AB: Diversity Leaders Open New Doors for Equity Investors

Published 07-11-22

Submitted by AllianceBernstein

By Gayle Baldwin| Senior Research Analyst—Equities and Vivian Lubrano| Portfolio Manager—Equities

More companies are discovering that policies promoting diversity, equity and inclusion (DEI) are good for business. Equity investors who can find these “diversity leaders” will discover a promising source of return potential, especially in businesses that rely on human capital to drive innovation and business performance.

A company’s success increasingly hinges on its capacity to see and meet challenges from different perspectives, and a deep bench of diverse talent often provides an important competitive advantage. Promoting DEI does a lot of good, for employees, the business and investors alike, by creating a more inclusive, productive labor force.

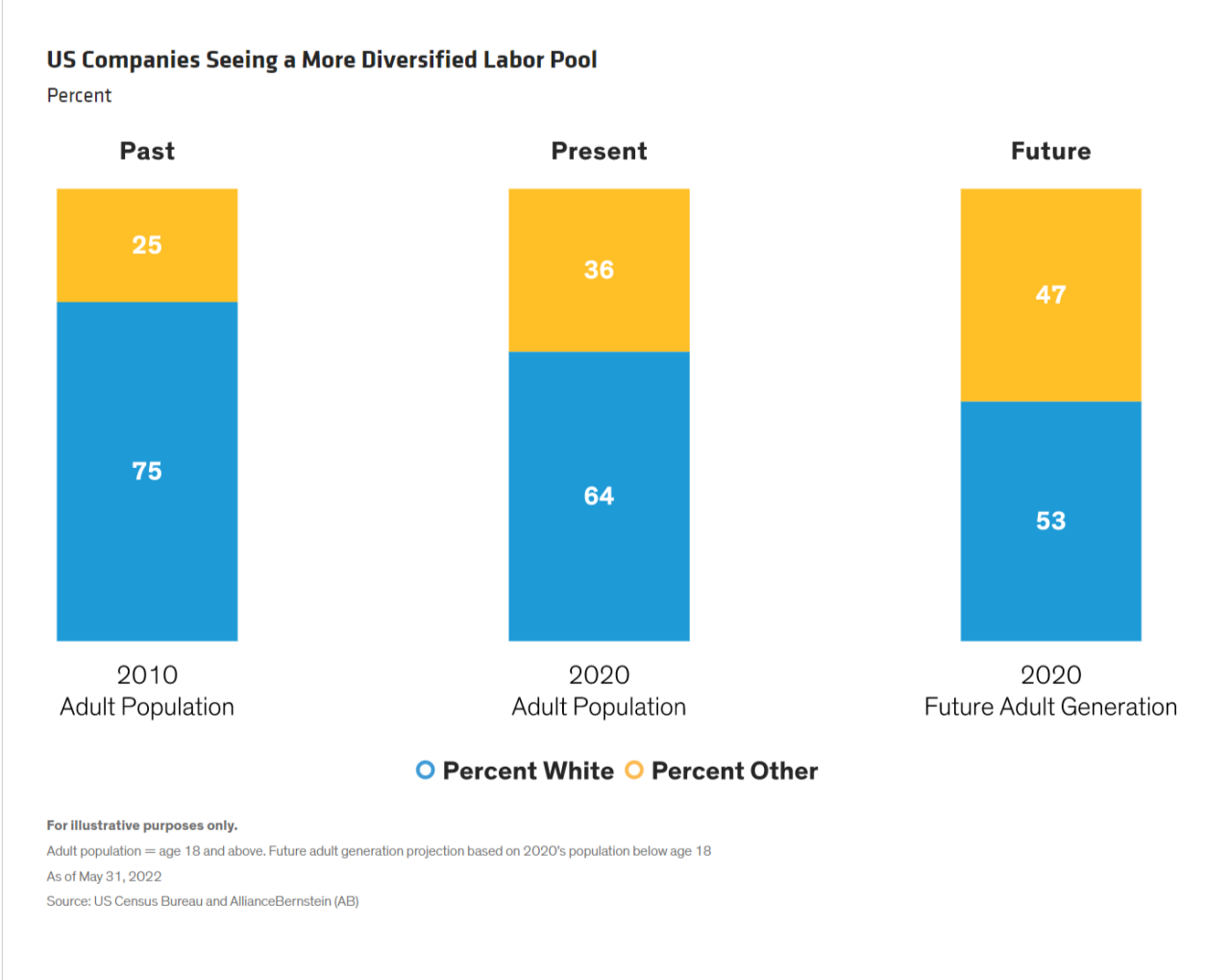

The global workplace identity is steadily changing—across age, gender, sexual orientation and especially race. In the US, for example, 75% of working-age adults identified as white in 2010, according to the US Census Bureau. The number dropped to 64% in 2020 and is expected to fall to about 53% as the next generation reaches adulthood (Display).

Forward-looking companies are embracing these demographic changes. We think those that harness a more diverse population by reshaping their recruiting, culture and employee development will have a clear strategic advantage.

Employees Thrive Where Trust Is Strongest

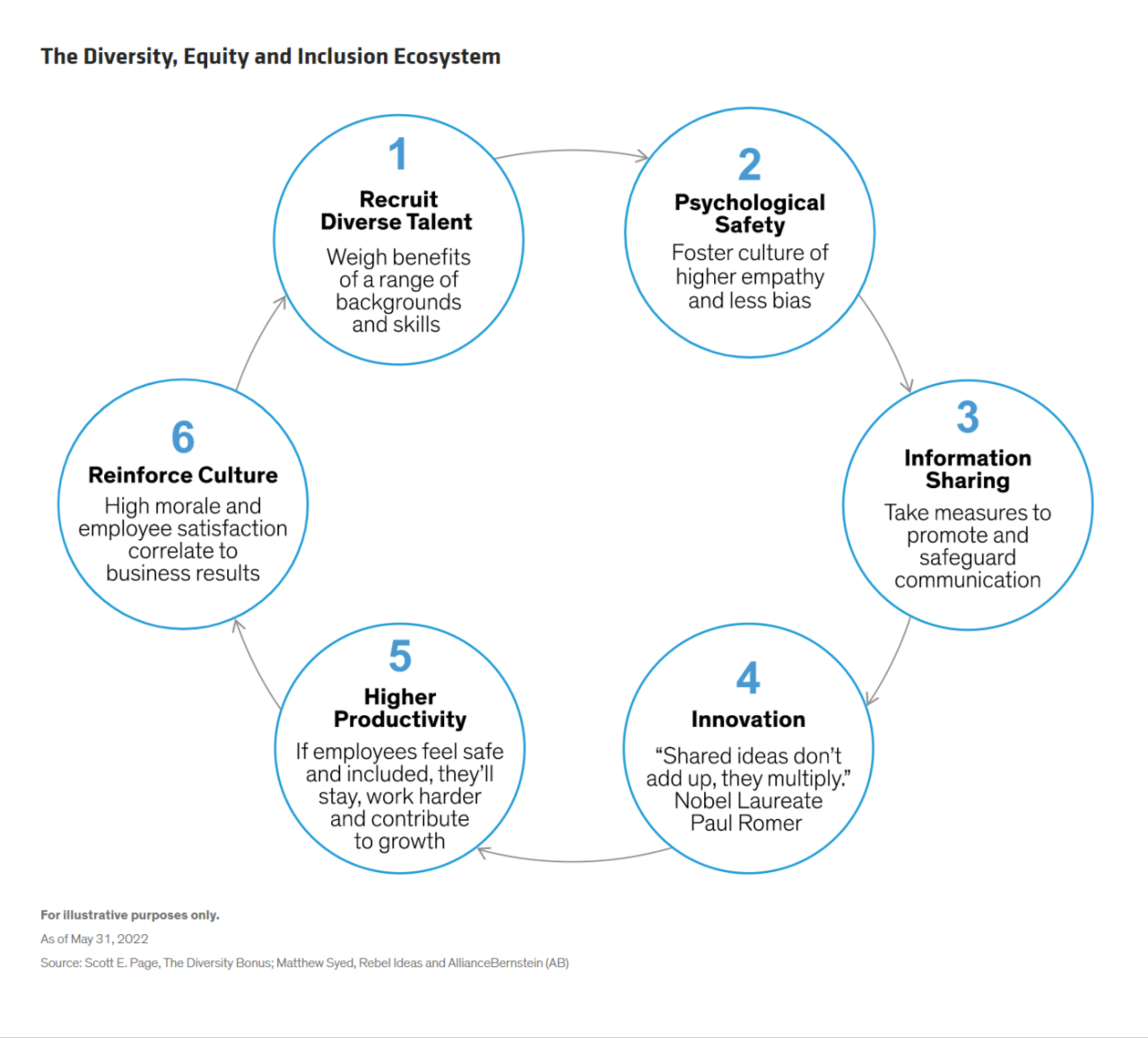

Effective DEI policies rely on a distinct ecosystem of actions and attitudes (Display). Recruiting diverse talent is an obvious starting point. A culture of information sharing, productivity, trust and employee satisfaction is also an essential ingredient. Psychological safety is important, too, fostered through sincere empathy and commitments to reducing workplace bias so people feel they can be themselves. These all orbit alongside innovation, which exponentially builds on itself as trust grows and ideas flow openly within and across teams. At companies where innovation really matters, we believe that DEI can have enormous influence on business success.

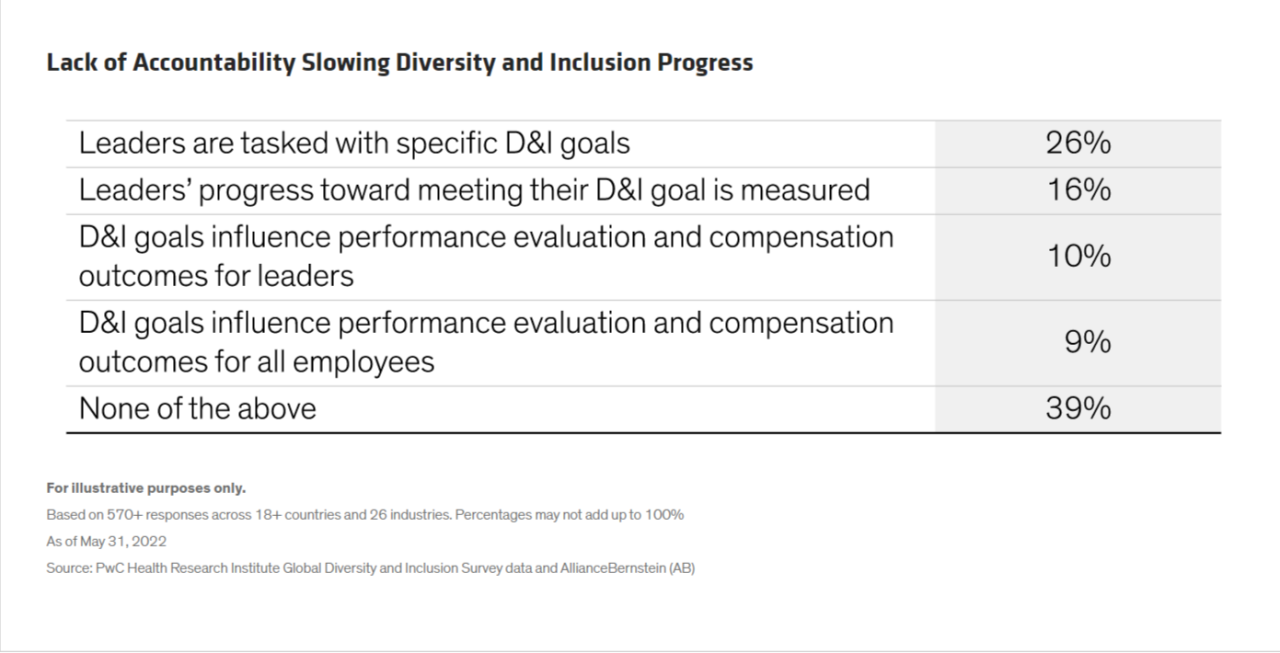

Many companies fail to capture the benefits of DEI, despite its proven connection to bottom-line performance. Lack of accountability is a big reason. Even among companies with DEI initiatives, only 26% of senior leaders are tasked with specific DEI goals. Even fewer are focused on reaching DEI targets or applying them to leadership or employee performance evaluations (Display).

Greater Diversity Linked to Better Profits

Although the pace of adoption is glacial, businesses that have pursued DEI have outperformed their peers. For example, a recent McKinsey report, covering a study of 1,000 large companies in 15 countries, linked gender and ethnic diversity to enhanced financial performance. Companies in the top quartile of executive-level gender diversity were 25% more likely to post above-average profitability than peers in the fourth quartile. Moreover, companies with women in more than 30% of senior roles are significantly more likely to outperform those with fewer in charge.

Ethnic and cultural diversity are just as empowering, according to McKinsey. Companies in the top quartile for ethnic diversity were 36% more profitable than those in the fourth, slightly up from prior years.

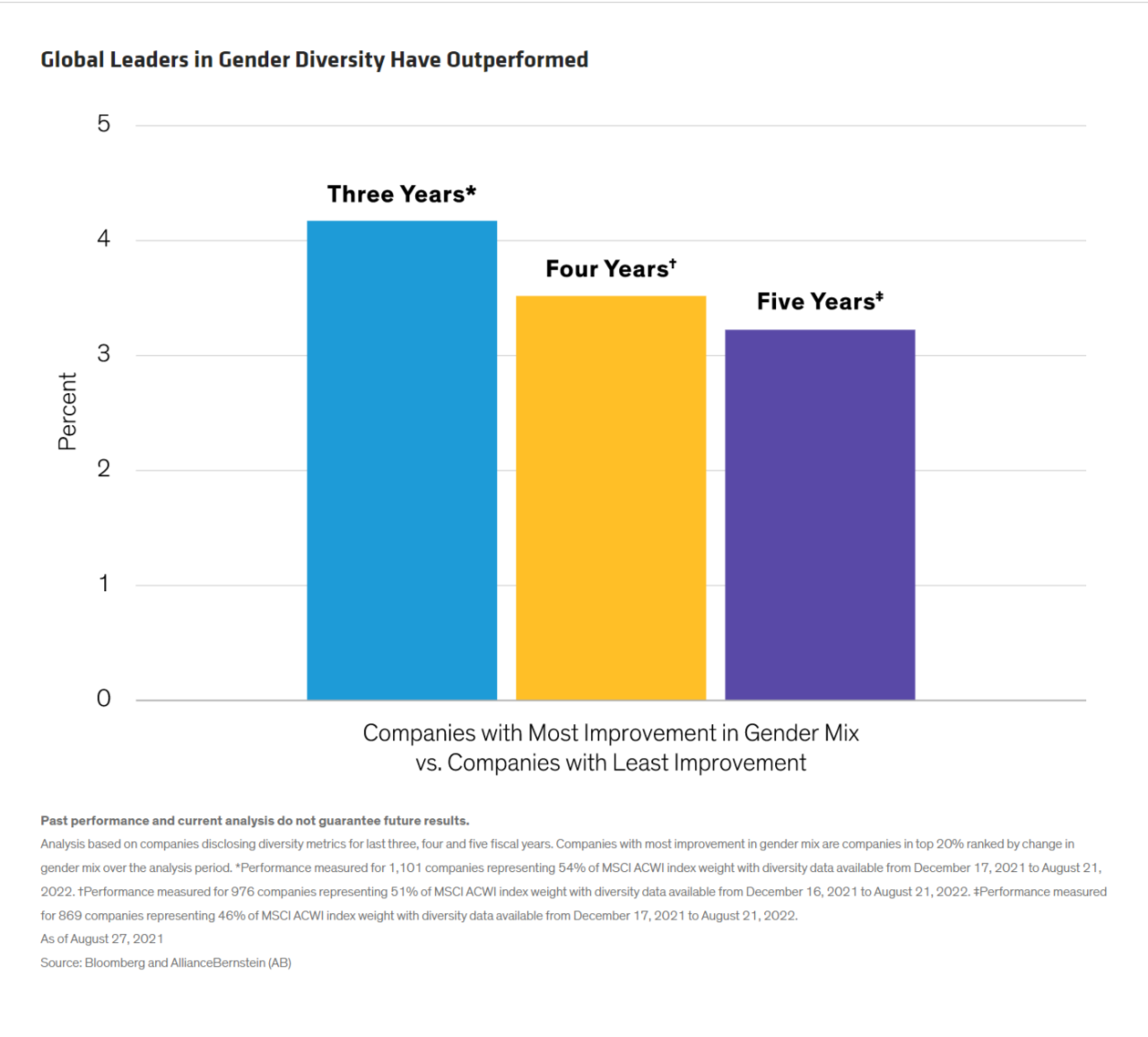

The McKinsey and other studies have extensively documented the diversity-to-profitability connection. The direct link between DEI and stock performance is still coming into light, however. Our research suggests that among global companies that report gender diversity metrics, shares of the top 20% outperformed lower scorers by about 4% over three years, with similar results for slightly longer periods (Display).

Diversity Research Should Be Diverse Too

Finding diversity leaders with outperformance potential requires careful research. It’s rarely obvious if a company’s diversity initiatives are ingenuous, and DEI disclosure and data in general are nascent and somewhat fragmented. That’s why vetting diversity leaders requires a broad mosaic of inputs, from traditional financial reports and quant research to data science analysis of recruiting websites and employee blogs. Glassdoor, for example, aggregates employee sentiment, and companies with higher scores have performed better, our research shows. Used together, these nontraditional data sources combined with fundamental research are much more telling of a company’s commitment and progress around DEI.

We also search for companies aligned with relevant UN Sustainable Development Goals, namely gender equality (#5), decent work/economic growth (#8) and reduced workplace inequalities (#10). Leading home-goods retailer Williams-Sonoma, whose female representation is sector-leading at 63%, and balanced across seniority levels, stands apart in these areas. Another is India-based Infosys, a top IT consulting firm who is working with community colleges to expand access to STEM (science, technology, engineering and math) education.

In the post-COVID-19 business world, human capital is more valuable than ever. But it’s a fluid asset that many investors don’t fully appreciate or know how to measure. Most companies know why human capital is so important, but relatively few embrace the idea that DEI provides a critical foundation for success. As more catch on, the growing number of diversity champions will offer selective investors a dual path to improve their potential returns while enhancing workplaces for millions of employees worldwide.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams. Views are subject to change over time.

About the Authors

Gayle Baldwin is a Senior Vice President and Senior Research Analyst on the Equities team, responsible for covering US consumer discretionary and healthcare. She also co-chairs AB's Equities ESG Research Group and serves on the firm's Responsibility Steering Committee. She rejoined the firm in 2019. In her previous role at AB, Baldwin was a research analyst, covering telecom, industrials and utilities for the Emerging Markets Value Equities team as well as telecom and cable for the US Large Cap Value Equities team. Before rejoining the firm, she was an analyst covering global emerging market equities at Schafer Cullen Capital Management. Prior to attending business school, Baldwin worked in M&A advisory and private equity investing at Greenhill & Co. She holds a BS (summa cum laude) in Economics from the Wharton School at the University of Pennsylvania, a BA (summa cum laude) in international and German studies from the University of Pennsylvania, and an MBA from Harvard Business School. Location: New York

Vivian Lubrano is a Portfolio Manager for Portfolios with Purpose on the Equities team. She joined AB in 2008, focusing on emerging markets. Lubrano has covered stocks across various industries, including financials, consumer cyclicals, consumer staples, agriculture, construction and construction materials. Previously, she worked in investment banking at Merrill Lynch. Lubrano holds a BS in operations research and industrial engineering from Cornell University and an MBA from the Wharton School at the University of Pennsylvania. Location: New York

View original content here.

AllianceBernstein

AllianceBernstein

AllianceBernstein (AB) is a leading global investment management firm that offers diversified investment services to institutional investors, individuals, and private wealth clients in major world markets.

To be effective stewards of our clients’ assets, we strive to invest responsibly—assessing, engaging on and integrating material issues, including environmental, social and governance (ESG) considerations into most of our actively managed strategies (approximately 79% of AB’s actively managed assets under management as of December 31, 2024).

Our purpose—to pursue insight that unlocks opportunity—describes the ethos of our firm. Because we are an active investment manager, differentiated insights drive our ability to design innovative investment solutions and help our clients achieve their investment goals. We became a signatory to the Principles for Responsible Investment (PRI) in 2011. This began our journey to formalize our approach to identifying responsible ways to unlock opportunities for our clients through integrating material ESG factors throughout most of our actively managed equity and fixed-income client accounts, funds and strategies. Material ESG factors are important elements in forming insights and in presenting potential risks and opportunities that can affect the performance of the companies and issuers that we invest in and the portfolios that we build. AB also engages issuers when it believes the engagement is in the best financial interest of its clients.

Our values illustrate the behaviors and actions that create our strong culture and enable us to meet our clients' needs. Each value inspires us to be better:

- Invest in One Another: At AB, there’s no “one size fits all” and no mold to break. We celebrate idiosyncrasy and make sure everyone’s voice is heard. We seek and include talented people with diverse skills, abilities and backgrounds, who expand our thinking. A mosaic of perspectives makes us stronger, helping us to nurture enduring relationships and build actionable solutions.

- Strive for Distinctive Knowledge: Intellectual curiosity is in our DNA. We embrace challenging problems and ask tough questions. We don’t settle for easy answers when we seek to understand the world around us—and that’s what makes us better investors and partners to our colleagues and clients. We are independent thinkers who go where the research and data take us. And knowing more isn’t the end of the journey, it’s the start of a deeper conversation.

- Speak with Courage and Conviction: Collegial debate yields conviction, so we challenge one another to think differently. Working together enables us to see all sides of an issue. We stand firmly behind our ideas, and we recognize that the world is dynamic. To keep pace with an ever changing world and industry, we constantly reassess our views and share them with intellectual honesty. Above all, we strive to seek and speak truth to our colleagues, clients and others as a trusted voice of reason.

- Act with Integrity—Always: Although our firm is comprised of multiple businesses, disciplines and individuals, we’re united by our commitment to be strong stewards for our people and our clients. Our fiduciary duty and an ethical mind-set are fundamental to the decisions we make.

As of December 31, 2024, AB had $792B in assets under management, $555B of which were ESG-integrated. Additional information about AB may be found on our website, www.alliancebernstein.com.

Learn more about AB’s approach to responsibility here.

More from AllianceBernstein