Investing Through the Renewable Energy Transition

Increasing demand and significant cost reductions have changed the clean energy landscape. Learn how decarbonization efforts may present opportunities for investors.

Published 03-29-22

Submitted by Morgan Stanley

Originally published on Morgan Stanley Insights

By Vijay Chandar

Investment Strategist, Wealth Management

The signs of growing interest in clean energy are easy to spot: solar panels line rooftops, wind turbines dot open plains, and electric cars cruise highways.

Less apparent, but equally important, are the economics at the center of this story: The costs to produce wind and solar energy have dropped markedly in the past decade, and demand has increased as electric utilities begin to phase out fossil fuels.

How could the mix of energy sources change over time? And how can investors position portfolios for a global shift toward renewables? These were some of the questions in focus during the annual AlphaCurrents conference that I recently co-hosted for Morgan Stanley Wealth Management’s Global Investment Office. Here's some of what we learned:

The Shift Toward Renewables Is Accelerating

Innovation in the energy sector is nothing new—energy consumption has changed throughout history. Most recently in the U.S., that’s been demonstrated in the decline of coal consumption and muted oil demand, while renewable sources such as wind, solar, geothermal and hydropower have grown their shares of the pie.

Globally, our strategists expect the shift toward renewables to accelerate in the years ahead, with renewable energy likely to represent 28% of global consumption by 2050, up from 15% in 2018, based on U.S. Energy Information Administration (EIA) forecasts.

Renewables Could Represent the Largest Share of Global Energy Consumption by 2050

Source: U.S. Energy Information Administration, MS & Co. Research, Morgan Stanley Wealth Management Global Investment Office as of July 23, 2021.

Wind and Solar Energy Are Quickly Gaining Ground

Over the last decade, costs have dropped precipitously for the two fastest-growing types of renewable energy: solar and wind.

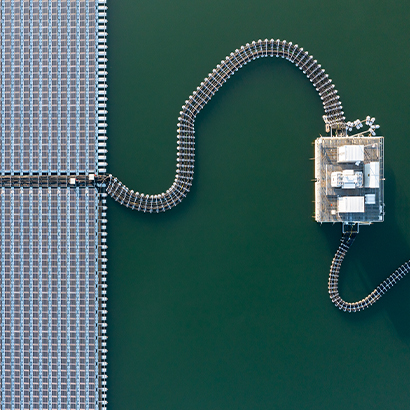

Solar power, for example, is gaining significant ground in two notable areas: rooftop solar panels for residential homes and solar farms built by electric utilities to replace coal-powered plants. Increased demand for solar products has fueled competition in the industry, driving costs down. In fact, solar electricity generation costs have decreased 83% since 2010.

Interestingly, wind-generated electricity costs have fallen by a similar amount—85%—assisted by a deceptively simple innovation: longer blades. In recent years, developers have successfully added longer rotor blades to both onshore and offshore wind turbines, allowing for increased energy output.

Note: Figures include production tax credits. 2022 costs are Morgan Stanley Wealth Management Global Investment Office estimates. Source: NextEra Energy, Department of Energy, Bloomberg, IHS Markit, Morgan Stanley Wealth Management Global Investment Office as of July 19, 2021.

Opportunities in Decarbonization Are Growing

Many believe climate change will be the defining issue of our time, and, so far, while government initiatives, policy and regulation have driven progress, going forward, the pace and success of decarbonization may increasingly depend on the private sector. With more companies pledging to address climate risk, investment opportunities around decarbonization have grown. These opportunities aren’t just limited to the energy sector, either—to varying degrees almost all industries globally likely will be affected.

For climate-conscious investors, consider looking across the energy supply and production landscape. For example, investors may find compelling opportunities in:

- Pure-play clean tech firms directly involved in renewable energy technology or production

- Electric utilities that are transitioning away from fossil fuels and toward cleaner generation

- Oil and gas companies that are investing in cleaner production, either through carbon capture or by diversifying production through renewables

While our strategists see strong growth potential for opportunities in renewables, investing in the space is not without risk. Growth for the sector assumes technological advancement, large-scale private investment and continued policy support from governments around the world.

You can find out more in our team’s AlphaCurrents report, “Future of Energy—Investing in Decarbonization.” Connect with your Morgan Stanley Financial Advisor to request a copy or discuss how your portfolio might benefit from the renewable energy transition.

Questions to Ask Your Morgan Stanley Financial Advisor:

- How can I position my portfolio for the global shift toward renewable energy?

- What investment opportunities in energy supply and production might make sense for me?

- Are there stocks or funds that would help me gain exposure to the trend toward cleaner energy?

Index Definitions

S&P 500 Index: The Standard & Poor's (S&P) 500 Index tracks the performance of 500 widely held, large-capitalization US stocks.

Risk Considerations

Equity securities may fluctuate in response to news on companies, industries, market conditions and general economic environment.

Bonds are subject to interest rate risk. When interest rates rise, bond prices fall; generally the longer a bond's maturity, the more sensitive it is to this risk. Bonds may also be subject to call risk, which is the risk that the issuer will redeem the debt at its option, fully or partially, before the scheduled maturity date. The market value of debt instruments may fluctuate, and proceeds from sales prior to maturity may be more or less than the amount originally invested or the maturity value due to changes in market conditions or changes in the credit quality of the issuer. Bonds are subject to the credit risk of the issuer. This is the risk that the issuer might be unable to make interest and/or principal payments on a timely basis. Bonds are also subject to reinvestment risk, which is the risk that principal and/or interest payments from a given investment may be reinvested at a lower interest rate.

Bonds rated below investment grade may have speculative characteristics and present significant risks beyond those of other securities, including greater credit risk and price volatility in the secondary market. Investors should be careful to consider these risks alongside their individual circumstances, objectives and risk tolerance before investing in high-yield bonds. High yield bonds should comprise only a limited portion of a balanced portfolio.

Yields are subject to change with economic conditions. Yield is only one factor that should be considered when making an investment decision.

Asset allocation and diversification do not assure a profit or protect against loss in declining financial markets.

Because of their narrow focus, sector investments tend to be more volatile than investments that diversify across many sectors and companies. Technology stocks may be especially volatile. Risks applicable to companies in the energy and natural resources sectors include commodity pricing risk, supply and demand risk, depletion risk and exploration risk.

The indices are unmanaged. An investor cannot invest directly in an index. They are shown for illustrative purposes only and do not represent the performance of any specific investment.

Disclosures

Morgan Stanley Wealth Management is the trade name of Morgan Stanley Smith Barney LLC, a registered broker-dealer in the United States. This material has been prepared for informational purposes only and is not an offer to buy or sell or a solicitation of any offer to buy or sell any security or other financial instrument or to participate in any trading strategy. Past performance is not necessarily a guide to future performance.

Morgan Stanley Smith Barney LLC, its affiliates and Morgan Stanley Financial Advisors do not provide legal or tax advice. Each client should always consult his/her personal tax and/or legal advisor for information concerning his/her individual situation and to learn about any potential tax or other implications that may result from acting on a particular recommendation.

This material, or any portion thereof, may not be reprinted, sold or redistributed without the written consent of Morgan Stanley Smith Barney LLC.

© 2022 Morgan Stanley Smith Barney LLC, Member SIPC.

CRC#4360648 (02/2022)

Morgan Stanley

Morgan Stanley

Morgan Stanley is a global financial services firm and a market leader in investment banking, securities, investment management and wealth management services. With more than 1,200 offices in 42 countries, the people of Morgan Stanley are dedicated to providing our clients the finest thinking, products and services to help them achieve even the most challenging goals. Through its Global Sustainable Finance Group, Morgan Stanley seeks to support community development initiatives with debt, equity, and philanthropy.

More from Morgan Stanley