As Climate Risk Sweeps Into Mainstream, Some Asset Managers Still Vote Against Most Climate Shareholder Proposals

Published 03-11-20

Submitted by Ceres

By Rob Berridge and Natasha Nurjadin

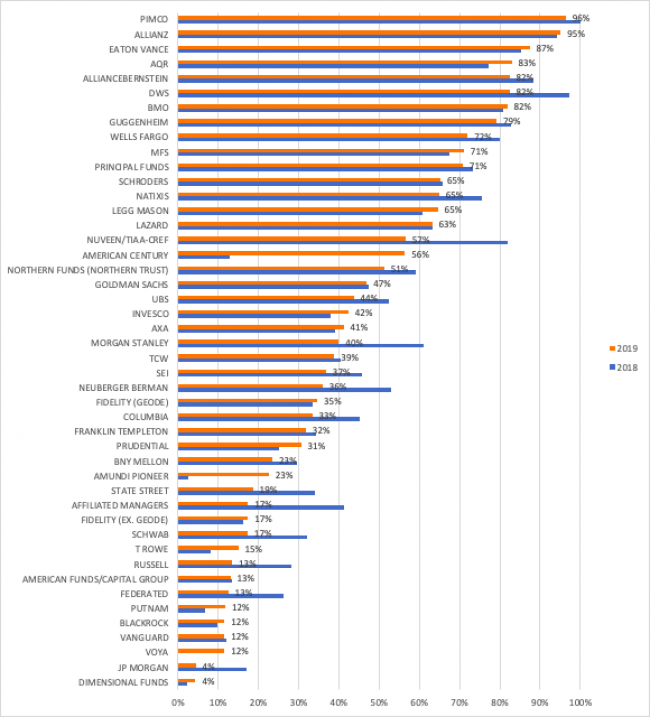

As Ceres publishes its annual ranking of asset manager proxy voting on climate-related shareholder proposals for 2019 in the table below, we hope this data is helpful to asset managers and individual investors preparing for the 2020 proxy voting season.

The good news in the data is that, for the first time, last year every asset manager studied voted “For” at least some of the proposals. In addition, 39% of climate-related shareholder proposals tracked by Ceres were withdrawn by the investors who filed them in return for companies committing to take actions to address the issues raised in the proposals. This demonstrates the willingness of companies to respond positively to shareholder proposals.

On the flip side, the 2019 data also reveals that a number of large asset managers continue to vote against nearly all climate-related proposals, a pattern similar to previous years.

Context: Climate Risk Goes Mainstream

The main goal of our annual analysis is to encourage investors to vote “For” more climate-related shareholder proposals because of the substantial business risks caused by climate change. We believe that companies can protect value-- and often create value --by understanding climate risks and responding with appropriate action. Often, shareholder proposals help companies see the need to do so.

Examples of climate risk have become disturbingly easy to recount. Consider just one from each of the last three years: In 2017, Hurricane Maria killed thousands of people in Puerto Rico and knocked out much of the territory’s electric grid for roughly a year. In 2018, the deadliest wildfires in California’s history killed more than 90 Californians and drove one of the largest electric utilities in the U.S. into bankruptcy. And in 2019, wildfires laid waste to portions of Australia larger than Vermont and New Hampshire combined, killing more than 30 people and an estimated one billion animals. Overall, global property losses from extreme weather now reach into the hundreds of billions a year.

In the World Economic Forum’s recent annual report, business leaders and policy makers identified the top five risks to the global economy as extreme weather, climate action failure, natural disasters, biodiversity loss and human-made environmental disasters. Meanwhile, the level of greenhouse gases in the atmosphere continues to rise and, as a result, the global average temperature is already roughly 1 ℃ higher than pre-industrial levels. Scientists say a rise beyond 1.5 ℃ will unleash catastrophic climate change impacts.

Investors, policy makers and consumers will continue to encourage companies to reduce emissions while ever more extreme weather and rising seas will force them to harden or move their physical infrastructure and/or find new commodity supply chains. As the CEO of BlackRock Larry Fink told corporate CEOs in January “Climate change has become a defining factor in companies’ long-term prospects,” and is “compelling investors to reassess core assumptions about modern finance.” This is a profoundly important statement from the world’s largest asset manager with nearly $7 trillion under management. Mutual fund companies and other asset managers have a fiduciary duty to their clients to try to protect their investments from material risks and maximize portfolio returns.

The Importance of Passive Investors and the Gordian Knot

The “Big Three” index fund providers (BlackRock, State Street and Vanguard) now hold an average of more than 20% of each company in the S&P 500. In addition, the shares they own add up to about 25% of all shares voted in corporate elections, since institutional investors are more likely to vote than are individuals. (Investors who fail to submit votes are not included in the formula used to count votes.)

As the data table below on 2019 proxy votes by asset managers shows, two of the Big Three voted against nearly 90% of climate-related shareholder proposals. And the third, State Street, voted “For” only 19%. So, it is easy to see that if the largest index fund providers had voted “For” more climate-related proposals, the votes on these proposals would be far higher.

In fact, majority votes on climate resolutions would become quite common if the Big Three joined the “For” voting, but in 2019 only one climate-related resolution garnered a majority vote. While nearly all shareholder proposals are advisory (meaning companies are not forced to take action even if a proposal receives a majority vote) in practice most companies feel tremendous pressure to address the issues raised in proposals that receive votes above 50%.

It is one of the great ironies of our time that index fund providers vote against such a large proportion of climate-related shareholder proposals. Since index fund providers can’t sell shares of individual companies in an index, they lack the ability to manage risk through investment decisions. In this sense, they are the ultimate long-term investors. Year after year, they simply continue to hold whatever companies are in the index their funds track, such as the S&P 500 or the Russell 2000.

Index fund providers’ only way to manage risk within any particular fund is through shareholder engagement. And the easiest form of engagement is proxy voting. For the reasons described above related to majority votes, if the “Big Three” vote for a climate proposal, odds are that the company that received the proposal will take action to address the issues raised.

So here’s the conundrum: Since climate risk is pervasive, index fund providers want to reduce risks, and the purpose of shareholder proposals is to mitigate risks, why don’t index fund providers generally vote “For” climate-related proposals?

Index fund providers have stated that they favor less public forms of engagement with companies, such as private dialogue. But why not engage in dialogue and vote for shareholder proposals? After all, if an investor’s vote sends a different message to management than a dialogue, doesn’t that weaken the dialogue? And if a giant investor really wants the company to take action, and a vote “For” is likely to make that happen, then time spent on the dialogue is unnecessary.

Maybe index fund providers believe some of the companies, such as oil and gas producers, will benefit more financially from causing climate change than they expect to lose from possible new regulations or adapting? Even then, index fund providers should want oil and gas companies to address climate risk.

Why? Because the large index fund providers are what is known as universal owners. They tend to own nearly all the publicly traded traded companies in many countries due to the breadth of their indexes. In this sense, they own a large slice of the global economy. What is bad for the global economy is bad for index fund providers. Remember, they are trying to maximize portfolio-wide returns, not the returns of any single company.

Most companies are not fossil fuel providers and can in fact profit from embracing key climate solutions such as boosting energy efficiency and purchasing renewable energy. Both of these solutions are now generally cheaper than new fossil fuel based energy. And their feasibility is demonstrated by the numerous corporate commitments (817 and rising) to reduce emissions in line with what scientists say is needed. In 2019, out of 12 resolutions filed on use of renewables and energy efficiency, 11 were withdrawn in return for a commitment by the company, and the SEC allowed 1 to be omitted from the proxy statement.

The best approach to climate risk for index fund providers is seeking an orderly transition to a lower carbon economy by encouraging portfolio companies to harness the many cost-effective solutions. The index fund providers would be joining large numbers of other institutional investors who use shareholder engagement to address climate risk. More than 450 global investors with a combined $40 trillion in assets under management have been engaging with the world’s largest corporate GHG emitters and other influential companies through Climate Action 100+ to reduce emissions and improve governance, often using shareholder resolutions as a tool of engagement.

And yet, index fund providers continue to vote against most climate-related shareholder proposals. We remain baffled by this Gordian Knot.

Alexander the Great tried to untie the proverbial Gordian Knot. When he failed, as everyone else had, it is said that he drew his sword and simply cleaved the knot asunder. Perhaps the words of Larry Fink will be used similarly to Alexander’s sword and index fund providers will begin to vote for many more climate-related proposals. The result would be reduced investment risk and reduced risk of catastrophic climate change.

In 2020, BlackRock received a shareholder proposal requesting a review of it’s proxy voting processes relating to climate change. Investors including Mercy Investment Services and Boston Trust Walden recently withdrew the proposal in return for a commitment from BlackRock to continue dialogue, stating: “We are hopeful that Blackrock’s voting and engagements will be an effective catalyst stimulating positive company changes on climate. Clearly investors and clients globally will be closely monitoring BlackRock’s proxy voting performance on climate to ensure their statements are translated into action.”

Insights From the 2019 Data and Related Trends

What can we learn from the 2019 data, and related trends, that will help voters as they determine how to vote on 2020’s crop of shareholder proposals? As mentioned earlier, one important trend is the decline in the number of asset managers that haven’t voted “For” any climate-related proposals. This metric fell from 12 asset managers in 2016 to zero asset managers in 2019. Voya was the sole firm that voted “For” none of the proposals in 2018; they then supported 12% in 2019. However, this still leaves Voya third from last in the 2019 ranking, as shown in the table above.

BlackRock’s percentage of votes “For” have been rising since 2017. Specifically, they voted for 0% in 2016, followed by 2% in 2017, then 10% in 2018 and 12% in 2019.

In addition, several asset managers that showed low levels of support in 2018 seem to have changed their perspective on climate-related resolutions over the year and increased their “For” votes significantly in 2019. For instance, American Century funds voted “For” 56% of climate-related resolutions last year, up from 13% in 2018. Amundi Pioneer voted “For” 23% of the resolutions in 2019 up from 10% in 2018.

However, several metrics show a decline in support for the proposals in 2019. JPMorgan Chase supported only 4% of climate-related proposals in 2019, down from 17% in 2018. The giant bank has suffered heavy criticism recently based on a report by Rainforest Action Network which found JPMorgan Chase is the top bank for financing fossil fuel companies. JPMorgan Chase has, however, committed $200 billion to financing climate solutions and recently announced it had joined CA 100+ and placed restrictions on investing and financing related to thermal coal. These commitments contributed to investor’s decision to withdraw a 2020 shareholder proposal filed with JPMorgan Chase on climate-related proxy voting policies.

Surprisingly, 61% of asset managers studied voted for fewer climate-related proposals in 2019 than they did in 2018. This breaks the trend we had seen for several years of generally increasing support levels. In addition, in 2019, only 39% of asset managers voted “For” at least half the climate-related resolutions presented to them, down from 46% in 2018. Moreover, 14 asset managers voted for fewer than 20% of climate-related resolutions in 2019 compared to 11 in 2018.

One possible explanation for the decline in support was a reduction in 2019 in shareholder proposals requesting sustainability reports. There were nine of these that went to a vote in 2018 and only one in 2019. (In 2019 an amazing 16 out of 21 of these proposals were withdrawn by their filers in return for commitments by the companies to issue reports.) The average percentage of “For” votes on these resolutions in 2018 was 41.8% compared to an overall average vote on climate resolutions in 2018 of 29.6%. So, a reduction in these resolutions, which attract a lot of “For” votes, could help to explain a reduction in total votes “For” by some asset managers.

Another possible explanation for the decline in “For” votes by some asset managers was reflected in what one asset manager told Ceres: that while they had voted for nearly all the proposals in 2018, they found that with some of their portfolio companies recently taking action to address climate risk, it was more challenging to vote for such a high percentage of the proposals. In their view, some of the proposals overlapped with corporate actions recently begun at the companies, so they voted against a few more proposals proposals compared to 2018.

Possible explanations for voting behavior and a look ahead

So why do some asset managers tend to vote against most climate-related proposals? Overall, some of the largest asset managers say they want companies to address climate risk (see their statements below), but they have also cited, in the past, various reasons not to vote for shareholder proposals. These include a preference for private dialogue, or concern about proposals they view as poorly written. Some also have shown a preference for waiting several years before voting for a proposal while the engagement with the company matures and votes rise.

BlackRock has relied heavily over the years on private dialogues rather than voting “For” climate related proposals. However, in January of 2020, the firm updated its proxy voting guidelines, stating ``We believe that climate presents significant investment risks and opportunities that may impact the long term financial sustainability of companies… We expect companies to convey their governance around this issue through their corporate disclosures aligned with TCFD and SASB.” These changes are supported by Fink’s letter to CEO’s in January stating: “We have a responsibility to engage with companies to understand if they are adequately disclosing and managing sustainability-related risks, and to hold them to account through proxy voting if they are not.”

Other asset managers have released similar statements. In a recent public letter to corporate board members, State Street Global Advisors CEO Cyrus Taraporevala stated that: “Ultimately, we have a fiduciary responsibility to our clients to maximize the probability of attractive long-term returns – and will never hesitate to use our voice and vote to deliver better performance. This is why we are so focused on financially material ESG issues.”

Ceres’ view is that climate risk is now so serious and widespread, and the needed solutions are so time-sensitive, that it is important to vote for relevant proposals while continuing to pursue other engagement approaches such as private dialogue. This approach is widespread among investors we work with.

Methodology

Proxy voting data was compiled for Ceres by Morningstar, using N-PX filings submitted to the Securities and Exchange Commission (SEC). For the study, 46 asset managers were selected by Morningstar -- these are among the largest 46 asset managers operating in North America. As a result, no pure-play socially responsible investment (SRI) firms were included. These SRI firms tend to vote for all or nearly all climate-related resolutions we track each year.

The analysis covers the 53 climate-related shareholder proposals that were put to a vote out of 141 total filed during the 2019 proxy season. Of the others, 56 resolutions were withdrawn in return for a commitment by the company -- an outcome that represents the goal of filing shareholder proposals -- with companies agreeing to take action to improve disclosure, reduce risk or seize opportunities. The remainder of the shareholder proposals did not go to a vote for various reasons including; being withdrawn for dialogue or for technical or strategic reasons; or the SEC allowing the company to omit the proposal from their proxy ballot.

The average vote on the 53 proposals was 26.8% “For.” Of the 53, 18 proposals focused on lobbying disclosure, eight related to greenhouse gas reduction goals, six concerned carbon asset risk or transition planning, five covered recycling / plastic packaging and the remainder covered six other climate-related topic areas. The actual shareholder proposals and the voting results for each can be viewed at www.ceres.org/resolutions.

Ceres

Ceres

Ceres is a nonprofit advocacy organization working to accelerate the transition to a cleaner, more just, and sustainable world. United under a shared vision, our powerful networks of investors and companies are proving sustainability is the bottom line—changing markets and sectors from the inside out.

For more information, visit ceres.org and follow @CeresNews.

More from Ceres