Timberland Harvests - Sustainable in more ways than one

At the Clean Energy Finance & Investment Summit 2010 EcoForests presents timber harvesting as a lucrative investment opportunity in today's environmental marketplace

Published 12-02-10

Submitted by Ecoforests Canada

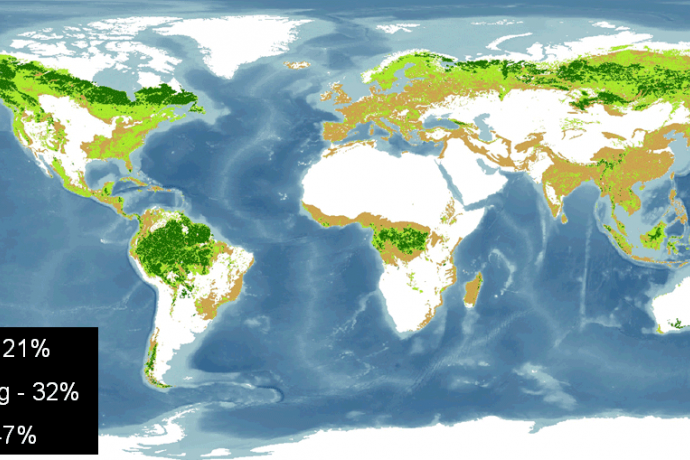

State of the Worlds Forest - World Resources Institute

State of the Worlds Forest - World Resources InstituteMichael Ackerman of EcoForests (also known as Ecobosques ) made his position unmistakably clear at the Clean Energy Finance & Investment Summit 2010. While this world-class event focused on clean energy, clean technology and attractive investments, Mr. Ackerman's presentation went a step further to establish timber as a distinct asset class in and of itself.

"The forestry industry represents a seriously undervalued opportunity for investment," explains Ackerman. "As matters stand, sustainable harvesting practices in the world's major timber producing economies cannot meet current demand. 47 percent of the world's forests have been depleted, 32 percent are currently undergoing aggressive harvesting with little provision for replenishment, and only 21 percent remain intact."

Ackerman goes on to cite compelling statistics discussed at the Summit, "This conference delved into the sustainability of the energy sector. 28 percent of today's carbon emissions come from power companies. This makes power generation the leading pollutant in the world today. Deforestation has the dubious distinction of second place at 18 percent. A growing population combined with the transition from rural to more urban living, are predicted to result in a 50 percent increase in energy demands by 2030. According to the Mckinsey Global Institute, in this same period of time, India alone is forecast to increase its demand for energy fourfold, and will require an additional 700-900 million cubic meters of commercial and residential space every year until that fateful date. By the same token, China's urban population is predicted to increase from 530 million to 875 million. Essentially this translates into the construction of 50 new cities the size of New York City within 20 years."

As a primary sponsor and selected keynote speaker at this year's event, Michael Ackerman, COO of EcoForests, offered a convincing case study which discussed the importance of reforestation and the quickly rising, and so far primarily overlooked, timberlands of the world as assets no different from any other.

Ackerman discussed not only timber harvesting as a wise initiative from an environmental standpoint in the creation of sustainable plantation forests to feed demand for the commodity, but also from the perspective of a sound financial investment. Consistently outperforming the S&P 500 since 1910, timber is the only asset class which has continued to rise in value during three of the four major market collapses in the 21st century. Hedged against inflation, boasting real rates of return, and providing additional benefit through the trade of carbon credits, timber has a low correlation with other investment vehicles. This alone offers great benefit to investors who choose to participate as a means of portfolio diversification.

According to the International Woodlands Company (IWC), the forestry industry has yielded a nominal annual return rate of 15.1 percent. As of this report, under $80 billion is invested in responsibly managed forests worldwide. Considering future market demand, the potential for returns on investments seems limitless. Authorities set the upper limits at some $430 billion USD. As of this writing, approximately 5% of the world's forests are actual plantations. Since it is reasonable to assume that demand for forestry products will parallel population growth, what is needed is a considerable rise in this figure in order to ensure that this valuable commodity survives into a sustainable future. An investment in timber harvests seems to be an extraordinary opportunity with no assessable downside: financial or environmental.

EcoForests is a forestry investment management company headquartered in Alicante, Spain and Toronto, Canada, with offices located in Portugal, Sweden, Spain, England and Northern Ireland. Growing and managing forest plantations throughout Argentina, Spain and Costa Rica, EcoForests specializes in the production and maintenance of tropical timber, both hardwood and softwood. The timber grown by EcoForests boasts high economic value and rapid growth, presenting both individuals and institutions with a 10 to 16 year investment opportunity where funds are invested in trees and timberlands, with a full, reliable management system in place. EcoForests creates and establishes sustainable plantations throughout the world and is founded on the best combination of financial accountability, social responsibility, and an unwavering commitment to the environment.

Ecoforests Canada

Ecoforests Canada

EcoForests is a forestry investment management company headquartered in Alicante, Spain and Toronto, Canada, with offices located in Portugal, Sweden, Spain, England and Northern Ireland. Growing and managing forest plantations throughout Argentina, Spain and Costa Rica, EcoForests specializes in the production and maintenance of tropical timber, both hardwood and softwood. The timber grown by EcoForests boasts high economic value and rapid growth, presenting both individuals and institutions with a 10 to 16 year investment opportunity where funds are invested in trees and timberlands, with a full, reliable management system in place. EcoForests creates and establishes sustainable plantations throughout the world and is founded on the best combination of financial accountability, social responsibility, and an unwavering commitment to the environment.

More from Ecoforests Canada