AB: Understanding Green Bond Performance in Market Setbacks

Published 10-03-22

Submitted by AllianceBernstein

Green bonds have gained a reputation for providing better downside mitigation than their conventional peers. But in this year’s market downturn, green bonds’ defensive performance patterns were mixed. What does this mean for investors?

We believe that the greater performance dispersion we’ve seen so far in 2022 makes a strong case for an active approach to investing in green bonds. With so many green bonds outstanding today, investors need sharper insights to help differentiate among them and to better understand each bond’s performance characteristics.

Getting a Grip on the Greenium

Green bonds have typically been more highly valued than their conventional counterparts, and consequently have generally traded at somewhat higher prices and lower yields. Expressed differently, a green bond typically exhibits a negative yield premium to conventional peers, also known as a “greenium.” When a green bond’s greenium gets bigger (negative yield premium becomes more negative), it outperforms comparable conventional bonds. So growth of the greenium is positive for a green bond’s performance.

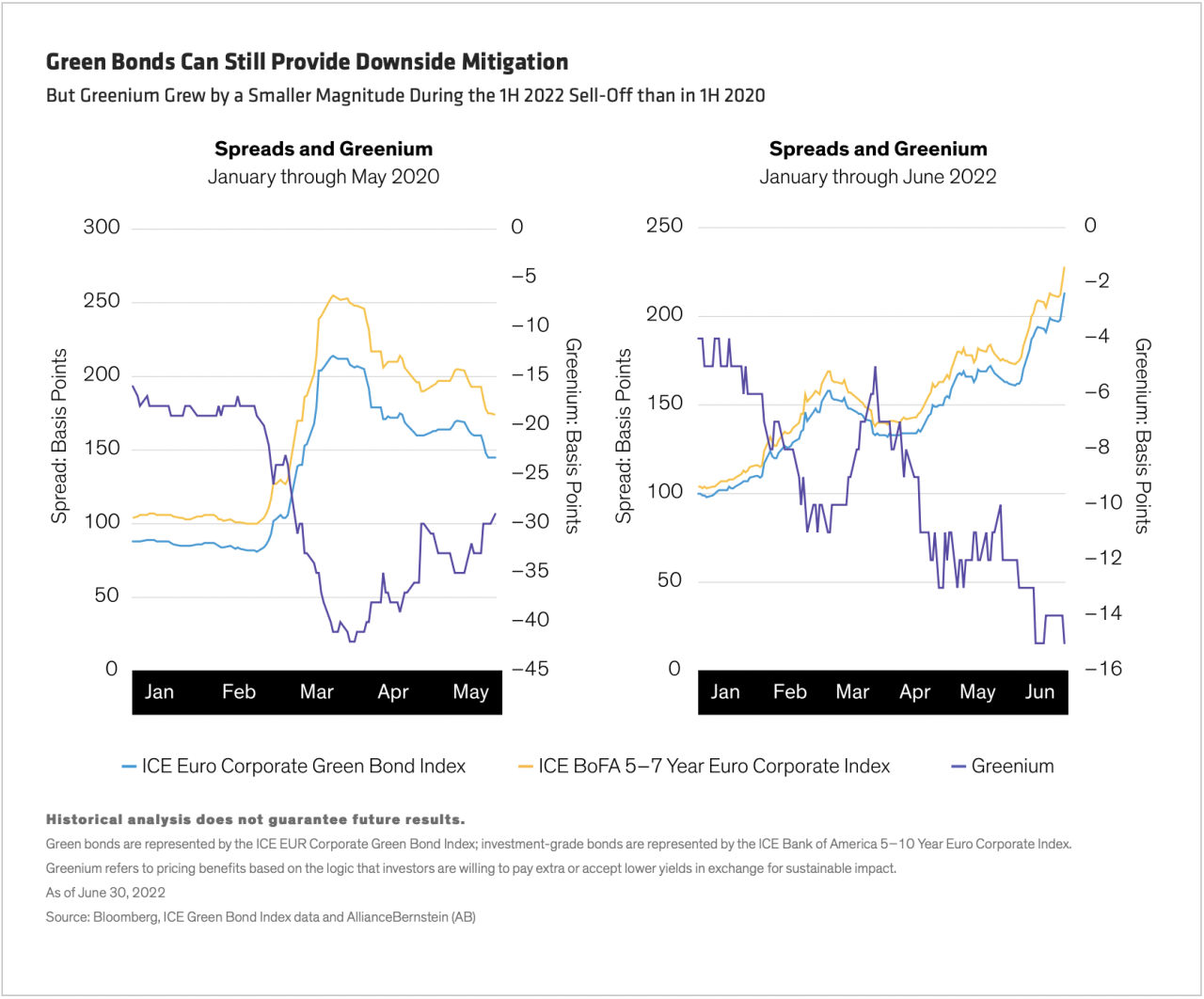

While in the 2020 risk-off period greeniums grew in lockstep, in 2022 greeniums moved to a lesser extent (Display) and with greater dispersion—and in a minority of cases, green bonds didn’t outperform at all.

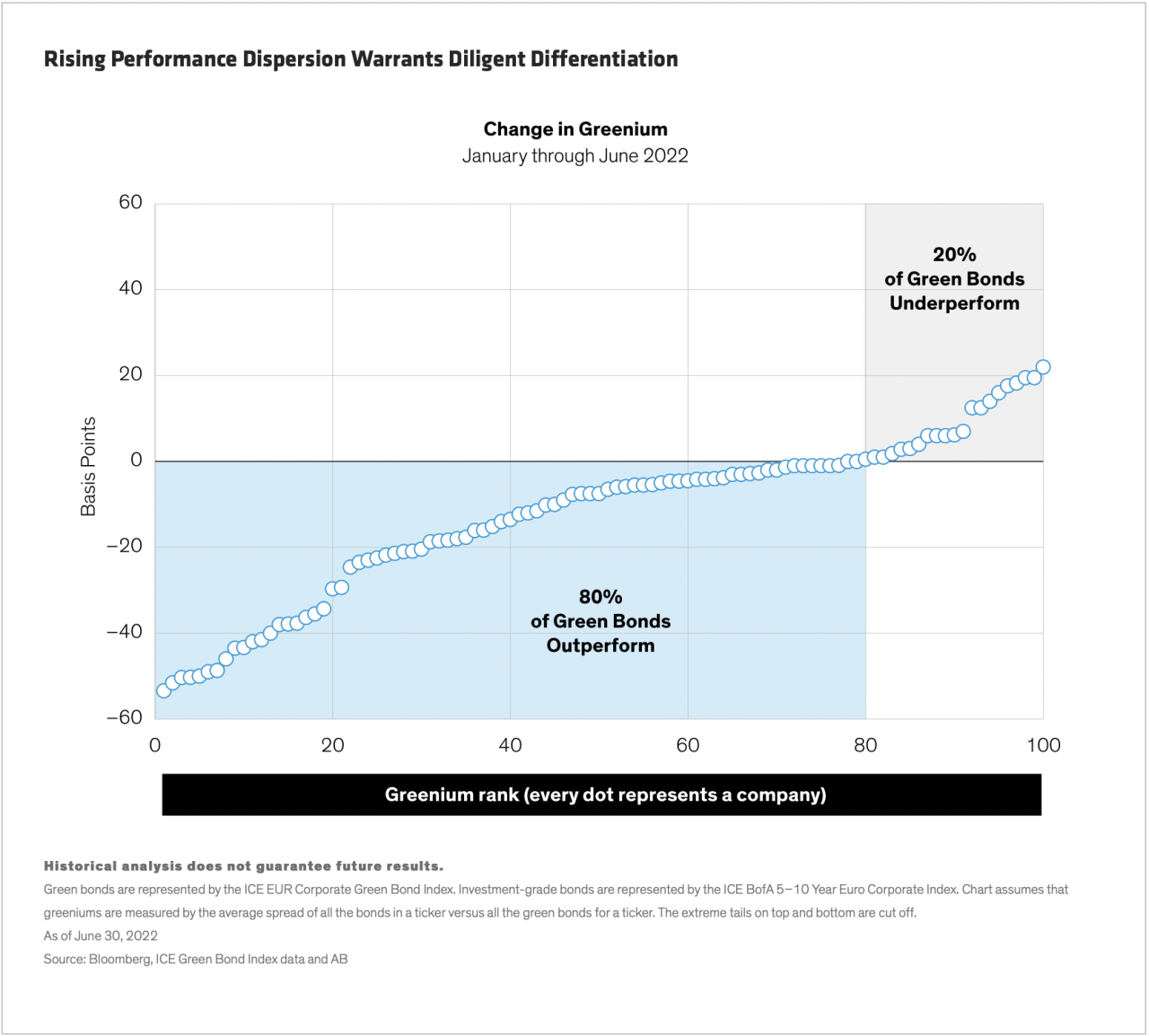

Market data across 100 representative euro-denominated corporate bonds show significant dispersion in performance across green bonds in the year to date. Although 80% of issuers saw their greeniums become more negative in the first half of the year (thus outperforming their conventional counterparts), 20% didn’t, and so displayed no favorable downside mitigation characteristics (Display).

What’s more, of the 80% of green bonds that saw their greenium increase, the magnitude of the changes differed materially, ranging from a few basis points (modest downside mitigation) to half a percentage point (strong downside mitigation). This market behavior makes a compelling argument for an active approach to green bond investing and reinforces the idea that not all green bonds should be regarded as equal. (In fact, we recently set out a ;comprehensive framework to analyze green bonds ;and other ESG-labeled structures.)

Bond Market Changes Drive More Differentiated Performance

Does that mean that green bonds’ defensive characteristics are eroding? Not necessarily. We think that green bonds can still offer favorable risk-mitigating characteristics relative to their conventional peers, but investors need to allow for several changes in bond markets that result from the increasing popularity of responsible investing. Although these will likely impact the size of the greenium, they are also helping to create a larger, broader universe of green bonds.

- Increased Issuance. Green investing is moving into the mainstream. As the market matures, we have seen a significant increase in green bond issuance resulting in less scarcity value being assigned to some of these bonds, creating a more balanced dynamic between supply and demand.

- Wider Sector Representation. Higher issuance has also led to green bonds being issued across a wider range of sectors. Accordingly, the composition of the green bond universe has also changed over time: more skewed to cyclical sectors, less skewed to more stable sectors like utilities. This may have resulted in a higher sensitivity to changes in the growth environment in the first half of 2022 than during the first half of 2020.

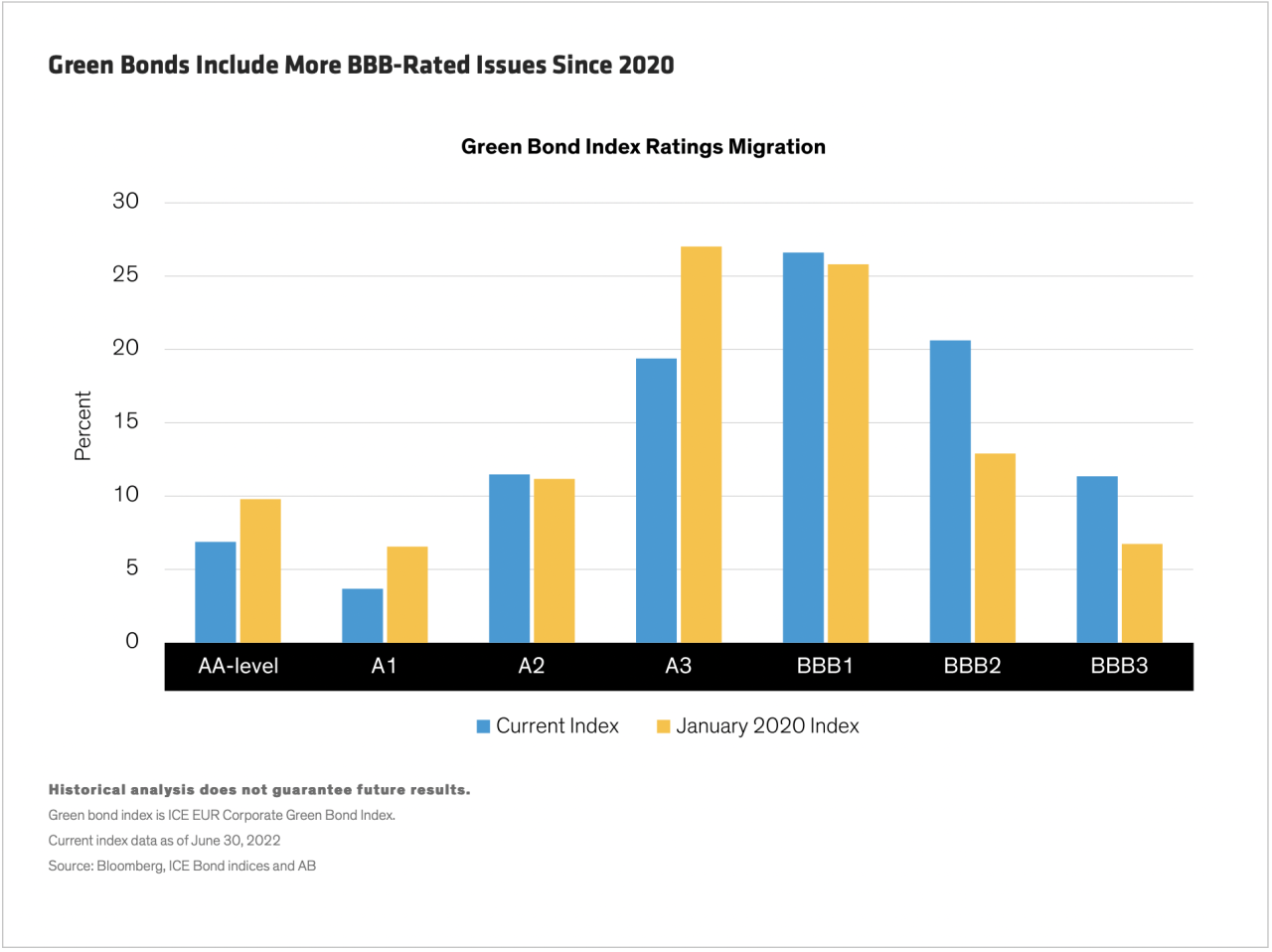

- Lower Average Ratings. Increased issuance has created greater depth and diversity in the green bond market, not only across sectors but also across quality tiers. This has resulted in a lower average rating for green bonds (Display) and consequently higher credit sensitivity. This may have contributed to a decrease in the resilience of green bonds overall during risk-off periods in 2022.

- Wider Investor Base. Investor demand has changed too. The buyer base has expanded for green bond structures, and demand is consequently no longer driven solely by investors with longer-term horizons, such as institutions. More investors are embracing responsible investing and responding to changes in the regulatory environment, such as in the context of the EU’s Sustainable Finance Disclosure Regulation (SFDR).

Over time we would expect investors to become less willing to pay a greenium for weaker structures, particularly where the use of proceeds is only loosely linked to eligible green projects, or where the issuer and its industry could be more susceptible to greenwashing allegations. Conversely, strong issues should be more likely to continue to attract a buyer base willing to pay a greenium for quality bonds. These include, for instance, green bonds that have full EU taxonomy alignment and whose issuer has very strong sustainability credentials.

We think that investors can still find green bonds with defensive characteristics. But we’ve also observed that the breadth and depth of the green bond market has significantly increased. That means investors need to differentiate more rigorously between green bond structures, based on careful evaluation of the characteristics of each individual issue.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams. Views are subject to change over time.

View the original content here.

AllianceBernstein

AllianceBernstein

AllianceBernstein (AB) is a leading global investment management firm that offers diversified investment services to institutional investors, individuals, and private wealth clients in major world markets.

To be effective stewards of our clients’ assets, we strive to invest responsibly—assessing, engaging on and integrating material issues, including environmental, social and governance (ESG) considerations into most of our actively managed strategies (approximately 79% of AB’s actively managed assets under management as of December 31, 2024).

Our purpose—to pursue insight that unlocks opportunity—describes the ethos of our firm. Because we are an active investment manager, differentiated insights drive our ability to design innovative investment solutions and help our clients achieve their investment goals. We became a signatory to the Principles for Responsible Investment (PRI) in 2011. This began our journey to formalize our approach to identifying responsible ways to unlock opportunities for our clients through integrating material ESG factors throughout most of our actively managed equity and fixed-income client accounts, funds and strategies. Material ESG factors are important elements in forming insights and in presenting potential risks and opportunities that can affect the performance of the companies and issuers that we invest in and the portfolios that we build. AB also engages issuers when it believes the engagement is in the best financial interest of its clients.

Our values illustrate the behaviors and actions that create our strong culture and enable us to meet our clients' needs. Each value inspires us to be better:

- Invest in One Another: At AB, there’s no “one size fits all” and no mold to break. We celebrate idiosyncrasy and make sure everyone’s voice is heard. We seek and include talented people with diverse skills, abilities and backgrounds, who expand our thinking. A mosaic of perspectives makes us stronger, helping us to nurture enduring relationships and build actionable solutions.

- Strive for Distinctive Knowledge: Intellectual curiosity is in our DNA. We embrace challenging problems and ask tough questions. We don’t settle for easy answers when we seek to understand the world around us—and that’s what makes us better investors and partners to our colleagues and clients. We are independent thinkers who go where the research and data take us. And knowing more isn’t the end of the journey, it’s the start of a deeper conversation.

- Speak with Courage and Conviction: Collegial debate yields conviction, so we challenge one another to think differently. Working together enables us to see all sides of an issue. We stand firmly behind our ideas, and we recognize that the world is dynamic. To keep pace with an ever changing world and industry, we constantly reassess our views and share them with intellectual honesty. Above all, we strive to seek and speak truth to our colleagues, clients and others as a trusted voice of reason.

- Act with Integrity—Always: Although our firm is comprised of multiple businesses, disciplines and individuals, we’re united by our commitment to be strong stewards for our people and our clients. Our fiduciary duty and an ethical mind-set are fundamental to the decisions we make.

As of December 31, 2024, AB had $792B in assets under management, $555B of which were ESG-integrated. Additional information about AB may be found on our website, www.alliancebernstein.com.

Learn more about AB’s approach to responsibility here.

More from AllianceBernstein