KKR 2021 Sustainability Report: Global Ambitions

Building on over a decade of work with portfolio companies, we seek to scale our ambitions for ESG performance.

Published 09-19-22

Submitted by KKR

Since formalizing our approach to ESG management in 2008, we have focused on supporting our companies' efforts on their business-relevant topics. We have also recognized that companies across sectors generally have responsibilities when it comes to managing a core set of issues, including climate, human capital, and data responsibility. In each area, we have aimed to pioneer value creation strategies to share best practices around energy efficiency and reduced resource use; workforce engagement; diversity, equity, and inclusion (DEI); and responsible data governance.

Learn more about our expertise and value creation in Driving Value Creation.

Last year, building on this decade of learnings, we devel- oped a set of Global Ambitions with the goal of inspiring strong performance across four focus areas, including management and governance, which are sector-agnostic and broadly applicable to our investments going forward. These ambitions reflect areas where we believe we can help mitigate ESG-related risks and capture value creation opportunities, particularly in our private markets funds.

OUR AMBITION IS THAT, WITH KKR’S SUPPORT, MAJORITY-OWNED COMPANIES IN OUR PORTFOLIO WILL ALIGN WITH THESE OVERARCHING AMBITIONS GOING FORWARD:

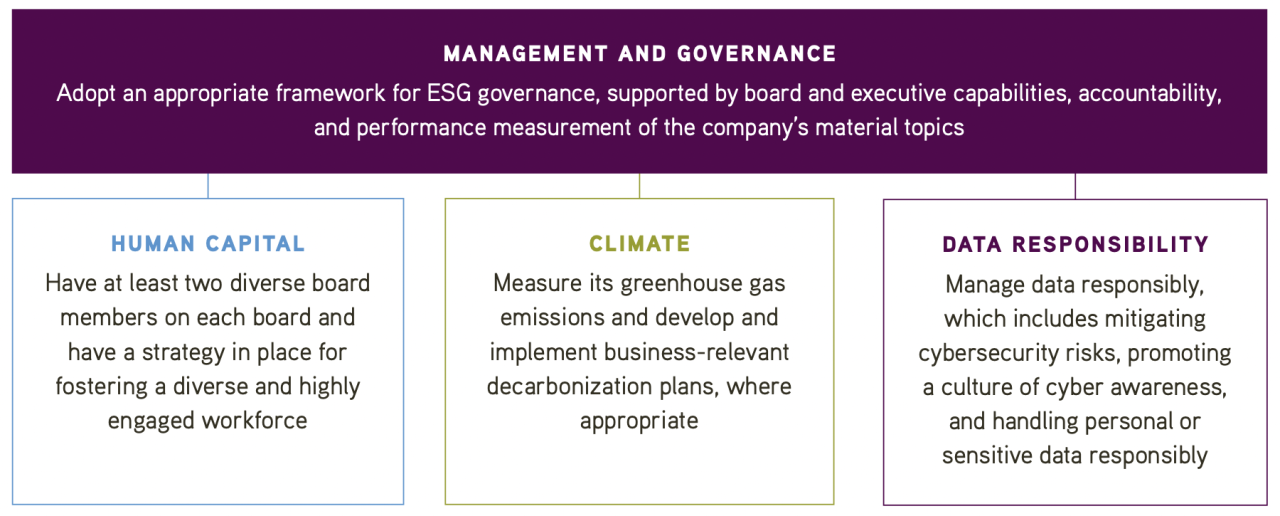

MANAGEMENT AND GOVERNANCE

Adopt an appropriate framework for ESG governance, supported by board and executive capabilities, accountability, and performance measurement of the company’s material topics

- HUMAN CAPITAL

Have at least two diverse board members on each board and have a strategy in place for fostering a diverse and highly engaged workforce - CLIMATE

Measure its greenhouse gas emissions and develop and implement business-relevant decarbonization plans, where appropriate - DATA RESPONSIBILITY

Manage data responsibly, which includes mitigating cybersecurity risks, promoting a culture of cyber awareness, and handling personal or sensitive data responsibly

Each area of the Global Ambitions includes a set of goals for investments going forward that differ by asset class but are meant to support our companies in achieving the ambitions outlined above. For example, our climate ambitions for the majority-owned companies in certain of our funds include:

- Integrating climate-related risks and opportunities into investment decision-making and portfolio management practices. This includes considering climate change risks and opportunities during diligence and engag- ing on these issues with the companies in which KKR invests or to which KKR provides financing

- Reporting on climate-related activities to fund investors annually, including seeking to provide information on Scope 1 and 2 emissions and certain Scope 3 emissions data, and describing the steps taken by portfolio companies in developing and implementing decarbonization plans, where relevant and available

- Where we are a minority investor, implementing a stewardship and engagement strategy consistent with the greenhouse gas (GHG) measurement and decarbonization ambitions described above

We are working to develop asset class-specific objectives and action plans and have begun deploying tools and guidance for deal teams and portfolio companies to start acting on these priority issues where they have not already.

"KKR's Global Ambitions build on over a decade of lessons learned from our work with portfolio companies and reflect our approach to managing ESG risks and opportunities for long-term value creation."

Ken Mehlman | Global Head of Public Affairs and Co-Head of KKR Global Impact (New York)

Read the full 2021 Sustainability Report.

KKR

KKR

KKR is a leading global investment firm that offers alternative asset management as well as capital markets and insurance solutions. KKR aims to generate attractive investment returns by following a patient and disciplined investment approach, employing world-class people, and supporting growth in its portfolio companies and communities. KKR sponsors investment funds that invest in private equity, credit and real assets and has strategic partners that manage hedge funds. KKR’s insurance subsidiaries offer retirement, life and reinsurance products under the management of Global Atlantic Financial Group . References to KKR’s investments may include the activities of its sponsored funds and insurance subsidiaries. For additional information about KKR & Co. Inc. (NYSE: KKR), please visit KKR’s website at www.kkr.com and on Twitter @KKR_Co.

More from KKR