AllianceBernstein: Can Multi-Asset Approaches Balance Sustainable Investing Risks?

Published 11-14-22

Submitted by AllianceBernstein

Investors who opt for a sustainable approach are aligning themselves with some of the world’s most powerful growth trends. But this can also inhibit diversification. Applying multi-asset perspectives can address these problems by balancing portfolio risks to improve risk-adjusted return potential.

Sustainable investing approaches aim to deliver attractive returns through investments in issuers that contribute to positive social and environmental outcomes. Yet this massive opportunity can also create risks, because there is a smaller pool of sustainable investment targets to choose from. The backbone of these approaches is implementing a repeatable process for selecting issuers that are aligned with sustainability goals and also have solid business models with strong return potential.

Consistency Matters When Sourcing Sustainability

That’s not so easy to do in a multi-asset portfolio. It’s hard to apply a consistent framework between different asset classes. But today, innovations are emerging that make multi-asset approaches more appealing.

These innovations are particularly important for investors with lower risk tolerances or those who seek a more balanced investment journey. Although equity approaches offer the most attractive long-term return potential, they can be prone to significant short-term volatility and drawdowns, as we’ve seen this year. Fixed-income and multi-asset approaches allow investors to access a wider range of sustainable investments and offer more diversification benefits.

More Levers to Reduce Volatility

Multi-asset portfolios have access to additional levers to balance portfolio risks and reduce volatility—especially in a sustainable universe.

The most obvious benefit is the ability to access a wider range of asset classes within a single portfolio. Multi-asset managers can combine equities and fixed income, and integrate exposure to nontraditional assets like real estate and infrastructure. For example, ESG-labelled bond issuances are booming, including green bonds that enable proceeds to be invested directly into sustainable projects. Within nontraditional assets, investors can increasingly access sustainable investments in digital infrastructure or in renewable power generation. These different exposures all enhance diversification in companies that contribute to positive environmental and social outcomes.

Maintaining balance rules out the use of too much ballast outside equities. For instance, in a multi-asset context, increasing the weights of lower-risk but lower-return asset classes such as bonds and cash to reduce equity volatility could undermine returns.

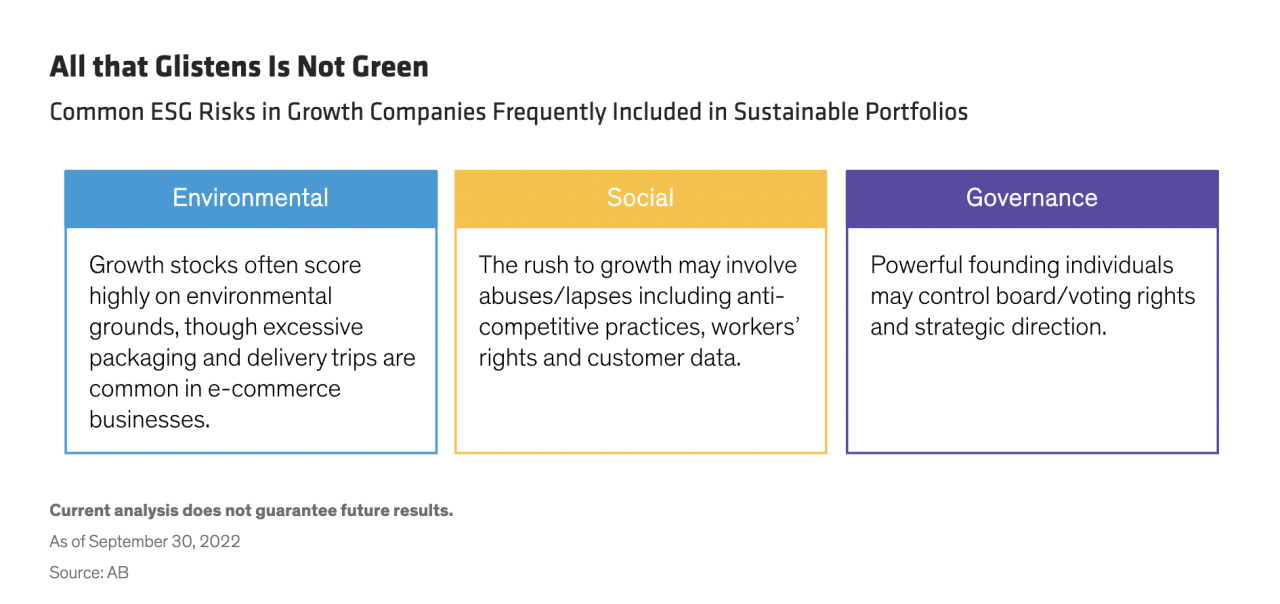

At the same time, maintaining high return potential and sustainability standards requires more than just a quant screen. Both warrant appraising companies individually by pairing fundamental and quantitative analysis, especially as ESG lapses are common in newer innovative fast-growing companies (See Figure 1).

Diversification in multi-asset portfolios also extends beyond simple asset class exposures. Within equities, for example, we can create positions across a broad range of investment styles to help deliver more balanced outcomes for investors.

Traditional diversification tactics won’t necessarily do the job. For example, rebalancing across a wider range of stocks isn’t a complete solution to address style bias in an equity segment of a sustainable portfolio. A sustainable multi-asset approach must be more nuanced because there are more issues to consider. Specifically, while aiming for lower volatility, it’s crucial to maintain both robust long-term return potential and strong sustainability credentials. And security selection across a wider mix of names must be driven by high quality fundamental and quantitative research to support both performance and sustainability alignment.

Correcting Biases in Sustainable Approaches

Finding companies with strong sustainability credentials requires a clear roadmap. We believe that the UN Sustainable Development Goals (SDGs), which are backing projects worth between US$5 trillion and US$7 trillion per year through 2030, provides a good framework for sustainable investors.

When constructed with a disciplined stock-selection approach, active equity portfolios that are aligned with the SDGs can capture strong long-term return potential. But they often have an intrinsic style bias toward growth stocks, according to Morningstar data. Growth stocks are more sensitive to changes in interest rates than other types of stocks. This is less of a problem in falling or low-interest-rate environments, or for investors with longer investment horizons or higher risk tolerance. But this year, rising rates have disproportionately hurt the performance of many sustainable equity funds.

For investors seeking more balanced exposure to sustainability opportunities, we believe a two-stage approach for the global equity component of a multi-asset strategy can be effective. First allocate to a concentrated, high quality sustainable equity growth portfolio. Then, allocate to a custom completion portfolio to balance the first and create a less growth-biased total equity mix.

Sourcing a complementary active equity strategy that focuses on mature, high quality companies with lower volatility characteristics, can help counter some common biases in sustainable equity portfolios. And by integrating a uniform and strict sustainability framework, it’s possible to create a less volatile and more balanced global equity allocation. We believe this approach can generate similar returns to a standard global equity growth portfolio—but with much less volatility.

Choosing the Right Approach

Both a concentrated active equity portfolio and a well-structured multi-asset approach can offer powerful sustainable solutions. The appropriate choice depends principally on an investor’s risk tolerance and time horizon. While a growth equity solution may offer higher returns over the long-term, the first half of 2022 provides a cautionary tale: against the backdrop of rising rates, global equity growth solutions suffered steep losses and sharp volatility.

Balanced by a broader mix of global equity components, we believe a multi-asset approach can help reduce drawdown risk in market downturns. When applied with consistency across asset classes, we believe this strategy can be particularly appealing to investors with shorter time horizons and lower risk tolerances seeking an innovative route to invest in sustainable businesses.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams. Views are subject to change over time.

About the Authors

David Hutchins, FIA

David Hutchins is a Senior Vice President and Head of AB's Multi-Asset Solutions business in EMEA. He is responsible for the development and management of multi-asset portfolios for a range of clients. Hutchins joined the firm in 2008 after spending two years at UBS Investment Bank, where he was responsible for devising and delivering innovative capital markets risk-management solutions for pension schemes. Prior to that, he spent 13 years at Mercer, where he served as a European principal and scheme actuary, providing trustee and corporate advice to a range of UK pension funds and their sponsors. Hutchins holds a BSc in mathematics and a PGCE from the University of Bristol. He has chaired the Investment Management Association's Defined Contribution Committee and formerly chaired the defined contribution industry working group for the UK government's "defined ambition" project. Hutchins is a Fellow of the Institute and Faculty of Actuaries. Location: London

Henry Smith, CFA

Henry Smith is a Vice President and Product Manager on AB's Multi-Asset Solutions team. He is responsible for the product strategy and communication of AB's UK defined contribution, custom multi-asset and sustainable multi-asset solutions. Smith joined the firm in 2019, following more than two years at Lane Clark & Peacock, where he provided investment, research and governance advice to a range of UK defined contribution pension schemes. Before that, he worked at Capita Employee Solutions, where he advised both UK defined contribution and defined benefit pension schemes. Smith holds a BSc in financial economics from the University of Essex and is a CFA charterholder. Location: London

Learn more about AB’s approach to responsibility here.

AllianceBernstein

AllianceBernstein

AllianceBernstein (AB) is a leading global investment management firm that offers diversified investment services to institutional investors, individuals, and private wealth clients in major world markets.

To be effective stewards of our clients’ assets, we strive to invest responsibly—assessing, engaging on and integrating material issues, including environmental, social and governance (ESG) considerations into most of our actively managed strategies (approximately 79% of AB’s actively managed assets under management as of December 31, 2024).

Our purpose—to pursue insight that unlocks opportunity—describes the ethos of our firm. Because we are an active investment manager, differentiated insights drive our ability to design innovative investment solutions and help our clients achieve their investment goals. We became a signatory to the Principles for Responsible Investment (PRI) in 2011. This began our journey to formalize our approach to identifying responsible ways to unlock opportunities for our clients through integrating material ESG factors throughout most of our actively managed equity and fixed-income client accounts, funds and strategies. Material ESG factors are important elements in forming insights and in presenting potential risks and opportunities that can affect the performance of the companies and issuers that we invest in and the portfolios that we build. AB also engages issuers when it believes the engagement is in the best financial interest of its clients.

Our values illustrate the behaviors and actions that create our strong culture and enable us to meet our clients' needs. Each value inspires us to be better:

- Invest in One Another: At AB, there’s no “one size fits all” and no mold to break. We celebrate idiosyncrasy and make sure everyone’s voice is heard. We seek and include talented people with diverse skills, abilities and backgrounds, who expand our thinking. A mosaic of perspectives makes us stronger, helping us to nurture enduring relationships and build actionable solutions.

- Strive for Distinctive Knowledge: Intellectual curiosity is in our DNA. We embrace challenging problems and ask tough questions. We don’t settle for easy answers when we seek to understand the world around us—and that’s what makes us better investors and partners to our colleagues and clients. We are independent thinkers who go where the research and data take us. And knowing more isn’t the end of the journey, it’s the start of a deeper conversation.

- Speak with Courage and Conviction: Collegial debate yields conviction, so we challenge one another to think differently. Working together enables us to see all sides of an issue. We stand firmly behind our ideas, and we recognize that the world is dynamic. To keep pace with an ever changing world and industry, we constantly reassess our views and share them with intellectual honesty. Above all, we strive to seek and speak truth to our colleagues, clients and others as a trusted voice of reason.

- Act with Integrity—Always: Although our firm is comprised of multiple businesses, disciplines and individuals, we’re united by our commitment to be strong stewards for our people and our clients. Our fiduciary duty and an ethical mind-set are fundamental to the decisions we make.

As of December 31, 2024, AB had $792B in assets under management, $555B of which were ESG-integrated. Additional information about AB may be found on our website, www.alliancebernstein.com.

Learn more about AB’s approach to responsibility here.

More from AllianceBernstein