Emerging-Market Investors Can't Afford to Ignore ESG Factors

Published 02-23-22

Submitted by AllianceBernstein

Most investors need little persuading that emerging markets offer exciting opportunities. The emerging-market (EM) corporate bond market in particular presents a tantalizing prospect for investors: Its size and strong historical performance make it impossible to ignore.

But emerging markets also pose significant and complex challenges. Some challenges—such as inconsistent regulations and a lack of standardization across countries—reflect the diverse nature of emerging markets. But others, such as the seemingly intractable problems of pollution and corruption—are ESG risks.

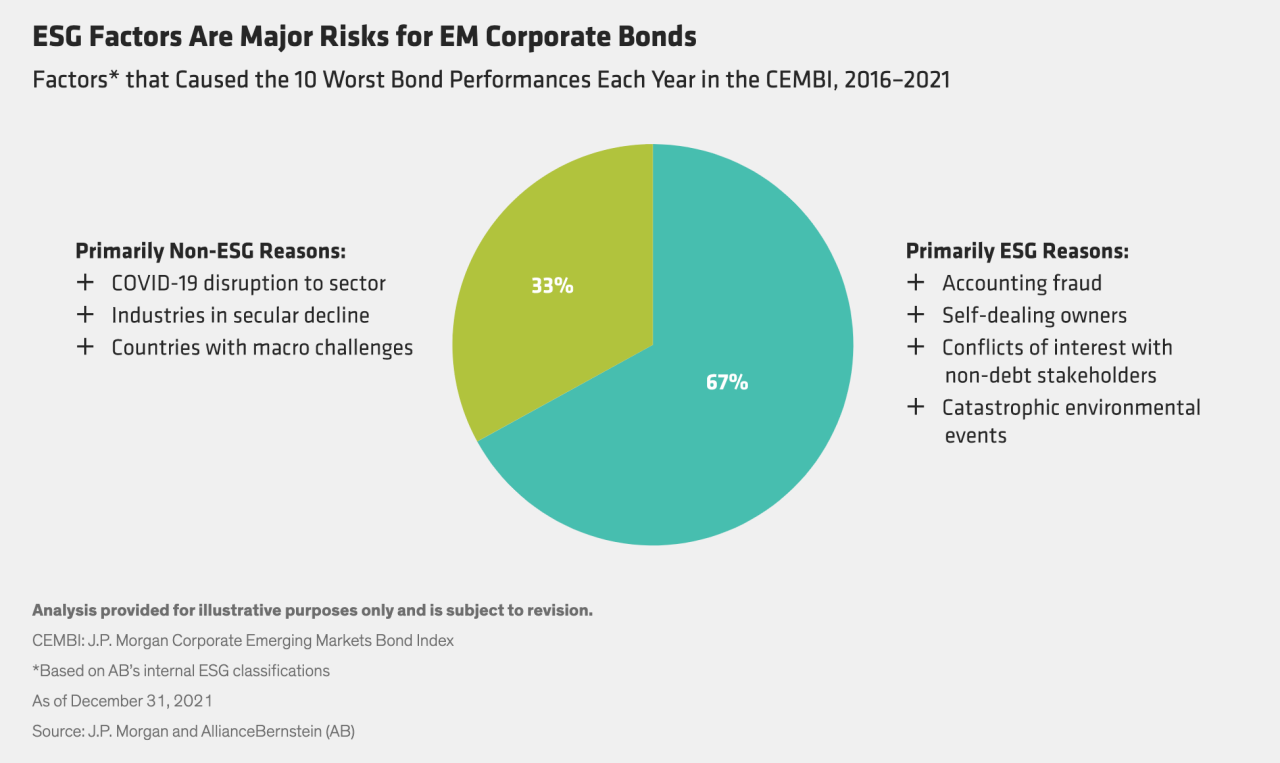

These risks can be material. Our analysis shows that, from 2016 through 2021, two-thirds of the worst-performing credits in the J.P. Morgan Corporate Emerging Markets Bond Index (CEMBI) were those with weak ESG practices.

Take NMC Healthcare, a private healthcare provider based in the United Arab Emirates. NMC Healthcare illustrates how governance risk can adversely affect investors. The company understated its borrowings by US$4 billion over several years. When the extent of its poor governance came to light in 2019, it was placed in administration and bondholders suffered an 80% loss. Similarly, Chilean coal-fired power company Guacolda Energia saw its bond price—and bond ratings—plunge when it resisted diversifying away from coal toward renewable resources, which led to difficulty securing long-term contracts. Investors who can thoroughly assess a company’s ESG risks can get ahead of such bad news.

At the same time, efforts by conscientious companies to improve their ESG practices can pay off handsomely for investors. ContourGlobal, a UK-based power generation company with operations in Brazil, Bulgaria and Africa, enhanced its governance and environmental risk profiles by carrying out an initial public offering—making it subject to increased scrutiny and standards of transparency—and committing to not build new coal plants. These initiatives resulted in a significant decline in the company’s cost of funds, and investors in the company’s bonds saw their holdings outperform.

Of course, ESG risks to investing in EM debt should be kept in perspective. For example, emerging countries’ per capita carbon emissions are much lower than those of developed countries. And not all EM companies are ESG laggards; some are leading the charge to slash emissions. Mexican chemical company Orbia Advance, for example, has some of the lowest emissions and most ambitious carbon-reduction plans in the industry—indeed, better than those of many leading US and European chemical companies.

The bottom line? ESG isn’t an alternative approach to traditional sovereign or corporate-credit analysis. It’s the foundation on which long-run economic performance is built. That’s why the key to unlocking opportunity in emerging markets lies in fully integrating ESG factors into bottom-up research and the investment process. We think that bond investors—whether or not they are driven by explicit responsible-investment objectives—are likely to see the merit of such a win-win proposition.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams. Views are subject to change over time.

AllianceBernstein

AllianceBernstein

AllianceBernstein (AB) is a leading global investment management firm that offers diversified investment services to institutional investors, individuals, and private wealth clients in major world markets.

To be effective stewards of our clients’ assets, we strive to invest responsibly—assessing, engaging on and integrating material issues, including environmental, social and governance (ESG) considerations into most of our actively managed strategies (approximately 79% of AB’s actively managed assets under management as of December 31, 2024).

Our purpose—to pursue insight that unlocks opportunity—describes the ethos of our firm. Because we are an active investment manager, differentiated insights drive our ability to design innovative investment solutions and help our clients achieve their investment goals. We became a signatory to the Principles for Responsible Investment (PRI) in 2011. This began our journey to formalize our approach to identifying responsible ways to unlock opportunities for our clients through integrating material ESG factors throughout most of our actively managed equity and fixed-income client accounts, funds and strategies. Material ESG factors are important elements in forming insights and in presenting potential risks and opportunities that can affect the performance of the companies and issuers that we invest in and the portfolios that we build. AB also engages issuers when it believes the engagement is in the best financial interest of its clients.

Our values illustrate the behaviors and actions that create our strong culture and enable us to meet our clients' needs. Each value inspires us to be better:

- Invest in One Another: At AB, there’s no “one size fits all” and no mold to break. We celebrate idiosyncrasy and make sure everyone’s voice is heard. We seek and include talented people with diverse skills, abilities and backgrounds, who expand our thinking. A mosaic of perspectives makes us stronger, helping us to nurture enduring relationships and build actionable solutions.

- Strive for Distinctive Knowledge: Intellectual curiosity is in our DNA. We embrace challenging problems and ask tough questions. We don’t settle for easy answers when we seek to understand the world around us—and that’s what makes us better investors and partners to our colleagues and clients. We are independent thinkers who go where the research and data take us. And knowing more isn’t the end of the journey, it’s the start of a deeper conversation.

- Speak with Courage and Conviction: Collegial debate yields conviction, so we challenge one another to think differently. Working together enables us to see all sides of an issue. We stand firmly behind our ideas, and we recognize that the world is dynamic. To keep pace with an ever changing world and industry, we constantly reassess our views and share them with intellectual honesty. Above all, we strive to seek and speak truth to our colleagues, clients and others as a trusted voice of reason.

- Act with Integrity—Always: Although our firm is comprised of multiple businesses, disciplines and individuals, we’re united by our commitment to be strong stewards for our people and our clients. Our fiduciary duty and an ethical mind-set are fundamental to the decisions we make.

As of December 31, 2024, AB had $792B in assets under management, $555B of which were ESG-integrated. Additional information about AB may be found on our website, www.alliancebernstein.com.

Learn more about AB’s approach to responsibility here.

More from AllianceBernstein