kirkland & Ellis LLP, “companies can anticipate that forthcoming rules are likely to include more prescriptive requirements than current SEC rules and will lead to increased oversight and scrutiny.”

We encourage companies to be thoughtful about anticipating potential new disclosure requirements. Those that can get ahead of the SEC reporting requirements could ultimately turn out to be a safer risk for investors.

DEI Makes Good Business Sense

Many companies center their DEI programs around reducing risks, rather than making DEI part of a positive corporate culture that supports business goals. We believe DEI initiatives should be undertaken not to meet regulatory requirements but because they make good business sense. One-off initiatives don’t do much to address systemic issues, so it’s imperative to include DEI as part of a larger strategic plan.

Ultimately, it’s up to each organization to decide how it measures success: where the company is, where it needs to go and how it plans to get there. We believe the interests of companies and investors can be aligned in creating a more effective talent pipeline through DEI initiatives, which takes more than increasing representation across the organization. Understanding what it takes for a DEI program to be effective provides investors with a window on a company’s competitive edge on talent, which leads us to believe that forward-minded investors will embrace DEI as an important factor in assessing risk management and potential investment opportunities.

Kevin Sacks, Proxy and ESG Engagement Associate from AB’s Responsible Investing team, contributed to this analysis.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams. Views are subject to change over time.

AllianceBernstein

AllianceBernstein

AllianceBernstein (AB) is a leading global investment management firm that offers diversified investment services to institutional investors, individuals, and private wealth clients in major world markets.

To be effective stewards of our clients’ assets, we strive to invest responsibly—assessing, engaging on and integrating material issues, including environmental, social and governance (ESG) considerations into most of our actively managed strategies (approximately 79% of AB’s actively managed assets under management as of December 31, 2024).

Our purpose—to pursue insight that unlocks opportunity—describes the ethos of our firm. Because we are an active investment manager, differentiated insights drive our ability to design innovative investment solutions and help our clients achieve their investment goals. We became a signatory to the Principles for Responsible Investment (PRI) in 2011. This began our journey to formalize our approach to identifying responsible ways to unlock opportunities for our clients through integrating material ESG factors throughout most of our actively managed equity and fixed-income client accounts, funds and strategies. Material ESG factors are important elements in forming insights and in presenting potential risks and opportunities that can affect the performance of the companies and issuers that we invest in and the portfolios that we build. AB also engages issuers when it believes the engagement is in the best financial interest of its clients.

Our values illustrate the behaviors and actions that create our strong culture and enable us to meet our clients' needs. Each value inspires us to be better:

- Invest in One Another: At AB, there’s no “one size fits all” and no mold to break. We celebrate idiosyncrasy and make sure everyone’s voice is heard. We seek and include talented people with diverse skills, abilities and backgrounds, who expand our thinking. A mosaic of perspectives makes us stronger, helping us to nurture enduring relationships and build actionable solutions.

- Strive for Distinctive Knowledge: Intellectual curiosity is in our DNA. We embrace challenging problems and ask tough questions. We don’t settle for easy answers when we seek to understand the world around us—and that’s what makes us better investors and partners to our colleagues and clients. We are independent thinkers who go where the research and data take us. And knowing more isn’t the end of the journey, it’s the start of a deeper conversation.

- Speak with Courage and Conviction: Collegial debate yields conviction, so we challenge one another to think differently. Working together enables us to see all sides of an issue. We stand firmly behind our ideas, and we recognize that the world is dynamic. To keep pace with an ever changing world and industry, we constantly reassess our views and share them with intellectual honesty. Above all, we strive to seek and speak truth to our colleagues, clients and others as a trusted voice of reason.

- Act with Integrity—Always: Although our firm is comprised of multiple businesses, disciplines and individuals, we’re united by our commitment to be strong stewards for our people and our clients. Our fiduciary duty and an ethical mind-set are fundamental to the decisions we make.

As of December 31, 2024, AB had $792B in assets under management, $555B of which were ESG-integrated. Additional information about AB may be found on our website, www.alliancebernstein.com.

Learn more about AB’s approach to responsibility here.

More from AllianceBernstein