How a Nonprofit Was Able to Reconnect With Their Mental Health Patients

A Truist Cares* grant is helping one of our community partners stay connected with one of our country’s most vulnerable populations.

Published 11-27-20

Submitted by Truist

Despite being one of the wealthiest regions of the U.S., Northern Virginia is also home to some of the country’s most underserved families. Northern Virginia Family Service (NVFS) is a nonprofit that takes a holistic approach to getting those families through whatever barriers they face and on a path to self-sufficiency, whether that means getting homeless youth off the streets, helping with immigration cases, or providing mental health counseling to survivors of trauma.

"Our goal is always to move people into successful lives where they feel a sense of well-being, safety, and accomplishment,” says David Billotti, marketing and communications director for NVFS. “Our community is stronger when all of our neighbors in need have those needs met.”

“Most of the clients that I see, when they get here to this country, they have already experienced hardship,” says Bianca Añez, one of NVFS’s mental health counselors. “Most of them live in multifamily or multigenerational households. They might not be able to social distance. There is a lack of health care access. In some cases, there’s a language barrier. So, let’s add the layer of COVID-19 to that, and the anxiety has spiked tremendously.”

Most of the patients Añez works with are also in NVFS’s Healthy Families program, which provides support to women who are pregnant and at risk of or affected by postpartum depression.

“If Mom doesn’t have her own needs met, it makes it very difficult for her to meet her child’s needs,” Añez says. “Most of them are new moms in a new country without the support of family. As a community, we want to be there and help them in this critical time.”

But connecting with a vulnerable population can be difficult during a pandemic.

A quick pivot to connect those in need

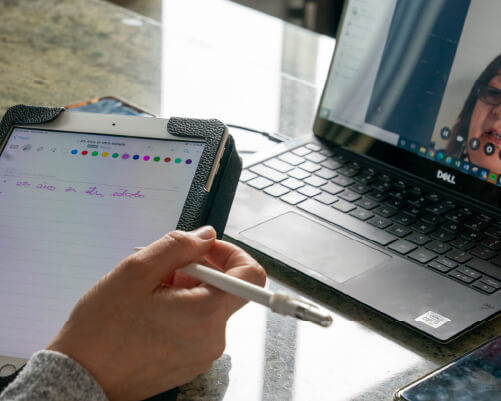

Before COVID-19, Añez would meet with many of her patients in person.

“We would go to their homes as a way of removing whatever barrier there might be for them to receive mental health services,” she says.

And when the pandemic forced practically all nonemergency health visits to go virtual, NVFS wasn’t set up for the shift.

“We started doing check-ins through phone calls, but we made sure that we did not leave our clients abandoned,” Añez says. “We had to up the game with our technology. It was maybe two months that we didn’t have that visual connection.”

Reconnecting visually meant NVFS needed to secure a HIPAA-compliant tele-mental health platform — and a $25,000 Truist Cares* grant helped it do just that. NVFS used the grant to set up the proper online portals, establish an emergency assistance line, and get their staff licensed and prepared so they could provide mental health services virtually.

“The support that Northern Virginia Family Service offers to families is more critical than ever, as the effects of the pandemic disproportionately impact vulnerable populations,” says Evelyn Lee, Greater Washington regional president at Truist. “As a part of our larger response to COVID-19 relief needs through the Truist Cares* initiative, the $25,000 donation helped NVFS overcome the barriers to shifting their services to a virtual format, allowing them to continue serving the community.”

“It was wonderful,” Añez says, describing the moment she was finally able to see her clients again. “It’s like seeing a loved one that you haven’t seen in months.”

“This pandemic has affected everybody as a whole — mental, physical, social, emotional, in some cases even spiritual,” she adds. “Having sessions right now, it brings some sort of normalcy to their lives, in a time where everything is unpredictable.”

Añez shares a story about a patient she was already working with when the pandemic knocked the patient out of work for a couple of weeks.

“She has a complex trauma history, and now she was being affected financially,” she says. “She felt isolated. She had a child who was part-time in day care — so now the child was with her all the time. She felt worried about her family overseas and her financial situation. And she found herself at home without a routine, and she was emotionally too exhausted to even play with her child.”

But establishing the HIPAA-compliant telehealth platform ensured Añez was able to make sure her clients did not feel abandoned or forgotten — and being able to stay connected has made a difference for that patient.

“After some work, she was able to overcome that to the point that she was actually aware of why she was feeling that way,” Añez says. “She was able to create a new routine. She was even able to enjoy playing with her child — she had the energy and the emotional presence to be there.”

Since then, the patient is back at work, too.

“Now she can look back and recognize the silver lining of the shelter in place — that she actually had time to be with her child and work on herself as well,” Añez says. “So now she has hope and a purpose again.”

Between mental health counseling, immigration-related legal services, career support, and food and housing assistance, NVFS annually impacts the lives of more than 40,000 individuals across Northern Virginia — immigrants, trauma survivors, and people who are impoverished. And while there’s still lots of work to do, Billotti says, support like the Truist Cares* grant has fueled their focus during a challenging time.

"To have something like Truist Cares* support us gives us the confidence to go forward in taking care of our clients,” Billotti says. “We can talk about it philosophically, but what it really means is more food, more mental health, more people getting the tools and resources that they need to get themselves on the road to independence, well-being, and safety. These dollars translate directly to people’s needs being met.”

Truist is proud to be a part of resilient communities that motivate us to build better lives every day. Seeing how our community partners have stepped up in the face of COVID-19 inspired us to form the Truist Cares* initiative, a $50 million commitment to help support youth, seniors, the workforce, small businesses, and increased connectivity. For more stories about the work our partners are doing, visit truist.com/truistcares.

*About Truist Cares: Truist Cares is a cooperative effort between Truist Financial Corporation, Truist Foundation, Inc., and Truist Charitable Fund to provide communities, organizations and individuals disaster relief and assistance during the COVID-19 crisis.

About Truist

Truist Financial Corporation is a purpose-driven financial services company committed to inspire and build better lives and communities. With 275 years of combined BB&T and SunTrust history, Truist serves approximately 12 million households with leading market share in many high-growth markets in the country. The company offers a wide range of services including retail, small business and commercial banking; asset management; capital markets; commercial real estate; corporate and institutional banking; insurance; mortgage; payments; specialized lending; and wealth management. Headquartered in Charlotte, North Carolina, Truist is the sixth-largest commercial bank in the U.S. with total assets of $504 billion as of June 30, 2020. Truist Bank, Member FDIC. Learn more at Truist.com.

Truist

Truist

Truist Financial Corporation is a purpose-driven financial services company committed to inspiring and building better lives and communities. As a leading U.S. commercial bank, Truist has leading market share in many of the high-growth markets across the country. Truist offers a wide range of products and services through our wholesale and consumer businesses, including consumer and small business banking, commercial banking, corporate and investment banking, wealth management, payments, and specialized lending businesses. Headquartered in Charlotte, North Carolina, Truist is a top-10 commercial bank. Truist Bank, Member FDIC. Learn more at Truist.com.

More from Truist