AllianceBernstein: How Impactful Are Your Munis? Five Questions To Ask Your Manager.

By Marc Uy

Published 12-19-22

Submitted by AllianceBernstein

You want to make a difference where it matters, like social or environmental conditions or both, by deploying capital to communities that need it. Impact investing is one way.

Muni managers may bill themselves as impact investors. But their approaches could be other forms of ESG investing in disguise—some just greenwashing or social washing—or they don’t have the roadmap, experience and resources to meet your impact goals. We’ve developed a list of five hard-hitting questions to help sort the wheat from the chaff.

1. What’s your approach to ESG investing in the municipal bond market?

Their answer may include integration, screening or a little of both. They’re valid approaches, but each takes a different ESG tack compared to impact investing. ESG integration assesses ESG factors for every holding to gauge risk and return potential more accurately across portfolios. ESG screening weeds out issuers that investors want to avoid, such as tobacco, gambling or oil.

However, if your objective is to go beyond just a financial return through the evaluation of additional risk factors and negative screens, the best answer is impact investing.

2. What’s your definition of impact investing?

Be wary of loose-fitting responses, such as defining an impact investment based only on investing in muni sectors that benefit society at large. Such answers don’t pinpoint meaningful impact, and any definition should be more specific.

Instead, look for exactly how the proceeds from their investments are used to promote social and environmental progress through programs or projects with a specific purpose and result in mind. Intentionality is key and is equal parts philosophy and investment discipline. Making an impact is not about investing in just any school bond, but rather in school districts that are addressing root-cause issues. These include schools that provide students with wraparound access to mental health services, medical and dental care, and access to nutritious food, as well as safe playgrounds and community centers.

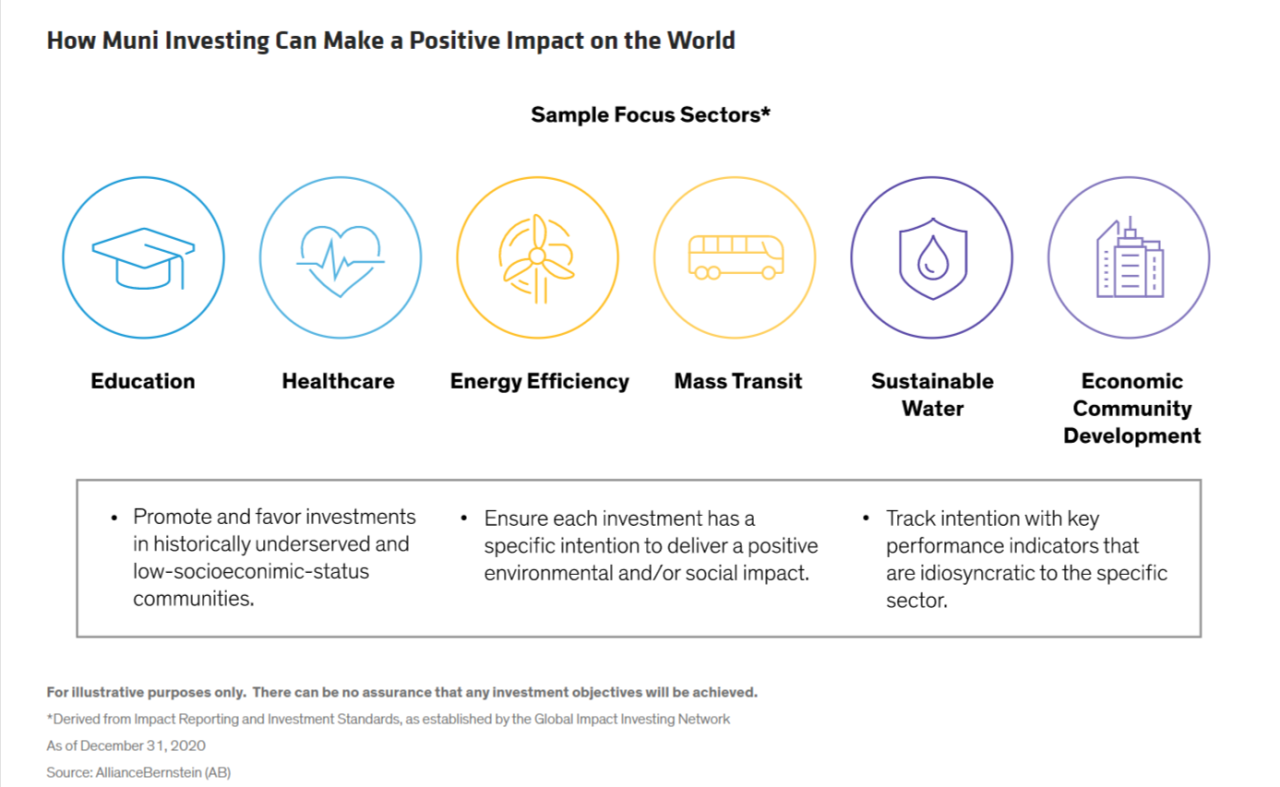

Intentional doesn’t mean overly constrained to one form of impact either, because different types of muni issuers underwrite a variety of projects intended to reduce certain societal disparities specific to their core purpose (Display).

3. How do you choose where to focus impact investments?

A manager may tell you that screening out certain sectors (alcohol, fossil fuels, firearms) is what guides their impact path. But subjective exclusions like these aren’t impact investing. Instead, impact investing works through measures of inclusion—it’s for something, rather than in opposition only.

Find out the manager’s parameters around what qualifies for inclusion in their impact investment universe. It’s one thing to be environmentally, socially and financially productive. But you’d have more impact by focusing on historically marginalized communities—even more so if the goal is to shrink gaps in areas like academic achievement, clean water, economic development and healthcare.

Then, look for clearly stated core measures of inclusion. A manager should set minimum thresholds that issuers need to meet in each sector, so they know they’re targeting communities most in need. For example, a threshold for education bonds could require at least 60% of students in the system to be receiving free and reduced priced meals. Likewise, hospital issuers would need to show at least 20% of their gross revenues coming from Medicaid patients and charity care. And the universe could be narrowed from there, based on local demographics and needs.

4. How do you know you’re making a true impact?

Measuring actual impact is hard work, because data isn’t standardized. So be wary of managers who claim it’s a simple process or defined with broad parameters. Instead, managers should identify key performance indicators specific to each impact bond’s sector, then measure the issuer’s progress toward such goals.

In mass transit, for instance, trends in greenhouse gas emissions, mechanical failures and low-income ridership really matter to a community’s progress. Improve these factors and you’re working toward making a true impact.

5. Beyond research, what other resources do you leverage for impact investing?

It’s very important to constantly apply the basic principles of municipal investing: staying well-diversified and conducting thorough quantitative and fundamental research. Technology is also supportive, especially in today’s highly fragmented muni market in which the faster you navigate, the better your alpha generation or tax-loss harvesting.

When it comes to impact investing, don’t let your manager coast on reputation. Expect thoughtfulness and experience, which can make all the difference between greenwashing and meaningfully uplifting under-resourced communities.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams. Views are subject to change over time.

Learn more about AB’s approach to responsibility here

AllianceBernstein

AllianceBernstein

AllianceBernstein (AB) is a leading global investment management firm that offers diversified investment services to institutional investors, individuals, and private wealth clients in major world markets.

To be effective stewards of our clients’ assets, we strive to invest responsibly—assessing, engaging on and integrating material issues, including environmental, social and governance (ESG) considerations into most of our actively managed strategies (approximately 79% of AB’s actively managed assets under management as of December 31, 2024).

Our purpose—to pursue insight that unlocks opportunity—describes the ethos of our firm. Because we are an active investment manager, differentiated insights drive our ability to design innovative investment solutions and help our clients achieve their investment goals. We became a signatory to the Principles for Responsible Investment (PRI) in 2011. This began our journey to formalize our approach to identifying responsible ways to unlock opportunities for our clients through integrating material ESG factors throughout most of our actively managed equity and fixed-income client accounts, funds and strategies. Material ESG factors are important elements in forming insights and in presenting potential risks and opportunities that can affect the performance of the companies and issuers that we invest in and the portfolios that we build. AB also engages issuers when it believes the engagement is in the best financial interest of its clients.

Our values illustrate the behaviors and actions that create our strong culture and enable us to meet our clients' needs. Each value inspires us to be better:

- Invest in One Another: At AB, there’s no “one size fits all” and no mold to break. We celebrate idiosyncrasy and make sure everyone’s voice is heard. We seek and include talented people with diverse skills, abilities and backgrounds, who expand our thinking. A mosaic of perspectives makes us stronger, helping us to nurture enduring relationships and build actionable solutions.

- Strive for Distinctive Knowledge: Intellectual curiosity is in our DNA. We embrace challenging problems and ask tough questions. We don’t settle for easy answers when we seek to understand the world around us—and that’s what makes us better investors and partners to our colleagues and clients. We are independent thinkers who go where the research and data take us. And knowing more isn’t the end of the journey, it’s the start of a deeper conversation.

- Speak with Courage and Conviction: Collegial debate yields conviction, so we challenge one another to think differently. Working together enables us to see all sides of an issue. We stand firmly behind our ideas, and we recognize that the world is dynamic. To keep pace with an ever changing world and industry, we constantly reassess our views and share them with intellectual honesty. Above all, we strive to seek and speak truth to our colleagues, clients and others as a trusted voice of reason.

- Act with Integrity—Always: Although our firm is comprised of multiple businesses, disciplines and individuals, we’re united by our commitment to be strong stewards for our people and our clients. Our fiduciary duty and an ethical mind-set are fundamental to the decisions we make.

As of December 31, 2024, AB had $792B in assets under management, $555B of which were ESG-integrated. Additional information about AB may be found on our website, www.alliancebernstein.com.

Learn more about AB’s approach to responsibility here.

More from AllianceBernstein