Food and Beverage Manufacturing: 6 Trends to Watch

Recent innovations are driving significant change in food and beverage manufacturing. Here are some of the processing, packaging and supply trends that are emerging in the industry.

Published 01-04-22

Submitted by CRB

by Jason Robertson, Vice President, Food + Beverage & Tony Moses, PhD, Director, Product Innovation

Like a powerful locomotive, the food and beverage manufacturing industry has incredible forward momentum, driven by innovative new processes and products. Consumer attitudes continue to evolve and people are more willing than ever to try new products and to embrace the use of science in food production.

There’s never been more science involved in food processing and packaging, geared to allay consumer concerns about cost, health and environmental sustainability. A great example is the way consumers have taken to alternative proteins to help feed the growing population in environmentally responsible ways. Here we discuss some of the food and beverage manufacturing trends that make this the most exciting time in food science in decades.

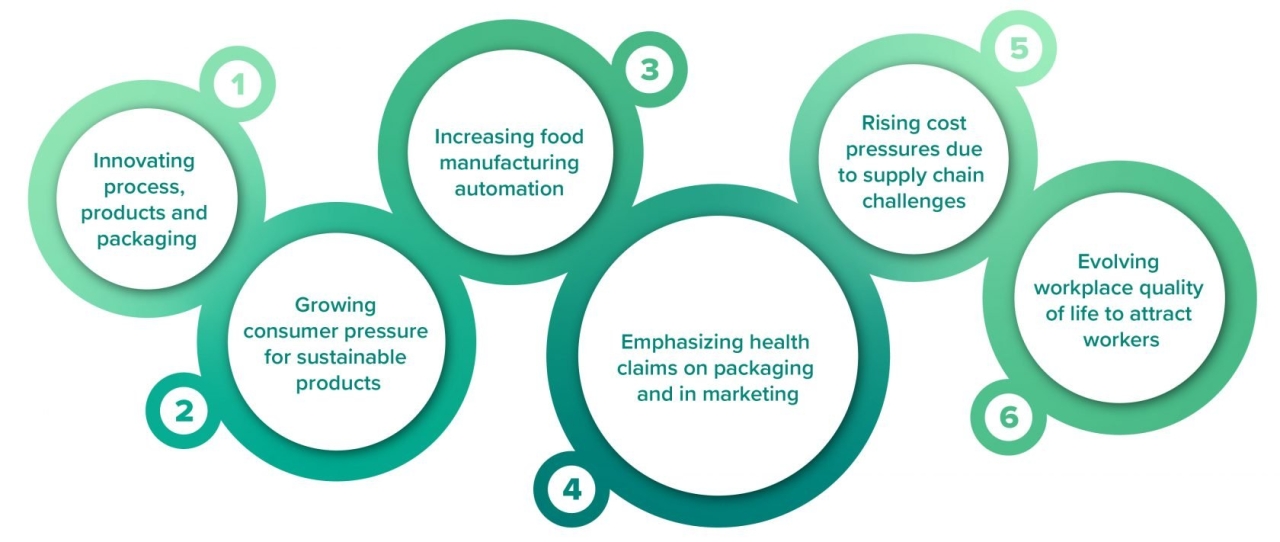

6 Food and Beverage Manufacturing Trends to Watch

1. Innovating process, products, and packaging

Food processors are developing and marketing novel processing techniques, products and packaging to appeal to consumer demand.

One of the most exciting new food and beverage manufacturing trends is the use of high-pressure processing (HPP). This low-temperature pasteurization technique is gaining traction among food producers for more natural applications, such as naked juice, ice cream and cookie dough. It is ideal as a final surface kill step for any bacterial contamination that may have been picked up during processing. HPP comes with challenges, including the equipment expense, the need for packaging that can withstand intense pressure (80,000+ lbs.) and, because it isn’t as thorough a kill step for all microbes, products may need to be refrigerated. Despite its challenges, expect to see wider adoption as HPP manufacturers and packaging suppliers innovate to improve throughput and therefore reduce processing costs.

Pet food production is also undergoing big changes, including the use of refrigeration during processing and packaging to maintain freshness. The desire of some pet owners for raw pet food is also gaining traction and requires special handling to prevent microbial contamination (e.g., HPP) and to preserve freshness (e.g., preservatives or freeze-drying).

The development of alternative proteins is one of the reasons that food scientists are so excited about the future of food.

The goal of alternative proteins is to make cell-based and plant-based products that have the same or better taste and feel—and cost the same or less—than comparable animal proteins. Plant-based foods can replace such animal products as ice cream, meat, chicken and pet food, while cell-based meat and seafood, including burgers that have the taste and feel of animal protein, are upending our notions of what is possible. There’s even recently been innovation in cell-based fats and blood to complement these spaces and create a more authentic eating experience. These products use novel technologies, including extrusion, that have been scaled up for commercial-scale manufacturing by engineers with experience in the design and construction of plant- and cell-based protein manufacturing facilities and process lines.

2. Growing consumer pressure for sustainable products

Consumer pressure continues to grow for the food industry to eliminate its reliance on single-use plastics, reduce waste and produce food in a sustainable way.

Reducing packaging waste

There is a science to food packaging. Companies must ensure food safety and satisfy consumers, all while carefully balancing product quality, appearance, functionality, cost and environmental impact. Driven by corporate responsibility and consumer demand, producers are taking a proactive approach to prioritize sustainability in their packaging.

As examples of companies stepping up to meet consumer preferences, Nestlé, KraftHeinz and Conagra have all committed to using only recyclable, reusable or compostable packaging by 2025. These companies recognize sustainability as an issue that provides value to their customers, who are willing to pay a premium for products they believe support environmental sustainability.

Retailers are also demanding change. A good way to see the direction that packaging is taking is to walk the aisles of the largest food retailers, like Walmart, which accounts for about one-quarter of Conagra’s net sales. Walmart announced sustainability goals aimed at reducing single-use plastic, making commitments to improve sustainability in its U.S. private brands. Walmart is also encouraging its national brand suppliers to make similar packaging commitments. When large retailers ask for something, suppliers will find a way to provide it.

Upcycling

Many companies, including numerous startups, are taking advantage of the trend to repurpose food products that would otherwise be wasted. Upcycling is the value-add process of turning food that would have been wasted into products for human consumption. According to the Upcycled Food Association, this has the benefits of:

- Reducing food waste and greenhouse gas emissions

- Increasing the value of food that would otherwise be wasted

- Creating a more sustainable and resilient food system

A good example is Unilever’s use of the ice cream that remains in its manufacturing lines when there is a changeover between products. What used to be waste at one of Unilever’s brands is turned into a best-selling flavor that repurposes 160 metric tonnes of waste annually and is beloved by consumers for its sustainable nature.

Indoor vertical farming

More fruits and vegetables will be grown in greenhouses, allowing them to be produced closer to where they’re consumed and dramatically change the way consumers interact with locally grown food. For example, instead of growing lettuce in California and shipping it thousands of miles, it can be grown in a controlled environment on the East Coast.

In addition to the reduction in shipping and the shorter time between harvest and consumption, proponents of this trend to vertical agriculture say it has environmental advantages. For example, AeroFarms grows greens in New Jersey on 1% of the land required by conventional agriculture using 95% less water, no pesticides and less fertilizer.

3. Increasing food manufacturing automation

The shortage of labor in the food and beverage industry is an ongoing issue and will speed up the transition to more automated facilities. The supply of raw materials and available land is often most abundant in rural areas where it can be hard to adequately staff production and packaging lines without bussing people in from a distance. COVID-19 has made this worse; even if you can find enough people to staff a plant, physical distancing prevents them from being there all at the same time.

Automation allows increased efficiency and flexibility of production, improved management of the supply chain and better record keeping for regulatory purposes.

It comes with significant initial and ongoing costs, however, and requires access to skilled operators. Some see it as a way to future-proof a facility in anticipation of cost pressures or labor shortages, such as those we’ve seen during the pandemic.

4. Emphasizing health claims on packaging and in marketing

Consumers are more informed about what goes into their food, which has resulted in a push toward clean labels listing fewer and simpler ingredients, including those that come with health claims. Functional ingredients—like pro- and pre-biotics, antioxidants and vitamins—require an intimate awareness of product qualities and the processing conditions they can withstand. This is driving the trend toward minimally processed foods.

The use of high temperature to eliminate microbial contamination adversely affects the quality of some specialty products, like a juice containing probiotics. This has led to some processors reconsidering pasteurization in search of gentler processing technologies, such as high-pressure processing (HPP).

5. Rising cost pressures due to supply chain challenges

Shortages of raw materials and rapid changes to how consumers shop are affecting the supply chain. There are short-term food and beverage manufacturing trends brought on by the pandemic. For example, some domestic processors of frozen broccoli and cauliflower had difficulty importing enough vegetables to process. The dramatic shift from restaurant eating to cooking at home also meant that some potato producers had excess potatoes normally destined for bulk delivery to restaurant chains and weren’t able to pivot to small packaging to divert them to supermarkets.

The industry also sees a shortage of refrigerated and frozen warehouse space. CRBE estimates that demand for cold storage space will rise by 100 million square feet during the next five years. That’s an increase of 47% from the current level of approximately 214 million square feet.

A long-term supply chain trend is the move to e-commerce and curbside pickup. The speed with which retailers had to adapt to pandemic shopping restrictions made this expensive, but many retailers have taken advantage of the shift. Target, for example, has seen a significant increase in sales due to curbside pickup. It’s likely that consumer demand for online shopping and curbside pickup is here to stay, meaning that retailers are preparing their stores for more efficient curbside pickup. Retail outlets could pressure producers to package foods in ways that optimize this process.

The need for efficiency and speed of transport to support digital ordering and curbside pickup could also have dramatic effects on the trucking industry, distribution centers and the use of automation (e.g., robotics) along the supply chain. For example, automation could allow a robot to pick up a product from a warehouse, send it by truck to a store and have the consumer pick it up, all in one day.

6. Evolving workplace quality of life to attract workers

Competition for labor—with companies that provide a more attractive quality of work life—is driving the transformation to improve work environments. Food and beverage manufacturing facilities in rural areas are in direct competition for employees with e-commerce and other newer industries that appeal to younger workers by offering competitive pay in a more relaxed and comfortable setting.

It can be a challenge to renovate facilities built in the 1960s or ‘70s that lack natural lighting and may be either too cold or too hot. When designing new or retrofitted plants, the food industry seeks to create better environments by doing things like incorporating better ergonomics, bringing in more daylight and improving break rooms and lounge areas to improve quality of life.

CRB

CRB

CRB is a leading global provider of sustainable engineering, architecture, construction, and consulting solutions to the life sciences and food and beverage industries. Our innovative ONEsolution™ service provides successful integrated project delivery for clients demanding high-quality solutions -- on time and on budget. Across 21 offices in North America and Europe, the company's nearly 1,800 employees provide world-class, technically preeminent solutions that drive success and positive change for clients and communities. See our work at crbgroup.com, and connect with us on social media here.

More from CRB